Information technology major Infosys is slated to detail in October-December earnings on January 16, with analysts forecasting lacklustre performance on the back of seasonal weakness. While revenue growth is expected to remain muted on a sequential basis, net profit is seen rising in low single-digit. However, most analysts anticipate an upward revision in the company's revenue guidance which will be closely tracked.

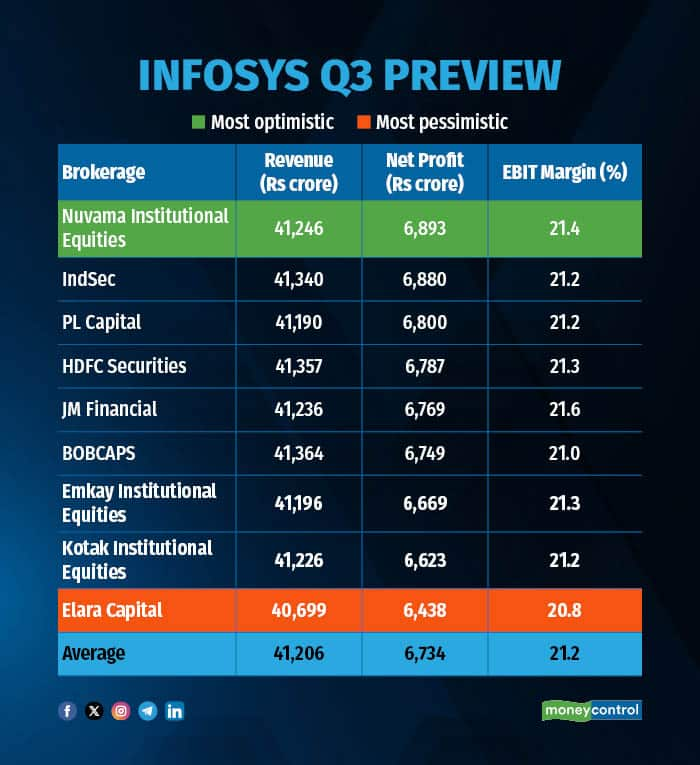

According to a Moneycontrol poll of nine brokerages, Infosys is expected to post a 0.5 percent sequential uptick in revenue to Rs 41,206 crore, as against the Rs 40,986 crore that it clocked in the preceding quarter.

The poll also pegged the IT behemoth's consolidated net profit to grow 3.5 percent on quarter to Rs 6,734 crore. Infosys had recorded a net profit of Rs 6,506 crore in the previous quarter.

Among the brokerages polled by Moneycontrol, Nuvama Institutional Equities rolled out the most bullish projections, forecasting a 6 percent rise in net profit while Elara Capital anticipates a marginal decline.

What factors are driving the earnings?

Infosys is expected to report muted revenue growth in Q3 on the back of weak seasonality for the IT sector due to higher furloughs. On the other hand, positive currency tailwinds and steady deal wins may aid a marginal rise in the bottomline.

Higher furloughs: Analysts across the board expected muted revenue growth for Infosys due to seasonal weakness from furloughs in Q3. Even though the impact of furloughs in the quarter is likely to remain normal, it will still impact Infosys' sequential growth.

Ramp-up of large deals: Analysts at Nomura expect continued demand improvement in financial services and ramp up of large deals to aid growth and offset some drag from higher furloughs in Q3. "Lower transition cost associated with large deals could benefit margin, though lower growth will limit the extent of expansion," believes JM Financial.

Margin performance: Infosys' EBIT margins in Q3 may witness a slight drop on quarter due to due to negative operating leverage and higher furloughs, Elara Capital stated. On that account, most brokerages anticipate Infosys to keep its margin guidance of 20-22 percent intact for FY25.

What to look out for in the quarterly show?

All eyes will now be on whether Infosys will raise its revenue guidance for the full year. Most analysts either expect an increase in guidance or narrowing of the guidance band. However, the larger consensus leans towards an upward revision of Infosys' revenue guidance to 4.5-4.75 percent from 3.75-4.5 percent in Q2. Hence the company's revenue guidance will remain at the top of investors' watchlist.

Additionally, attention will be on the management's outlook regarding cost takeout projects, the state of discretionary spending across verticals, especially in financial services and developed markets and the deferred wage hikes. Market participants will be keen to understand the reasoning behind the delay and look for details about the pending wage hike cycle.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.