As consumers switch to smaller and cheaper packs to control spending in the face of rising prices, packaged consumer goods makers, too, have shifted focus to low unit packs (LUPs) across product categories.

Companies such as Parle Products and Dabur India are stepping up the production of LUPs as they try to tap the consumer demand shift.

“We have seen downtrading happening across categories, including biscuits, salty snacks and bakery products. As we have seen higher traction for LUPs, we have improved the production capacity of lower packs by 12-15 percent over the last two months,” Krishnarao Buddha, senior category head at Parle Products, told Moneycontrol.

The demand shift is taking place at a time when inflation is quickening. Consumer price inflation surged to 7.79 percent in April, the highest since May 2014 and 84 basis points higher than the March number. One basis point is one-hundredth of a percentage point.

Parle Products, the maker of popular biscuit brands Parle-G and Hide & Seek, has experienced an increase in sales of Rs 10 and Rs 5 packs in the biscuit categories. In the salted snacks segment, packs priced at Rs 30 and Rs 60 are selling more.

Dabur India, too, has increased the production of LUPs.

“We have observed that some consumers have shifted to affordable packs or LUPs to manage their monthly grocery budget. We have also increased supplies of LUPs of our key brands across categories to meet this consumer need,” said Ankush Jain, chief financial officer at Dabur India.

Dabur India is witnessing consumers downtrading—switching to smaller and cheaper packs—across product categories, said CEO Mohit Malhotra.

“Our price points of Rs 1, Rs 5, Rs 10, and even Rs 20 are faring significantly better than larger packs with an exception of modern trade and e-commerce,” said Malhotra in a post-earnings call on May 5.

Companies such as Asian Paints and Hindustan Unilever (HUL) also reported downtrading by consumers. HUL has introduced so-called bridge packs in several product categories.

Fast-Moving Consumer Goods (FMCG) makers have also resorted to grammage cuts—introducing lower-weight packs—instead of hiking prices as they battle inflation.

Companies like Amul, operating in the "value segment", claim to be gaining out of the consumer shift to more affordable brands.

“Our sales have jumped by 50-60 percent as compared to the last year due to consumer shift to brands that offer value,” said RS Sodhi, managing director of Gujarat Cooperative Milk Marketing Federation, which owns the Amul brand.

Urban consumers also downgrade

The trend is not limited to rural centres. In recent months, consumers in urban centres, too, have showed an inclination for buying smaller packs.

“Even in urban India, we are finding downtrading across our portfolio—be it shampoo, hair oil or oral care,” said Malhotra.

