An income tax revamp is expected in the budget. Some reports say that the Income-tax Act of 1961 will be rewritten. The aim? Make the laws concise, easy to follow, and reduce litigation. The momentum is with the new tax regime, introduced in 2020-21, which 72 percent of taxpayers now prefer, with many more likely to adopt it after the tax cuts in 2024.

The new tax regime offers higher tax-free income, fewer deductions and greater ease of filing. With very few deductions and exemptions available, taxpayers are spared the cumbersome paperwork of proof submissions. Tax-free income levels are now at Rs 7.75 lakh. If we look at the AY 2023-24 data from the Income Tax Department, we see that 70 percent tax filers reported a taxable income of Rs 5 lakh or less, which means they had no tax liability. Furthermore, 88 percent are under the Rs 10 lakh limit, and 94 percent under Rs 15 lakh.

From this, we can deduce that nine in 10 taxpayers are either in a no-tax or a low-tax bracket. Most of them will choose the new regime. And, therefore, this provides us the opportunity to look at the behavioural shifts triggered by the new regime in the context of troubling new trends and suggest what more could be done.

Here are three asks from the forthcoming budget as far as personal tax is considered.

Ask #1 — Enhance the 30% slab to Rs 18 lakh

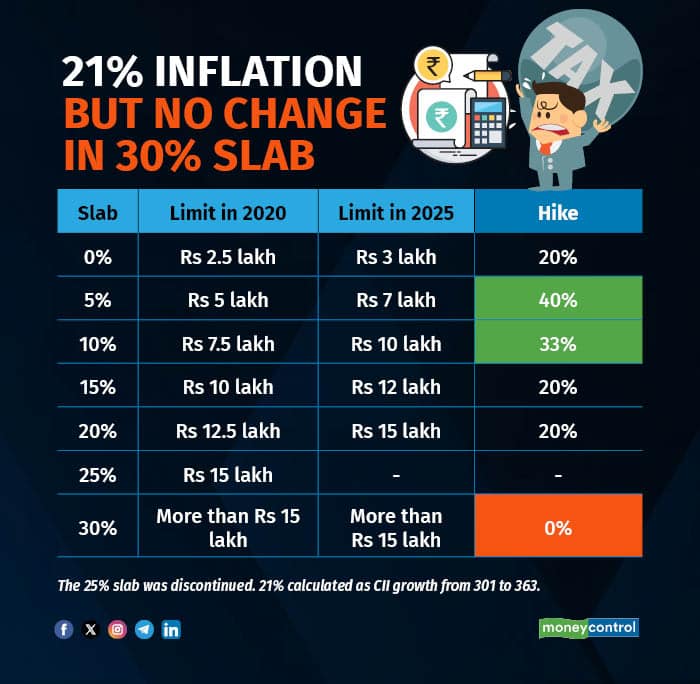

The new regime was introduced in 2020. Since then, the Cost Inflation Index (CII) is up 20.59 percent. Most new regime brackets have been enhanced by at least 20 percent. Except one. The 30 percent slab is stuck at the Rs 15 lakh level set at the start. If we update it by 20 percent, it needs to be at Rs 18 lakh. Without this update, taxpayers with higher income get burdened with a disproportionately higher share of the taxes. More on that in the next point. For the urban salaried—someone with high-interest EMIs, schoolgoing children and dependent family elders—a higher income compared to the average Indian may offer little consolation due to high inflation in healthcare, education and costs of living. Such taxpayers, too, deserve some relief.

