At 04.55 am, two aircraft pushed back simultaneously at Delhi Airport. One was an Air India Boeing 787 and another was an AirAsia India A320. Both were bound for Kochi. Thirty-five minutes later, a Vistara aircraft pushed back to fly on the same route. Clearly, Campbell Wilson, the new CEO of Air India, will have his task cut out. There is a scope for improvement just about everywhere, but it will have to start with schedule integration.

On the eve of Wilson starting his tenure, the Competition Commission of India (CCI) approved the merger of AirAsia India with Air India, which paves the way for the merger of AirAsia India with AirIndia Express.

While the Tata group and Singapore Airlines have both said that Vistara and Air India will continue to operate separately, reports indicate that all the airlines will be housed under one roof in Gurugram. So, while Vistara might continue as is for a while, there will still be synergy among the various carriers.

Pricing power in aviation comes from capacity. If an airline operates on a particular route with options to fly multiple times a day, it presents a better offering to the corporate market. For this to work, an airline needs to have frequencies spaced out across the day on most major sectors in the country. This is all the more important in a country like India, where over half the market is controlled by one carrier, IndiGo.

Data exclusively shared by OAG Aviation for this article shows that IndiGo operates on 746 sectors, while Air India operates on 169, followed by Vistara with 104 sectors and AirAsia India with 90. Air India Express, which primarily serves international routes, operates on 14 domestic sectors. There are 222 sectors in the country in which Air India group airlines (including Vistara) and IndiGo both have a presence. But there are only 110 sectors where IndiGo is competing with either Air India, Air India Express and/or AirAsia India. There precisely lies the need for Air India to have Vistara under its wing, to compete with the market leader.

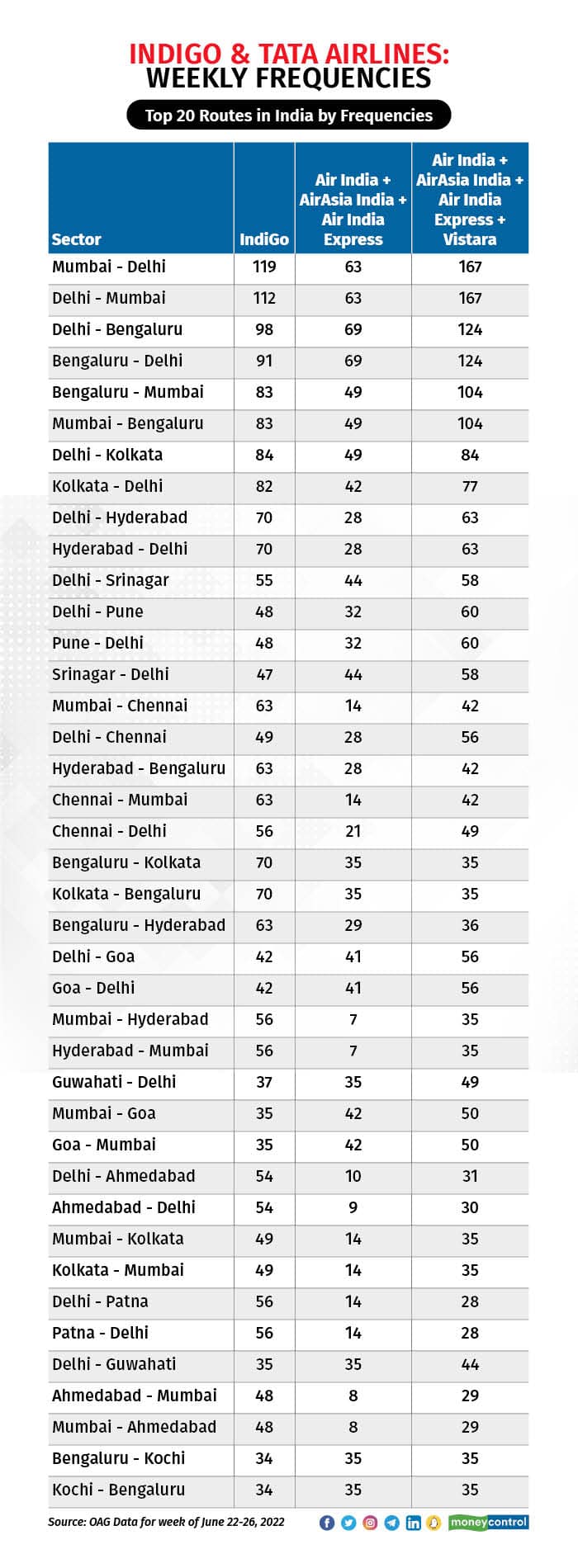

AI, AI Express and AirAsia India: Not a potent combo to take on IndiGoA look at the top 20 routes in the country by frequency shows there is only one where IndiGo has fewer frequencies than Air India, Air India Express and AirAsia India combined. That sector is Mumbai-Goa-Mumbai. Air India Express being primarily an international carrier, there hardly is any overlap with IndiGo on domestic routes.

That leaves Air India and AirAsia India to take the battle forward. The last eight years has seen IndiGo build a formidable presence against AirAsia India, leaving it in tatters on many sectors. Even after getting slots for flights on metro routes after the fall of Jet Airways, AirAsia India’s presence on them was skeletal as compared to IndiGo.

With Air India’s cost structure, taking on IndiGo will come at a price that may not be affordable till the reorganisation is completed and cost controls are in place.

Add Vistara to the mix and you have a winnerThe moment Vistara’s network is added to the mix, the Tata group airline combo pips IndiGo in terms of frequencies on 17 of the top 40 sectors in the country. This includes the lucrative Delhi-Mumbai and Mumbai-Delhi sectors, where the Tata group would have 40 percent more frequencies per week than IndiGo. The combine would also fare better on the next set of routes, such as Delhi-Bengaluru-Delhi and Mumbai-Bengaluru-Mumbai.

Of the 169 sectors where Air India operates, it does not have IndiGo as a competitor only on 23. AirAsia India operates on 90 sectors, with only two sectors where it does not compete with IndiGo. Air India Express operates on 14 domestic sectors, most being position flights before international operations. Nine of them are without competition from IndiGo and in fact monopoly routes.

Tail NoteFrequency denotes a presence in the market. Multiple frequencies a day helps capture a significant market and more importantly gives an airline pricing power to an extent, which is important in a cut-throat market like India.

All of the calculations with Vistara as part of the Air India combine are hypothetical for now. Both the airline groups have publicly stated that a decision has not yet been taken on merging them but at the same time, the Tata group has made it clear that it wants to be a dominant force in this sector.

With AirAsia India set to merge with Air India Express, the deployment of capacity will have little meaning if they do not sell each other’s inventory. While this is a step forward, it will continue to create confusion in the minds of customers given that one is a full-service offering and the other is a low-cost offering. Two full-service carriers have tried that model in the past, and failed.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.