India’s equity markets are emerging as a rare bright spot in a world dominated by red screens. As Donald Trump’s re-election fuels a dramatic rally in US stocks, major global markets across Europe, Asia, and the Middle East are deep in the red. Yet, India stands out, delivering near-flat returns in dollar terms, showcasing resilience amid global turmoil.

India stays strong

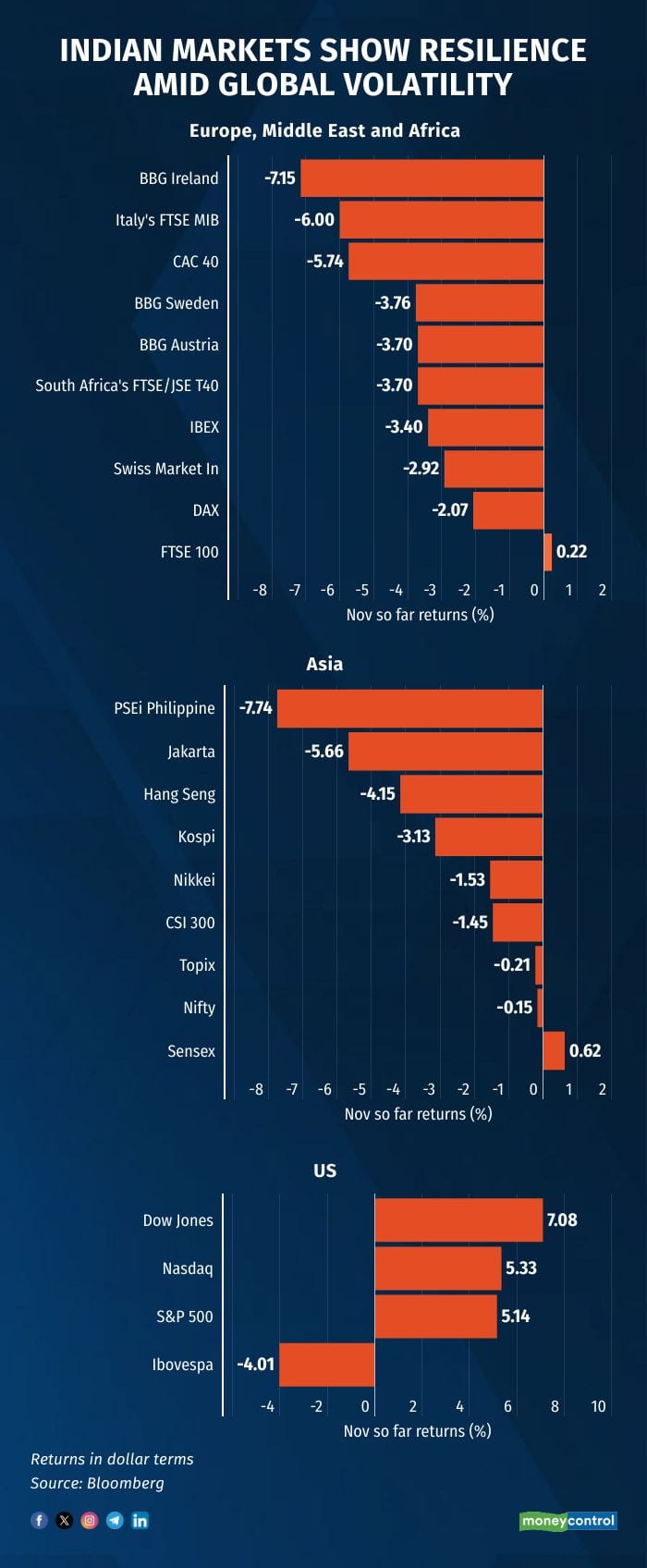

The Sensex has edged up 0.62% in November, and the Nifty 50 is down just 0.15% in dollar terms. This positions India as the most resilient among major global markets outside the US.

Catch all the market action and business updates on out live blog

Among the developed markets, France’s CAC 40 has plunged 5.7%, Germany’s DAX is down 2.1%, Japan’s Nikkei has fallen 1.53% and the UK’s FTSE 100 is barely positive, up 0.2%.

Asian markets have fared worse, with the Philippines’ PSEi leading losses (-7.74%), followed by Indonesia’s Jakarta Composite (-5.66%) and Korea’s Kospi (-3.1%). China’s CSI 300 (-1.45%) couldn’t escape the slide.

Meanwhile, the US is blazing ahead. The Dow Jones has soared 7.1% in November, the S&P 500 gained 5.1%, and the NASDAQ added 5.33%, driven by optimism surrounding Trump’s second term and expectations of pro-growth policies.

Why India is resilient

India’s resilience is anchored by robust domestic inflows and improving market sentiment. Domestic institutional investors (DIIs) have pumped over Rs4.5 lakh crore into equities in 2024, shielding markets from the impact of significant foreign outflows.

“India is in a sweet spot under President Trump,” said Ritesh Jain, founder of Pinetree Macro. “Markets had already corrected in October, so what you’re seeing now is stabilisation.”

The country’s resilience also stems from improving investor confidence. Manish Chowdhury, Head of Research at StoxBox, pointed to the BJP’s electoral victory in Maharashtra and hopes for stronger corporate earnings in the second half of FY25 backed by a revival in demand as key drivers. Anand Rathi Research sees an 11% earnings growth for FY25.

US markets roaring

While US equities continue to gain momentum, foreign investors are retreating to the safety of US markets, pushing the dollar index up by 3%. An easing monetary policy by the US Federal Reserve has bolstered hopes for improved economic performance, supporting corporate earnings and driving gains in US equities.

Although lower rates typically encourage a risk-on trade, with capital flowing out of dollar assets into riskier asset classes like emerging markets, investors are betting on Trump’s policies to boost American growth and corporate profitability through tax cuts and tariff barriers.

Apurva Sheth, Head of Market Perspectives and Research at SAMCO Securities, said, “This preemptive 'Santa Claus Rally' reflects investor confidence ahead of Trump’s inauguration and his agenda to 'Make America Great Again.'”

Global markets struggle

Outside the US, markets are reeling. Europe is contending with deteriorating economic data, while Asia faces sluggish growth. The stronger US dollar, buoyant corporate earnings, and expectations of aggressive US trade policies under Trump have added pressure globally.

“Trump’s re-election is perceived negatively for Japan, Europe, and China, while India stands out with its relatively stronger positioning,” said Jain. Pinetree Macro’s Jain echoed the same sentiment, saying, “The market is positioning for an 'America First' policy under Trump’s presidency.”

India’s growth and valuation

As global markets struggle to adjust to Trump’s presidency and a rapidly evolving macroeconomic landscape, India’s stability stands out. With steady domestic inflows, and the recent correction which makes valuations a tad cheaper, sentiment is improving. India’s Nifty 50 trades at a valuation of 19.1x one-year forward earnings, below its historical average, presenting what analysts call an attractive entry point.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.