The finance ministry's weeks-long labour will bear fruit when Nirmala Sitharaman presents the 2024-25 interim Budget in Parliament on February 1. And while it may only be an interim Budget, the underlying numbers may not change much when the full Budget is presented in July 2024 by the victor of the Lok Sabha elections.

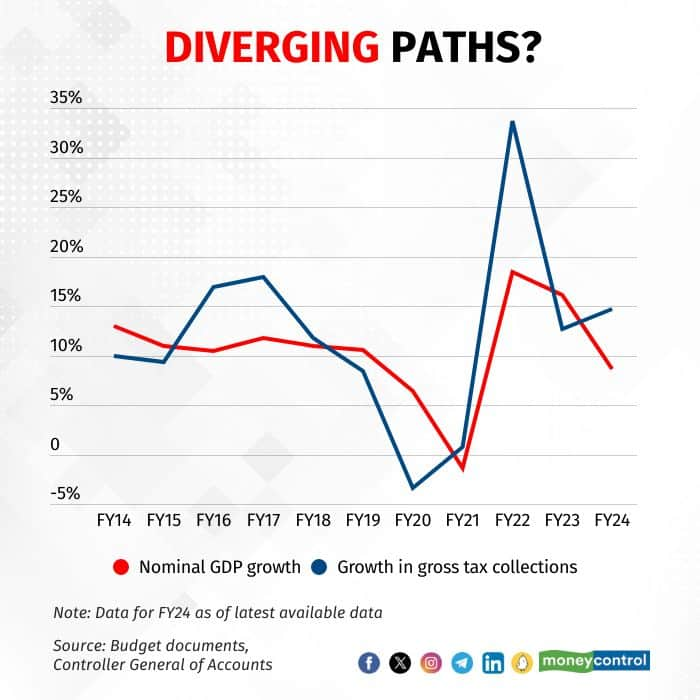

The annual budget-making exercise, however, may be more difficult this time due to the diverging paths of India's nominal GDP growth and tax collection growth. In the first half of 2023-24, the nominal GDP grew by just 8.6 percent, down from 22.2 percent in April-September 2022. Despite this, gross tax collections grew by 14.7 percent in April-November, up from a 12.7 percent increase in 2022-23.

Also Read: RBI model pegs India's FY25 GDP growth at 6.0% vs official view of 6.5%

While the government's tax revenue does not necessarily grow at the same rate as nominal GDP, they generally move in the same direction. But as can be seen in the above chart, 2023-24 has seen nominal GDP growth take a sharp dive while tax growth has actually edged up.

For making the Budget, the government assumes a number for next year's nominal GDP growth – that is, GDP growth without adjusting for the rate of inflation – and uses it to predict how much its tax collections will grow. Take, for instance, the Budget for 2023-24, which assumed nominal GDP growth of 10.5 percent, with growth in gross tax revenues pegged at 10.4 percent from the revised estimate for 2022-23.

"If nominal GDP growth is lower than 10.5 percent but tax collections meet Budget estimates, then we can clearly see buoyancy is high," a senior finance ministry official said on the condition of anonymity.

