State-run Oil & Natural Gas Corporation Ltd (ONGC) is likely to report a fall in revenue and net profit for the December quarter, weighed by higher net oil price realisations, a weaker rupee, and lower operating expenses. The company is set to announce its results on January 31.

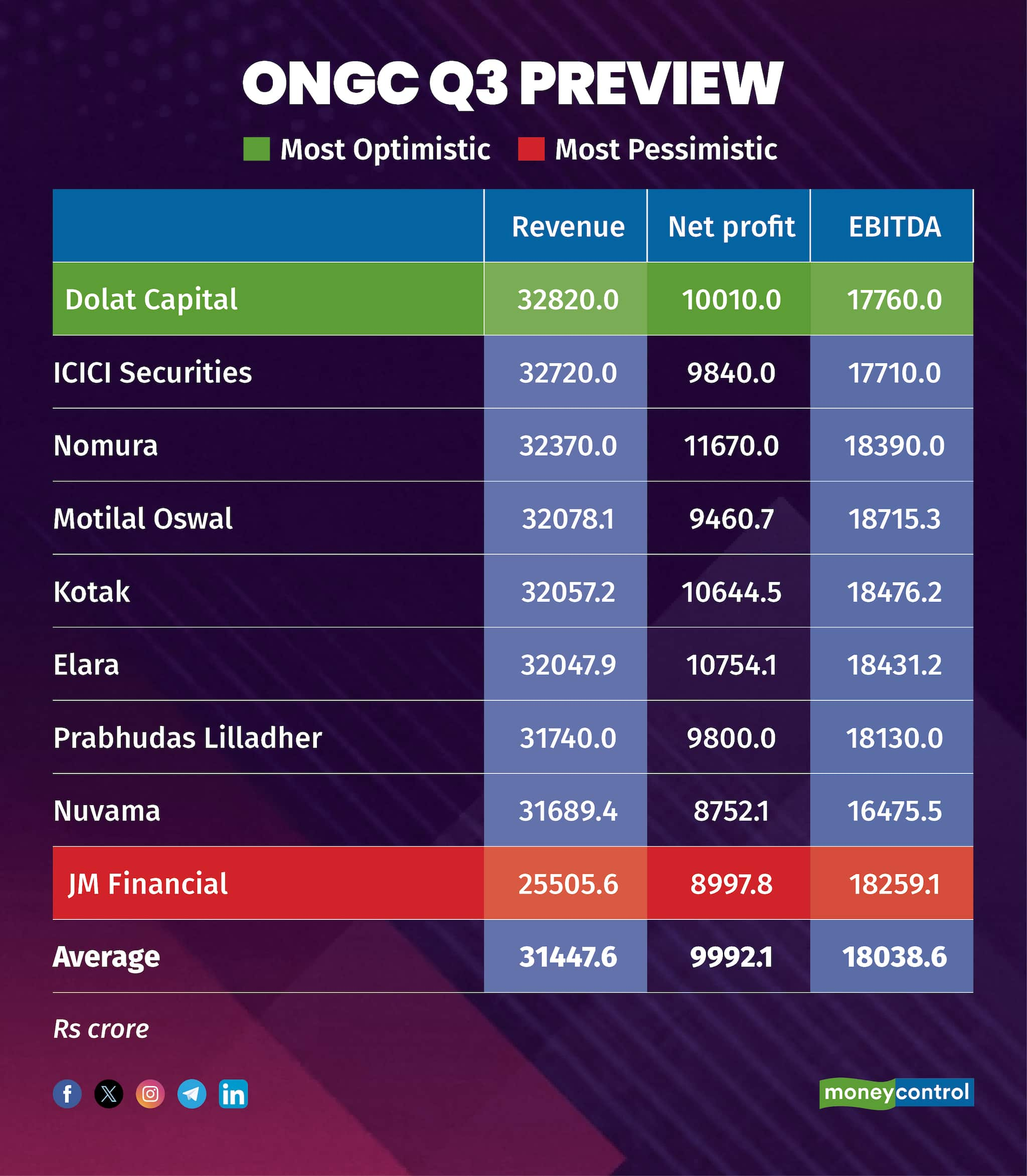

According to a poll of nine brokerages conducted by Moneycontrol, ONGC’s net profit is expected to decline 16 percent year-on-year (YoY) to Rs 8,997.8 crore, while remaining flat sequentially.

Revenue is projected to drop 10 percent YoY and 7 percent quarter-on-quarter (QoQ) to Rs 31,447.6 crore. EBITDA may see a slight 5 percent rise to Rs 18,038.6 crore but is expected to slip marginally on a sequential basis.

Key metrics expected for Q3:

Crude oil sales volumes: Estimated at 4.54 MMT (-4% YoY, -1% QoQ)

Natural gas sales volumes: Forecasted at 3.9 BCM (-2% YoY, flat QoQ)

Gross crude price realization: $73/bbl (-11% YoY, -7% QoQ)

Net oil price realization (post royalty, windfall tax, cess): $52/bbl (+1% YoY, -3% QoQ)

What factors are driving the earnings?

Volumes: Experts suggest ONGC’s standalone production volumes may remain flat QoQ, as incremental growth from the KG Basin offsets natural declines in legacy fields.

Realisations: Crude oil realisations are likely to decrease in line with global trends, while gas realisations may improve following the notification of premium pricing for new well gas (NWG).

EBITDA Growth: Higher net oil price realisations, a weaker rupee, and reduced operating expenses are key contributors.

Net Realisations: Estimated at $74.7/bbl for oil and $6.5/mmBtu for gas. Upstream is likely to report flattish QoQ EBITDA, with QoQ drop in crude prices compensated by rupee weakness and premium APM gas.

Production Trends: Oil production is projected to decline 2% QoQ (5% YoY), while gas production is likely to remain flat QoQ (down 1% YoY).

What will investors look out for in the Q3 show?

Consolidated earnings will be under scrutiny following robust performance by subsidiary HPCL. Analysts forecast consolidated EBITDA to rise 29% QoQ, supported by improved profitability at HPCL due to stronger marketing margins. Investors will also closely monitor the ramp-up of gas production.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!