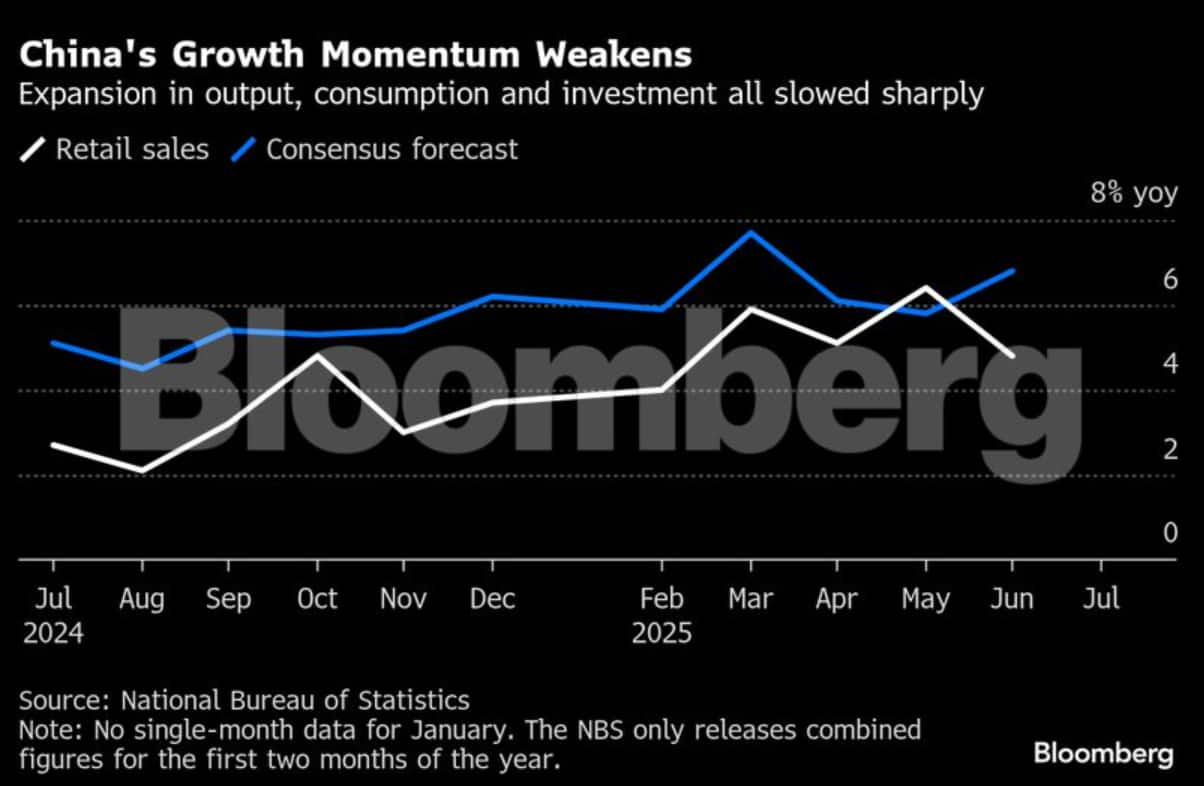

China’s economy slowed across the board in July with factory activity and retail sales disappointing, suggesting the world’s No. 2 economy is losing traction in the third quarter.

Production at Chinese factories and mines rose at the slowest rate since November and expanded 5.7% last month from a year earlier, according to data released by the National Bureau of Statistics on Friday, compared with June’s gain of 6.8%. The median forecast of economists in a Bloomberg survey was for an increase of 6%.

Retail sales grew 3.7% on year in July, the least this year, down from 4.8% in the previous month. Expansion in fixed-asset investment in the first seven months of the year decelerated to 1.6%, as a contraction in the real estate sector deepened. The surveyed urban unemployment rate worsened more than expected to 5.2%.

“China’s economy overcame negative factors including a complex and fast-changing external environment and extreme weather at home, and maintained progress amid stability,” the NBS said in a statement. “The economy showed relatively strong resilience and vibrancy.”

The offshore yuan held steady after the data release and the yield on China’s 10-year government bonds edged slightly lower. Chinese equities largely held on to their earlier losses, with the Hang Seng China Enterprises Index down 1% and the onshore CSI 300 Index trading slightly lower.

China’s economy slows

China’s economy slows

The latest snapshot of the economy indicated China’s growth lost steam after a show of resilience earlier in the year allowed Beijing to take a wait-and-see approach to further stimulus.

Top leaders have signaled they will stick with supportive measures already planned while promising to pump more aid when needed, a strategy analysts expect to be fine-tuned pending economic figures in the coming months.

Although uncertainty abounds over the outlook for global trade, industrial activity and construction also suffered from extreme weather. The disruptions in July, caused by high temperatures, unusually heavy rain and flooding in large swathes of China, added to what’s traditionally a slow season for the economy.

Growth in yuan-denominated new loans contracted for the first time in 20 years in the month, highlighting subdued willingness for borrowing and spending.

But in a boost to the economy, China’s exports remained a bright spot this year despite a drop in shipments to the US after President Donald Trump raised tariffs.

Instead of announcing massive new measures to juice growth, Beijing in recent weeks ramped up efforts to curb cutthroat competition among businesses. The campaign has attracted intense attention from investors given the stakes involved in reflating the economy and the potential impact on corporate profitability in industries from steel to solar energy and electric cars.

Authorities are also looking for ways to boost domestic consumption to reduce reliance on foreign demand in the long run amid rising rivalry with the US.

The government this week unveiled a plan to subsidize part of the interest payments on some consumer loans, after announcing earlier it will gradually waive preschool fees to ease education costs and offer childcare subsidies for families across the nation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.