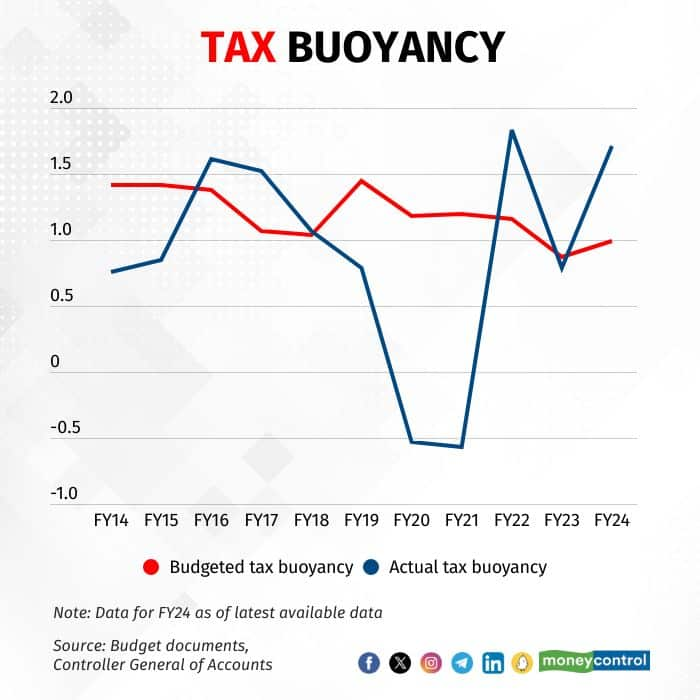

Tax buoyancy is the ratio of growth in tax collections to nominal GDP. As such, the buoyancy is said to be greater than 1 when tax collections grow faster than nominal GDP.

Rise in tax buoyancy

Tax collections this year have indeed been impressive, with the available numbers, so far, suggesting a tax buoyancy of 1.7 – far higher than the average of 1.2 across the five pre-pandemic years from 2014-15 to 2018-19.

But why is the tax buoyancy so high this year? According to economists and tax experts, compliance is playing a big role in garnering direct taxes. Within this segment, corporate tax collections – which are up 20 percent year-on-year in April-November – require a deeper explanation.

A fall in input costs has boosted corporate earnings. According to a Reserve Bank of India (RBI) analysis of the performance of listed non-financial companies from the private sector, the growth in their operating profits jumped nearly five times to 26.2 percent in July-September 2023 from 5.3 percent the previous quarter. This is leading to stronger growth in corporate tax collections than nominal GDP growth and also somewhat explains the far higher real GDP growth rate of 7.6 percent in the second quarter of 2023-24 than what most economists and even the RBI expected.

According to Aditi Nayar, chief economist at ICRA, the Centre's direct tax collections in 2023-24 may exceed the Budget estimate by around Rs 85,000 crore.

The budgeted tax buoyancy is usually rather different from the actual.

The budgeted tax buoyancy is usually rather different from the actual.

But can't the 2024-25 Budget just assume a higher tax buoyancy and account for any possible differences in the nominal GDP growth and tax growth numbers? Sure, but as the chart above shows, it is notoriously difficult to correctly predict how buoyant tax collections will be.

The growth conundrum

A fall in input costs for companies this year is also reflected in the wholesale inflation numbers. In the first eight months of 2023-24, Wholesale Price Index (WPI) inflation has averaged -1.3 percent. And while it finally exited the deflationary zone in November, rising to 0.26 percent and is seen increasing further in December and beyond, economists see it averaging under 1 percent for the financial year as a whole.

But why does WPI inflation matter here? Because its progression is a key input in forecasting nominal GDP growth for the year as WPI inflation forms the majority of the GDP deflator – used to adjust nominal GDP to arrive at real growth. Of course, the issues with India's current GDP deflator are well known, with the government currently working on a Producer Price Index.

But there are issues too with how India measures its nominal GDP. Following the release of the excellent July-September 2023 GDP data, Chief Economic Adviser V Anantha Nageswaran had said that when the tax buoyancy is as high as it currently is "then it is quite possible that we are not measuring the economy's underlying momentum and activity and dynamism as we should be".

"These are real numbers. These are cash flow statements put out by companies... It behooves us to consider the possibility that the economy could be actually growing far better than what we are actually measuring," the government's top economist had said.

Also Read: Finance ministry may assume nominal GDP growth of 11% for FY25

Where does that leave the government's Budget math? Well, no one will really complain as long as tax collections grow more than estimated.

"If the Budget is being balanced within the estimates, then we are good," the aforementioned finance ministry source said.

However, the disconnect between growth in nominal GDP and tax collections does raise issues about the sanctity of the Budget numbers.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!