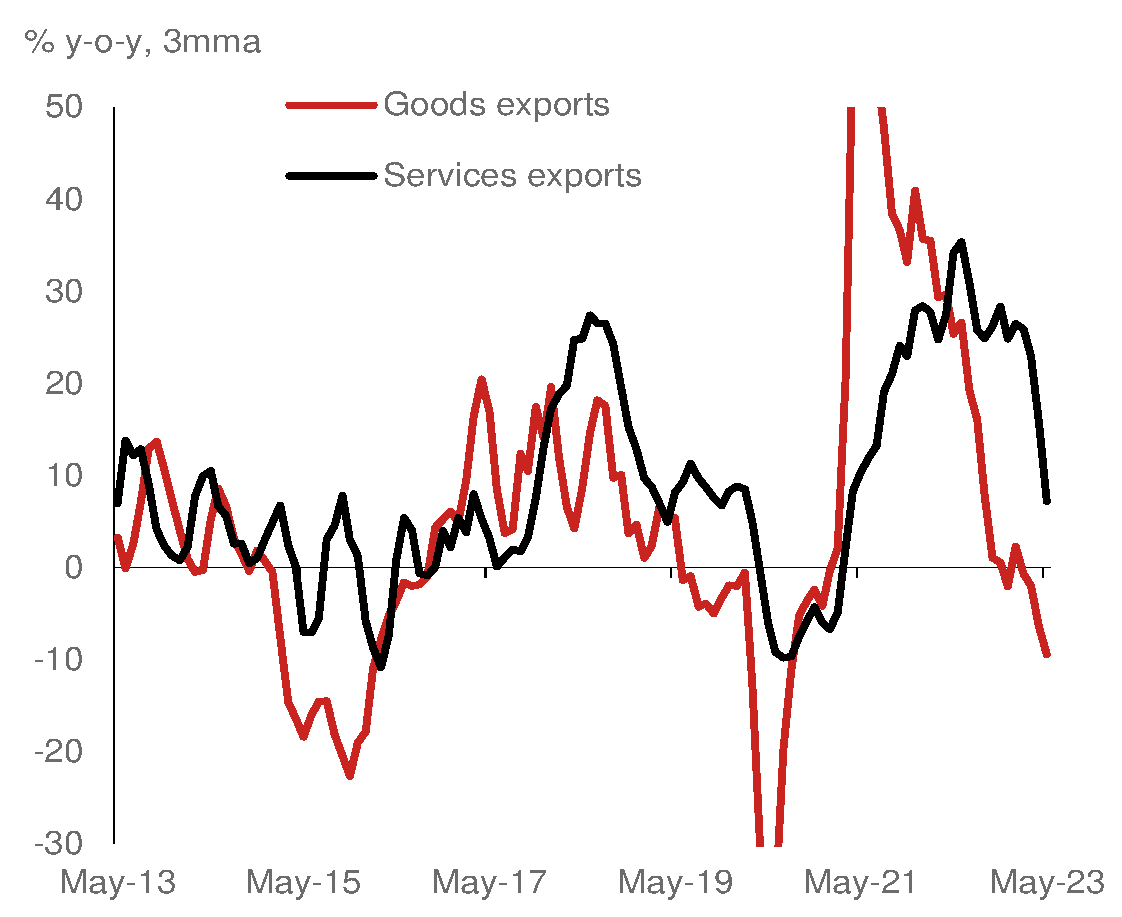

The reduction in discretionary tech spending by companies in the US and other Western countries is starting to affect the services exports of India, according to Nomura.

Growth of services exports has fallen to 0.7 percent year-on-year (YoY) in May — which is a 28-month low — from 7.4 percent YoY growth in April and 26.7 percent YoY increase in FY23.

Also read: China's exports fall 7.5% in May

The brokerage’s analysts peg this to “weak external demand” spreading now to the services sector, after affecting demand in goods exports.

“While an updated sectoral break-up of services exports is not yet available, data up to Q4 2022 indicated that the post-pandemic improvement in services exports was driven mainly by IT services, but was also supported by stronger professional & consulting services,” wrote the analysts.

“We believe the ongoing moderation reflects cutbacks in discretionary tech spending by Western firms in the BFSI (banking, financial services and insurance) and retail verticals,” they added.

According to Nomura’s analysts, the structural drivers of India’s services exports remain intact. The current slowdown is “likely cyclical”.

They pointed to how it could affect the local economy.

“A slowdown in services exports could weaken urban consumption, as the IT sector is an important generator of employment. However, the balance of payments impact should be manageable, as services imports will also likely slow,” they wrote.

“We expect the services trade surplus to rise by 4 percent YoY in FY24 from 32.8 percent in FY23, but the current account deficit to still narrow to 1.4 percent of GDP from 1.8 percent in FY23,” they added.

Also read: Nomura rates ITC a buy with target price of Rs 485

Good exports still remain in contractionary territory, but its de-growth has slowed down.

“Merchandise export growth contracted by 10.3 percent YoY in May, improving from -12.5 percent in April, in line with our expectations,” wrote the analysts in an earlier report.

The slowdown in oil exports deepened in May, but core exports improved to -4 percent YoY from -9.2 percent in April, with sequential momentum picking up to 2.3 percent MoM (month-on-month, sa) from -1.2 percent in April.

“Our proprietary indicator – the Nomura India Normalisation Index (NINI) for trade, which excludes base and seasonal effects – shows exports largely remained flat in May at 30 percent above pre-pandemic levels. Our price volume analysis suggests that on a 3-month rolling sum basis, both prices and volumes continue to contract, although a larger share of the underperformance in core exports is driven by prices,” wrote the analysts.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.