Reliance Industries Ltd (RIL) is set to announce its Q2 FY25 results on 14 October, with analysts expecting a mixed performance. While weaker oil-to-chemical (O2C) margins will weigh on RIL’s earnings, steady growth in telecom and retail segments is expected to offset the decline partially.

Investors are likely to focus on Reliance Jio’s average revenue per user (ARPU) growth and retail segment performance.

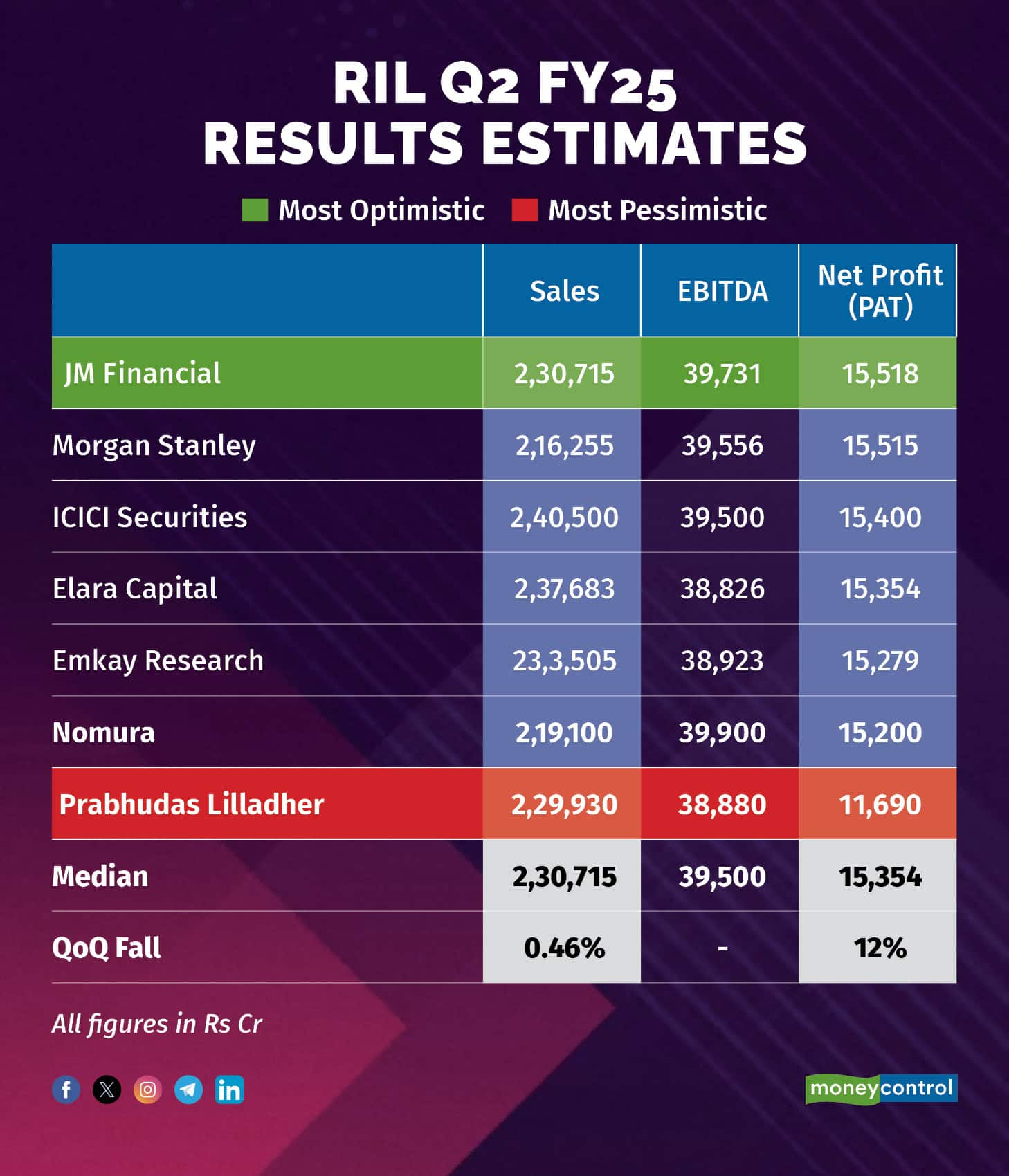

A Moneycontrol poll of seven brokerages estimated Reliance Industries fiscal second-quarter revenue to fall marginally to Rs 2.31 lakh crore from the preceding three months. Net profit is expected to fall 12 percent to Rs 15,354 crore.

Steady subscriber growth in telecom and resilient consumer demand in retail, countered by weaker refining margins, will shape RIL’s Q2 performance. The O2C business continues to face challenges. But, the telecom segment -- driven by price hikes and higher ARPU, and the retail segment’s stable growth are expected to provide some relief. Elara Capital said that weakness in refining spreads, aggravated by inventory loss, will weigh on oil & gas companies’ Q2 earnings.

Factor 1: Oil-to-Chemicals (O2C) WeaknessRIL’s O2C segment is expected to face lower refining margins and petrochemical spreads. Elara Capital estimates a decline in gross refining margins (GRM), estimating $9 per barrel for Q2, down significantly from $19 per barrel in the same period last year. Emkay Global expects O2C EBITDA to fall by 3 percent sequentially to Rs 12,760 crore. Brokerages said lower GRMs and weaker refining spreads are the key reasons for this decline.

Factor 2: Steady Growth in Reliance Jio TelecomRIL’s telecom segment is expected to perform well. Prabhudas Lilladher forecasts a 6 percent quarter-on-quarter (QoQ) growth in Jio’s ARPU to Rs 194 per month, along with a 0.6 percent QoQ increase in subscriber growth. Emkay Global also anticipates a 6 percent sequential rise in Jio’s EBITDA to Rs 15,900 crore, citing price hikes as the primary driver. JM Financial estimates even stronger growth, projecting a 9.4 percent QoQ rise in digital services EBITDA to Rs 16,400 crore.

Factor 3: Stable Performance for Reliance RetailDespite challenges such as store rationalisation and a heavy monsoon season, JM Financial expects RIL’s retail EBITDA to increase by 0.6 percent QoQ to Rs 5,700 crore. Emkay Global projects retail EBITDA to rise by 1 percent sequentially to Rs 5,740 crore, driven by resilient consumer demand.

RIL’s upstream segment, while generally stable, is expected to see a slight dip in performance. Emkay Global expects a 1 percent QoQ decline in upstream EBITDA due to higher operating costs. ICICI Securities said that production softness and the higher profit petroleum share of the government would likely dent RIL’s upstream margins.

What should you look out for in the quarterly show?Investors will be closely watching for further updates on Reliance Jio’s ARPU growth and its potential impact on overall telecom earnings, especially as price hikes continue to drive margins. In the retail segment, investors will be looking for signs of a stronger recovery and expansion, especially given the impact of store rationalisation efforts. Additionally, the O2C segment’s performance, especially GRM trends, will be critical to assess how much the weak global refining spreads are impacting the company’s overall earnings.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.