Grasim Industries Limited (Grasim) is likely to witness a 22 percent year-on-year (YoY) decline in standalone profit after tax (PAT), while sequentially, PAT is forecasted to tank 61 percent. Grasim is scheduled to declare its results for the quarter ended December 2022 on Tuesday, February 14.

Experts expect the standalone revenues of the company, comprising viscose (fibre and yarn) and chemicals (caustic soda and allied chemicals) to grow 13 percent on-year, but the revenues are likely to remain flat with a marginal dip of 3 percent compared to the previous quarter.

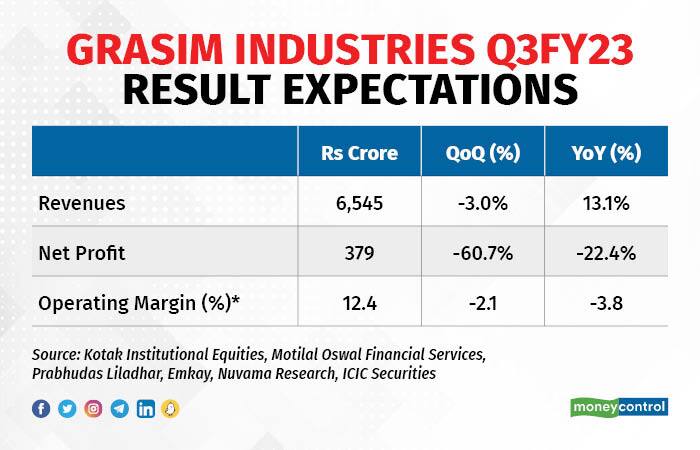

According to a poll of brokerages conducted by Moneycontrol, the flagship company of the Aditya Birla Group is forecasted to report a standalone PAT of Rs 379 crore for the quarter, and the standalone revenues are likely to come in at Rs 6,545 crore.

The company had recorded a standalone PAT of Rs 489 crore during the corresponding period of the previous year when it had achieved revenues of Rs 5,785 crore.

During the September ending quarter, the standalone PAT stood at Rs 964 crore on revenues of Rs 6,745 crore.

The YoY growth in revenues is likely to be aided by favourable market conditions for both the viscose and chemicals businesses, which are likely to see a low to mid-single digit growth in both, volumes and realisations.

However, the increase in input costs will negate the growth in revenues and might result in a margin contraction of 4 percent on-year and 2 percent quarter-on-quarter (QoQ) to 12 percent.

Brokerage and research firm, Kotak Institutional Equities, models a “7.1 percent YoY volume increase in VSF operations and a 6.1 percent YoY volume increase in the chemical operations led by ramp-up of new capacity partly offset by near-term demand headwinds”.

At the same time, the analysts at Motilal Oswal Financial Services Ltd (MOFSL) expect revenue for the VSF business to grow by 8 percent on-year, while that of the chemicals segment to grow by 6 percent YoY, led by 1 percent YoY growth in volume in both the businesses, and 7 percent YoY growth in VSF realisations, while realisation in chemicals is likely to witness an uptick of 5 percent YoY.

The increase in operating costs is likely to cause serious damage to the earnings before interest, tax, depreciation and amortisation (EBITDA) of both the businesses, with the VSF business seeing an on-year decline of close to 45 percent in its EBITDA, while the chemicals business is likely to see a mid-single digit decline.

The experts at MOFSL expect EBITDA per kg of Rs 11.9 for the VSF segment (including VFY), compared to Rs 23.6 per kg during the same period a year ago, and Rs 17.8 per kg in the previous quarter of the current fiscal.

They expect EBITDA for the company to decline by 25 percent on-year led by a sharp decline of 49 percent YoY in EBITDA and operating margin contraction of 6.4 percent in the VSF business. EBITDA in the chemicals segment is expected to decline 6 percent YoY, while its operating margin is expected to decline 2.6 percent YoY, and 2.5 percent QoQ to 20 percent.

Kotak Institutional Equities estimates, “VSF EBITDA of Rs 130 crore (-67 percent YoY, -60 percent QoQ) on weaker realisations, and chemicals EBITDA of Rs 580 crore (+10.2 percent YoY, -4.4 percent QoQ), benefiting from elevated prices”.

Grasim closed Rs 13 lower at Rs 1,622.3 on February 13 at the National Stock Exchange. The stock is down 5.1 percent over the past one year and has declined 2 percent over the past one month.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.