The Union Budget was a mixed bag as far as provisions for taxation and investment avenues for individual investors are considered.

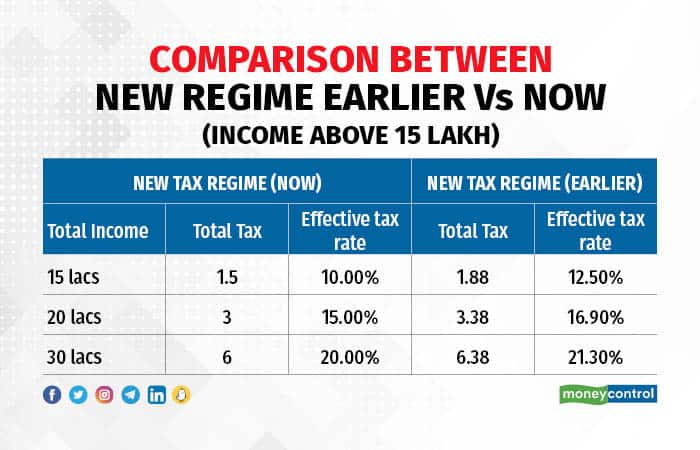

There is a lot to cheer for individuals with the prospect of an increase in disposable and investable income on account of enhanced slab limits and reduction in surcharge for individuals in the highest tax bracket. The move is aimed at incentivising taxpayers to shift to the new tax regime, which has not seen much traction since its launch in FY21.

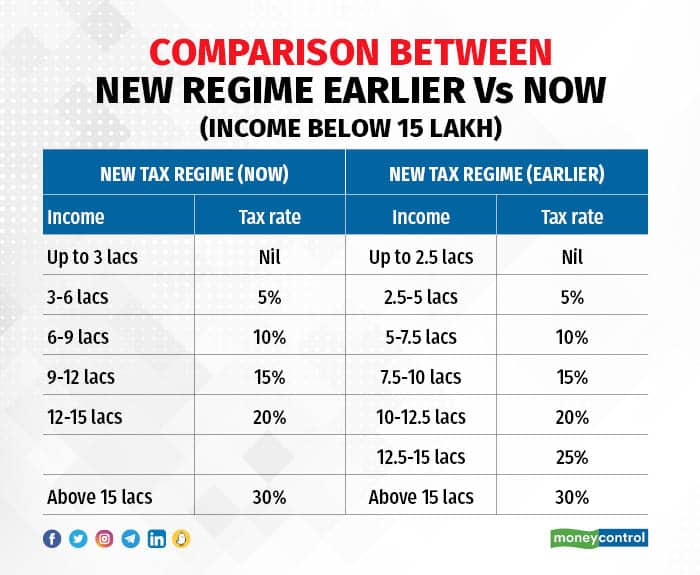

The new tax regime is the default option, but the old regime is still available if preferred. An individual with a total income of up to Rs 7 lakh (Rs 5 lakh earlier) does not need to pay any tax, which is a relief for individuals at the bottom of the taxpayer pyramid.

The new regime is beneficial for individuals who are not in a position to invest and claim deductions. Every individual, based on their special circumstances, will have to see which tax regime is more beneficial for them.

However, it would be advisable to continue with some form of investment in mutual funds, equity or insurance cover even though exemptions under Section 80C would not be available.

Also, individuals who are at the margin, where the surcharge rate changes, i.e., taxable income of Rs 50 lakh or Rs 1 crore, may benefit from the old regime as the exemptions may lower their taxable income to be eligible for a lower surcharge rate.

Additional funds

From an individual’s perspective, the money saved, if invested, can have a multiplier impact over the following few years and, if spent, will help meet other goals and requirements.

According to the finance minister’s calculations, the total savings by individuals would amount to Rs 35,000 crore. These additional funds will partly come to the financial system in the form of savings and investments and partly as increased demand for goods and services.

Senior citizens can benefit from the enhanced limit of Senior Savings Bonds from Rs 15 lakh to Rs 30 lakh at an interest of 8 percent.

For ultra-high net worth individuals, the positive is a reduction in taxation at the highest bracket from 42.7 percent to 39 percent. Investment products where the marginal rate of taxation was applicable like interest income or short-term capital gains from fixed income-oriented mutual funds, et al will be more beneficial.

However, some investment avenues that became very popular for high net worth individuals in the past few years such as Market Linked Debentures (MLDs) are as good as dead now as the tax arbitrage has been plugged. MLDs were linked to the market movement of underlying securities but for all practical purposes the conditions were highly unlikely to occur; hence MLDs were quite akin to non-convertible debentures as far as the risk was concerned.

However, MLDs enjoyed a flat 10 percent capital gains tax when held for more than 12 months (listed MLDs) and 36 months (unlisted MLDs). Now all MLDs maturing after April 1, 2024, will be treated at par with fixed deposits with income getting taxed at the individual’s marginal rate of tax.

The other provision that will hurt wealthy individuals is taxation on returns from investments made in non-ULIP or traditional insurance products where, if the premium per person exceeds Rs 5 lakh, then the returns, which were earlier tax exempt, will be taxable.

But all investors, including high net worth individuals, can be relieved that the much-speculated changes in capital gains tax rates on equity or fixed-income mutual funds or equity shares or their tenors did not take place.

The budget, if seen from a broader perspective, offers consolidation and continuity on the path of fiscal prudence, enhanced capital expenditure through a number of existing and new projects and initiatives, and focuses on creating infrastructure, jobs, and opportunities for an aspirational New India to leverage the demographic dividend.

The bottom line is that India will continue to be the fastest-growing major economy and every individual should participate in the Indian growth story by becoming a shareholder, rather than a lender, to generate long-term wealth. Budgets and other news are short-term noises that should not distract from the goal of long-term wealth creation. Disciplined asset allocation will be key in this journey.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.