The Finance Minister walked away with kudos for not taking the populist route despite this being an election year and, perhaps more impressively, for prioritising fiscal consolidation with realistic assumption. A nominal GDP growth of 10.5 percent for FY25, with a 5.1 percent fiscal deficit, a net borrowings of Rs 11.73 crore with a modest 11 percent increase in capex spend sounds prudent and achievable.

On the face of it, stock markets did not seem to cheer the move with the Nifty ending the session with a mild loss, but the fact that the market held up in the face a 2 percent fall in US markets on January 31 after negative cues from the Federal Reserve and weak Asian markets was proof that investors were not too disappointed after all.

Equally, that FM’s reiteration of commitment to focus areas such as rooftop solars, affordable housing, green energy, EV transition, metros, railways did not cause an upswing in these stocks only meant that capex spending has already been priced in. Consumption stocks were not delivered any big surprises either. In fact, the other way round. Baring rural housing, the budget did not have any triggered to lift rural demand. The only exceptional gainers were the public sector bank stocks, which along with other banking stocks, were on a tear thanks to fall in yields after the pleasant surprise on the lower than expected net market borrowing number.

Falling yields or stronger bond prices will result in mark-to-market gains on banks’ bond portfolios, which will flow directly into their bottomline.

Overall, markets are clearly running out of triggers, and valuations continue to be elevated across most segments of the market, both industrials and consumption. Both government capex spend and pace of execution are expected to slow down ahead of elections, which would result in industrial stocks moving sideways for a bit. Consumption stocks, in pockets, have been correcting steadily because of high valuations, although certain segments catering to premiumisation have been doing well. Overall though the momentum in the market continues to be strong because of the avalanche of fund flows from local investors. The steady flow through Systematic Investment Plans, and greater commitments from high net worth individuals and family-offices is triggering more and more demand for stocks, pushing prices higher.

The general sentiment among investors seems to be that equities will only go one way, that is up. Thus, all falls are being bought into. And elevated valuations have generally compelled investors to keep moving from one pocket to another, keeping sector rotation at play. Even so, investors fancy for smids has caused valuations to go through the roof as the lure of quick returns draws in more and more investors into poor quality stocks. This is unlikely to change unless there is an accident that causes a sharp fall and dents investor sentiment, scaring them away like it did in the previous bull runs.

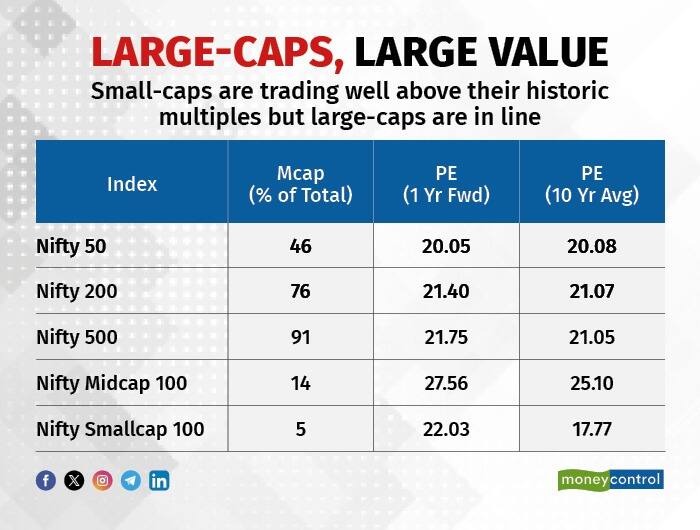

In the world of stock markets, whatever is unsustainable usually finds a way not to sustain itself. It’s hard to say how and when. But valuations, if one looks at large-caps, even the entire Nifty 500 pack, which constitutes 91 percent of the total market-cap of all listed companies is hardly screaming caution. One-year forward P/E for Nifty 500 stands at 21.75, nearly the same the 10-year average. Nifty Small-cap 100, which constitutes 5 percent of all listed companies trades at 22.03x compared with 17.77x. Specific stocks command much higher multiples. In that sense, there is exuberance, but that is only a small segment of the market. The rest of the market is neither a screaming buy nor a screaming sell. It’s a market that can deliver returns in line with the economy’s growth plus a couple of percentage points as corporate profits can be better than topline growth because of scale, productivity and efficiency benefits.

Going by segments, currently, large-caps offer a lot more value than smids, which command a significant valuation premium. This mismatch will be bridged eventually, but once again it is hard to predict when. For this to happen, one, enough money needs to flow into these stocks and that will happen only when foreign investors come in because large stocks are their natural hunting ground because of size. Another way for this to happen would be through any regulatory intervention that diverts the avalanche of funds flowing into small-cap fund schemes into large-cap fund schemes. For investors who are willing to stay invested for the medium-term, where to hunt for relative value is a no-brainer.

Having said that, making outsized returns from hereon will require investors to take sharply contrarian calls, and take a leap of faith on an entrepreneur, business or an institution. There was a time not long ago when power financials like PFC and REC were trading at yields higher than 15-20%, as if they were about to go bankrupt. Today, investors can’t get enough of these stocks. On the other hand, HDFC Bank, the darling of stock market for 30 years is trading at its lowest valuation in more than 20 years, and there are hardly any takers. Where there is pain, there is money to be made. That’s one way to think, not the only way though.

Over the next few months, till general elections, markets will be driven by stock-specific factors as well as an eclectic bunch of concerns, from geo-political news, political noise and commentary on US inflation to interest rates, dollar index, crude oil and news on China and so on.

Meanwhile, the hunt for value will continue and market will become even more unforgiving towards companies who fail to meet expectations, as was made painfully evident with the sharp stock reactions in companies that faltered on quarterly results.

Correction if any will only be welcome, soothe some nerves and extend the bull run.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.