India's second largest private sector lender ICICI Bank's shares trimmed their intraday gains on April 21 to settle flat, after reporting a better-than-expected earnings show for the quarter ended March FY2025.

Brokerages rushed to upgrade their target prices on the bank. "Seldom does a bank of the size of ICICI Bank surprise with its operating performance the way this bank has done, that too amid a volatile macro environment, elevated competition for deposits, and ongoing normalization in asset quality," noted domestic broking house Motilal Oswal.

For the quarter ended March, ICICI Bank posted an 18 percent year-on-year rise in standalone net profit to Rs 12,629.58 crore. On a sequential basis, net profit rose 7.1 percent.

ICICI Bank's gross non-performing asset (NPA) ratio shrunk to 1.67 percent as on March 31, 2025, from 1.96 percent a quarter ago, and 2.16 percent a year ago.

Net interest income (NII) increased by 11.0 percent year-on-year to Rs 21,193 crore in Q4FY25 from Rs 19,093 crore in Q4FY24. Net interest margin was 4.41 percent in Q4FY25 compared to 4.25 percent in Q3FY25 and 4.40 percent in Q4FY24. The net interest margin was 4.32 percent in FY25.

At close, shares of the bank trimmed all wins to eke out minor gains of 0.1 percent, settling at Rs 1,408.1 apiece.

Should you buy, sell, or hold ICICI Bank shares?International brokerage CLSA said that ICICI Bank delivered yet another strong quarter, prioritising profitability over growth. The brokerage noted that the NIM improved a 'surprising' 15 basis points on a sequential basis.

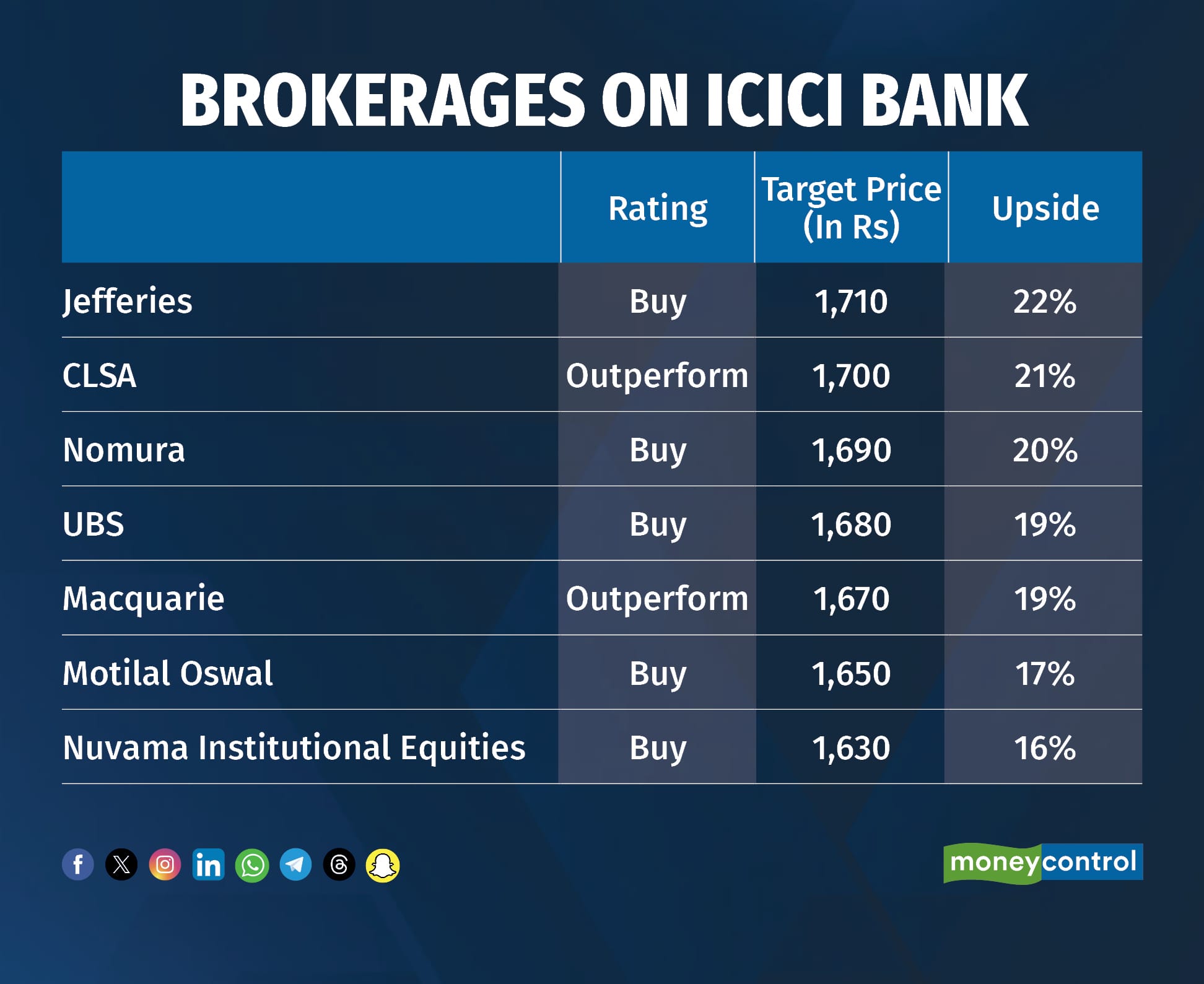

Global broking firms CLSA, Jefferies, and Nomura Holdings, along with domestic players Nuvama and Motilal Oswal all hiked their target prices on the bank's shares.

Discussing the improving asset quality, Nuvama Institutional Equities said, "Asset quality in business banking is turning out to be better-than-expected despite high growth because the bank focused on the better-rated borrowers in this segment, does not lend at very high yields and has invested in sound credit models."

On this front, Motilal Oswal called the improvement in NIMs commendable. "Our estimate of a modest NIM expansion in Q4 was not easy to achieve given the ongoing rate-cut cycle, but delivering a 16 bps NIM expansion, which has covered the margin fall over the entire year and taken NIMs back to the level seen in 4QFY24, was indeed very commendable."

Despite the positive reactions from all brokerages, experts noted that ICICI Bank's loan growth for the three months ended March at 13 percent on-year was modest, slipping to the low-teens. Global broking house Macquarie said the loan growth was lower than expectations. The growth was a tad lower than 14 percent in Q3FY25 due to slower volume growth in 'Personal Loan on Credit Cards', which has now bottomed.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.