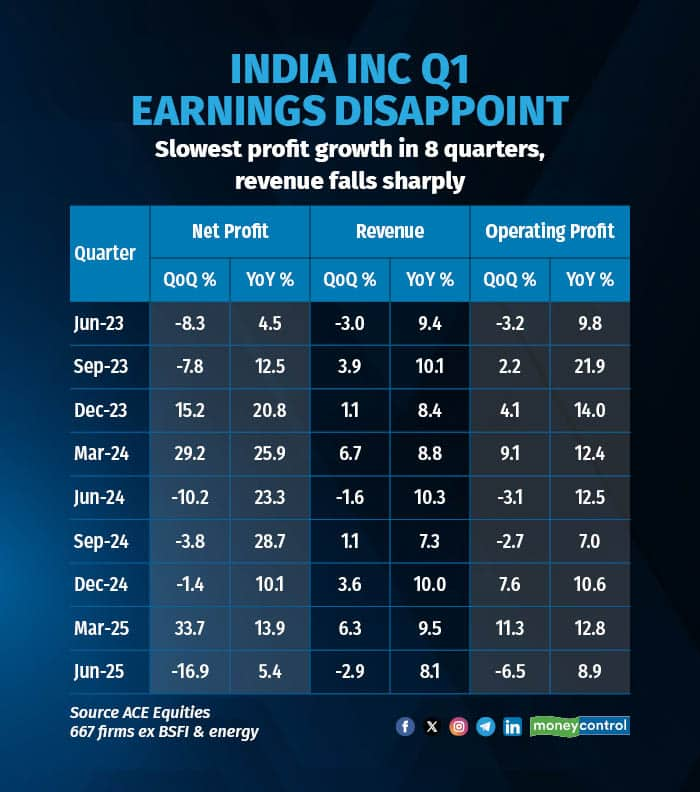

India Inc reported its slowest year-on-year net profit growth in eight quarters in the June quarter, while revenue growth was the weakest in the last three quarters. On a sequential basis, both net profit and revenue registered negative growth. Notably, net profit saw its steepest quarterly decline in 20 quarters, while revenue experienced its sharpest drop in eight quarters.

According to data analysed by Moneycontrol, 667 companies -- excluding those in banking, financial services, insurance (BFSI), and oil & gas -- have so far reported their Q1FY26 earnings. The net profit for June quarter rose by 5.4 percent year-on-year, marking the slowest growth since the June 2023 quarter. Sequentially, net profit dropped by 17 percent, the steepest quarterly fall since June 2020.

Further, revenue increased by 8.1 percent year-on-year, its slowest pace of rising since the September 2024 quarter. On a quarter-on-quarter basis, revenue declined by 3 percent, the most significant fall since the June 2023 quarter. Operating profit rose by 9 percent year-on-year, the slowest pace since September 2024, and declined by 6.5 percent sequentially, marking its steepest drop since June 2022.

Independent market expert Ajay Bagga said the numbers are a clear sign of demand-side weakness and margin compression creeping into India Inc., especially outside BFSI and oil & gas. As global trade headwinds and domestic consumption slow, policymakers need to act fast with a calibrated mix of fiscal stimulus and GST rationalisation could help reignite momentum, he said.

Incidentally, a 7% sequential drop in profits is not just a statistical blip — it suggests deeper cyclical softness, say experts. With global growth slowing and domestic levers not firing, it’s time to reassess earnings expectations for FY26, they add.

Experts further say that for investors, this is a moment for portfolio recalibration. Earnings visibility is weakening in core industrials and consumption sectors. Defensive positioning and stock-specific strategies will be key in the coming quarters

During the week, several major companies announced their quarterly earnings, including L&T, Asian Paints, Sun Pharma, and Varun Beverages, among others. Varun Beverages reported a modest 5 percent year-on-year increase in net profit, while revenue declined by 2 percent. Asian Paints posted subdued results as well, with net profit falling by 6 percent and a marginal decline in revenue on a year-on-year basis.

In contrast, engineering giant L&T and FMCG major Hindustan Unilever Ltd (HUL) delivered strong performances. L&T reported a 30 percent rise in net profit, with revenue increasing by 16 percent year-on-year. HUL's net profit rose by 7.5 percent, while revenue grew by 4 percent. The company also reported a 4 percent volume growth, surpassing market expectations.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!