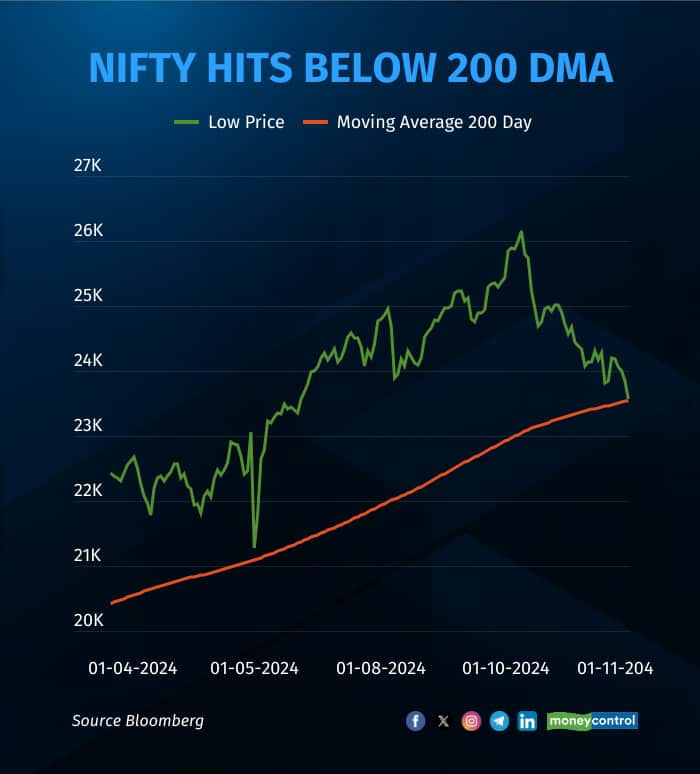

Benchmark Nifty 50 index briefly slipped below the 200-day moving average - a key technical indicator - for the first time in 20 months, signalling cautious investor sentiment and a potential turning point for market's near-term direction.

The Nifty index first dropped below its 200-day moving average (DMA) in February 2022, briefly rebounded above it, but then continued to trade below this threshold until July 2022. From Feb 2022 to March 2023, it entered a period of consolidation.

Between Feb and March 2022, Nifty declined by nearly 10%, then swiftly regained 11% within a single month. From April to June 2022, it experienced an 18% drop, followed by a strong rebound of 22.5% in the next few months. Between Dec 2022 till Mar 2023 it remained below 200 DMA and was consolidating. In April 2023, the index began a significant upward trajectory, climbing over 40% through mid-September 2024.

The Nifty 50 hit a low of at 23,509, slipping below its 200-day moving average (DMA) of 23,545 in trade on November 13, before rebounding. The index still ended lower by 1.36% for the session. The last time Nifty 50 had slipped below this key indicator was in April 2023.

The recent, heavy sell-off, particularly by foreign investors, has intensified pressure, and experts believe with limited positive triggers in sight, the short-term volatility is expected to persist. While retail participation remains steady, concerns are rising over how resilient it will be in the face of continued market declines.

According to Nirav Karkera, Head of Research at Fisdom, the Nifty could fall an additional 150-200 points, cautioning against looking at the 200-DMA in isolation.

Foreign investors' continued selling has weighed heavily on market sentiment, with over Rs 1 lakh crore offloaded in October, and an additional Rs 26,000 crore so far in November.

Kranthi Bathini, Director of Equity Strategy at WealthMills Securities, said the unrelenting foreign selling and weak global cues have dented domestic market sentiment, with DIIs’ continued buying unable to shift the market equilibrium back to positive territory.

15 out of 19 sectoral indices have fallen over 10 percent from their respective 52-week highs, moving decisively into the correction territory. The 52-week highs for these sectoral indices were seen in August and September, before the retreat.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.