Cipla Ltd is scheduled to report its Q4 FY25 earnings on May 14, with analysts anticipating a strong year-on-year performance aided by steady traction in the US business and a rebound in domestic sales. However, sequential margin pressure and regulatory headwinds may temper investor sentiment.

A Moneycontrol poll of analysts projects Cipla’s revenue to rise 18.6% YoY, supported by new launches in North America, stable contributions from key respiratory products, and robust demand in the SAGA region. Net profit and EBITDA are also expected to rise sharply, with EBITDA seen growing 55.7% YoY, driven by operating leverage and better product mix.

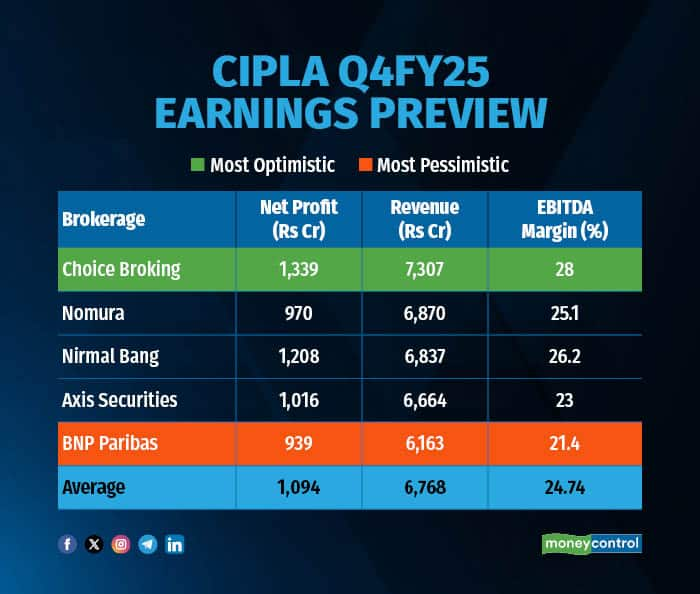

On average, the poll indicates that Cipla is likely to report a revenue of around Rs 6,230 crore, net profit of Rs 860 crore, and EBITDA margin of 24.5%, compared to 20.2% a year ago.

Read more: Pharma Q4 preview: Lupin, Sun Pharma, Cipla among top sectoral picks across brokerages

Key factors driving Q4 earnings

Cipla’s Q4 performance is likely to be supported by a multi-pronged growth engine, with contributions from its US respiratory portfolio, new product launches, and stable tender revenues in South Africa.

In the US market, which contributes 20–25% of Cipla’s overall sales, analysts expect sales of $235 million, underpinned by gRevlimid ($30 million), Albuterol, Brovana, and Lanreotide injections. While Cipla continues to face some market share pressure in Albuterol, gains in Brovana and ramp-up in Lanreotide are helping stabilise its position.

Cipla’s de-risked US model across inhalers (DPIs, MDIs) and oral solids (OSDs) is expected to offer resilience against pricing volatility. Further, continued investments in Invagen facilities are now yielding returns and strengthening Cipla’s US compliance and manufacturing depth.

Cipla's US business accounts for 20-25% of its US sales, which itself makes up 5-7% of the company’s total sales. This implies that while the US market is important, it does not form the largest chunk of Cipla’s revenue base, providing some level of insulation from heavy reliance on this market. If tariffs fall within the 5-10% range, Kotak Securities suggests that it might not be very difficult for Cipla to either pass on these increased costs to customers or absorb them within its margins.

In India, a strong rebound is expected, supported by better seasonal demand, product launches, and normalisation in the acute segment. Additionally, Cipla’s SAGA business (South Africa, Sub-Saharan Africa, and Global Access) is showing sustained growth, with tender wins in South Africa helping offset seasonal weakness elsewhere.

Analysts like those at Choice Broking forecast robust YoY EBITDA expansion, led by a favourable product mix and stronger realizations in key markets. However, Nomura notes that Q4 may see sequential EBITDA margin moderation due to a high base in Q3, even as the company maintains a positive FY26 outlook supported by new launches and tender wins.

What to watch out for

Investors will closely monitor management commentary on regulatory issues — particularly with respect to USFDA inspections and remediation updates. Any progress or setbacks could materially impact future growth visibility in the US market.

Cipla’s ability to retain and grow market share in inhalation therapies, especially Albuterol and Brovana, will also be a key focus area. Analysts will also track Cipla’s ramp-up strategy for complex generics like Lanreotide and oncology assets like Nilotinib in North America.

Additionally, the Street will look out for updates on product filings and launch timelines, particularly in the respiratory and injectables portfolio, as these will be key to sustaining growth in FY26.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.