Ask #2 — Fix the brackets, not just tax-free income

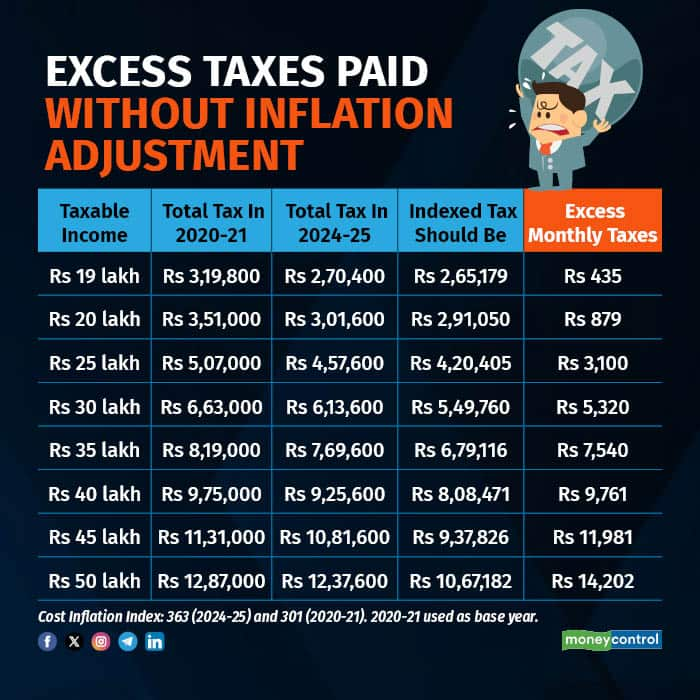

To expand on the above point, this is also an ask to make the bracket enhancements secular. There are calls to increase tax-free income to Rs 10 lakh from the current Rs 7.75 lakh. Tax-free income has its benefits. But it is being enabled at the cost of taxpayers in the higher brackets that haven’t been adjusted for inflation for at least half a decade now. To put this into perspective, in AY 2023-24, the bottom 98 percent of taxpayers accounted for only 23 percent of tax payments. The problem isn’t that the other 77 percent comes from just 2 percent of taxpayers. The problem is those 2 percent amount to barely 1.3 million taxpayers. Of them, just 91,000 filers alone—the top 0.1 percent—with incomes above Rs 1 crore accounted for 58 percent of income tax collections. Merely increasing tax-free income without bracket enhancement shifts the income tax burden on those with higher incomes. As per our calculations, all those who earn more than Rs 19 lakh are now paying excess taxes—which we calculated as the difference between inflation-adjusted taxes and actual taxes. For instance, basis the CII, a taxpayer with a taxable income of Rs 25 lakh now pays Rs 37,200 a year in excess taxes.

Also read | Budget 2025: Hike in tax deduction on health insurance premiums critical, say experts

Ask #3 – Provide a 30% deduction, fix the incentives

One of the key benefits of the new regime is the absence of deductions and exemptions. But five years later, we’re also seeing some troubling trends emerge. Life insurance penetration is dropping. Investments in ELSS—equity linked savings schemes, instruments that allow for tax incidence —are falling during some tremendous years for equity. Among those surveyed by BankBazaar, fewer salaried respondents are interested in small savings schemes, and interest in NPS or the National Pension System remains low. We postulate that in the absence of tax deductions, interest in essential protections and long-term savings is declining. In the past year, we’ve had an economic slowdown, declining household savings and stagnant incomes. Simultaneously, there’s increasing reliance on credit for consumption to a point where delinquencies have started to hurt. These are circumstances where low savings and protections can be particularly damaging for households.

The point can be made that deductions tied with the right incentives are necessary for fixing this problem. Traditionally, tax deductions have been linked to insurance and savings. The absence of one may be hurting the other. While the new regime had no deductions to start with, a few have now been added. More are needed. In the interest of simplification, a flat deduction of 30 percent of the gross income should be provided to include long-term savings, essential insurance, healthcare and education costs, and loan payments without confusing caps and sub-limits. The deduction can be capped at Rs 15 lakh to ensure equity among income levels.

Also read | Will Budget 2025 scrap the old, with-exemptions tax regime?

The problem of tax rates also needs to be seen from the perspective of the government. Net income tax collections grew 25 percent last year. The share of direct taxes in total taxes has risen to a 14-year high of 56.72 percent, and the largest contributor to this growth is income tax, which provides 54 percent of all direct taxes. These taxes are necessary for building the physical and digital infrastructure driving India into its future. The government must ensure robust revenue generation. But with income tax, we are at an inflection point. Relief is due in some quarters.

The writer is CEO, BankBazaar.com

Disclaimer: The views expressed by experts on Moneycontrol are their own and not those of the website or its management.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.