The Reserve Bank of India’s (RBI) multi-year process to normalise banking system liquidity will spill over into the next financial year, the governor of the central bank said on August 5.

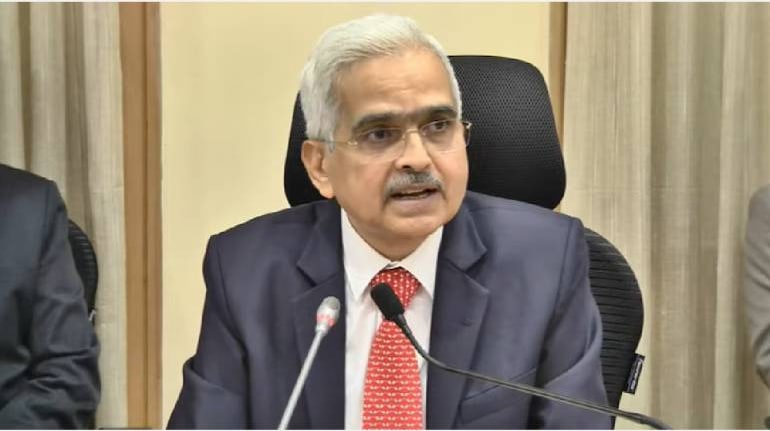

“The overall liquidity in the system is upwardly high. Like we have said before, liquidity normalisation will be a multi-year cycle,” Shaktikanta Das told reporters at a press briefing post the rate-setting Monetary Policy Committee’s interest rate decision.

ALSO SEE: RBI Monetary Policy Highlights

Das elaborated that one important factor to consider is that some of the targeted long-term repo operations that were announced in the first year of the pandemic will mature in 2023. Hence, the process will spill over into the next year as well.

Simply put, banking system liquidity is calculated on the basis of supply and demand for central bank money. The RBI uses the Liquidity Adjustment Facility (LAF) window to manage liquidity.

Using this window, the central bank lends short-term funds to banks at the repo rate, accepting government securities as collateral, and sucks out funds from banks at reverse repo rate. Presently, the repo rate stands at 5.40 percent.

The RBI has the LAF framework and a number of liquidity management tools at its disposal to manage inflation in the economy by increasing and reducing money supply.

The RBI, which is looking to scale back pandemic-era surplus, has ensured that liquidity will continue to be in surplus at least this year. Although RBI will continue to suck out liquidity surplus, the process is unlikely to be hurried, said bankers.

Earlier today, Das had said that due to the steps undertaken by central bank, surplus liquidity in the banking system has come down from Rs 6.7 lakh crore in April-May to Rs 3.8 lakh crore in June-July. This was largely due to the variable rate reverse repo operations and Standing Deposit Facility, he said.

However, the central bank will conduct two-way fine-tuning liquidity operations depending on evolving financial conditions, Das had said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!