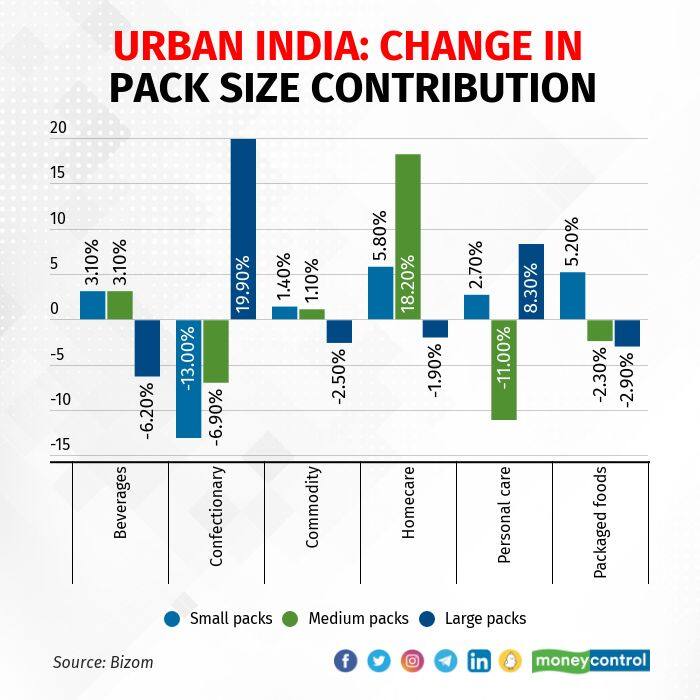

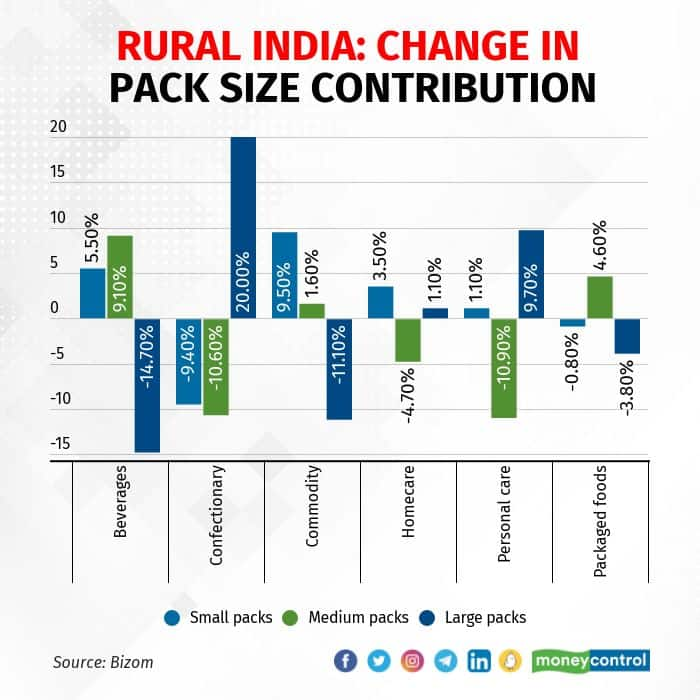

According to data from retail intelligence platform Bizom, five of the five categories tracked by the company in urban areas are seeing downtrading; four out of six categories in rural areas have indicated a similar trend (as shown below).

“A sharp rise in edible oil prices in March-2022 has led to the consumption of commodities dropping by about a third with sharp downtrading of these products, especially among rural consumers. This downtrading is not limited to just rural consumers and urban ones also seem quite affected,” said Akshay D’Souza, chief of growth and insights at Bizom.

“Products where oil is a key input ingredient are seeing an unprecedented sharp increase in prices, which are taking up input costs significantly and impacting profitability. This is forcing brands to push out their next round of price hikes,” he added.

Tough times ahead

Most FMCG companies have indicated that they expect challenges related to inflation and demand to persist at least in the near term and any relief is possible only in the second half of the calendar year.

“Moving forward in the near term, demand outlook is uncertain… We also expect margins to remain subdued but there is some degree of comfort from copra prices, which have inched down,” said Saugata Gupta, MD and CEO of Marico.

Coconut oil is extracted from copra; Marico makes Parachute coconut oil, the top brand in India in the category by a distance.

“Both demand and margins should improve in the second half of this year,” he added.

FMCG giant HUL also sees the second half of the year witnessing a revival in rural demand, the company’s CEO and MD Sanjiv Mehta said at a press conference after reporting fourth-quarter earnings.

According to Mehta, a good rabi harvest, coupled with bountiful monsoon rains and government spending, augur well for the rural economy and the demand scenario in the hinterland could improve in the second half.

The company, however, expects margins to remain under pressure in the short term.

Most FMCG companies reported an impact on their margins in the quarter gone by due to inflation and tepid demand, which made it challenging for them to pass on cost increases to consumers.

HUL’s overall gross margin contracted by 331 basis points year-on-year (YoY) in Q4. The homecare segment saw an Earnings Before Interest and Tax (EBIT) margin contraction of 138 basis points year-on-year (YoY) and the beauty and personal care segment of 129 basis points (YoY).

Cost-control measures, however, shielded its EBITDA margins, which were down by 20 basis points YoY. Marico’s consolidated gross margin expanded 30 basis points year-on-year to 44.5 percent, driven by some softening in copra prices. Dabur reported a 130-basis-point YoY contraction in gross margin to 47.4 percent due to inflation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.