Expectations from Budget 2025 were high and Finance Minister Nirmala Sitharaman did not disappoint taxpayers.

“Slabs and rates are being changed across the board to benefit all tax-payers. The new structure will substantially reduce the taxes of the middle class and leave more money in their hands, boosting household consumption, savings and investment,” she said during her Budget speech.

For one, she hiked the tax rebate limit under the new tax regime from Rs 7 lakh to Rs 12 lakh. Put simply, those earning up to Rs 12 lakh will not have to pay tax, though they have to file returns to claim the rebate of up to Rs 60,000.

For salaried employees, the effective limit is Rs 12.75 lakh, thanks to the standard deduction. However, special-rate incomes such as capital gains are not eligible for this rebate. You will have to pay tax at applicable rates for such incomes.

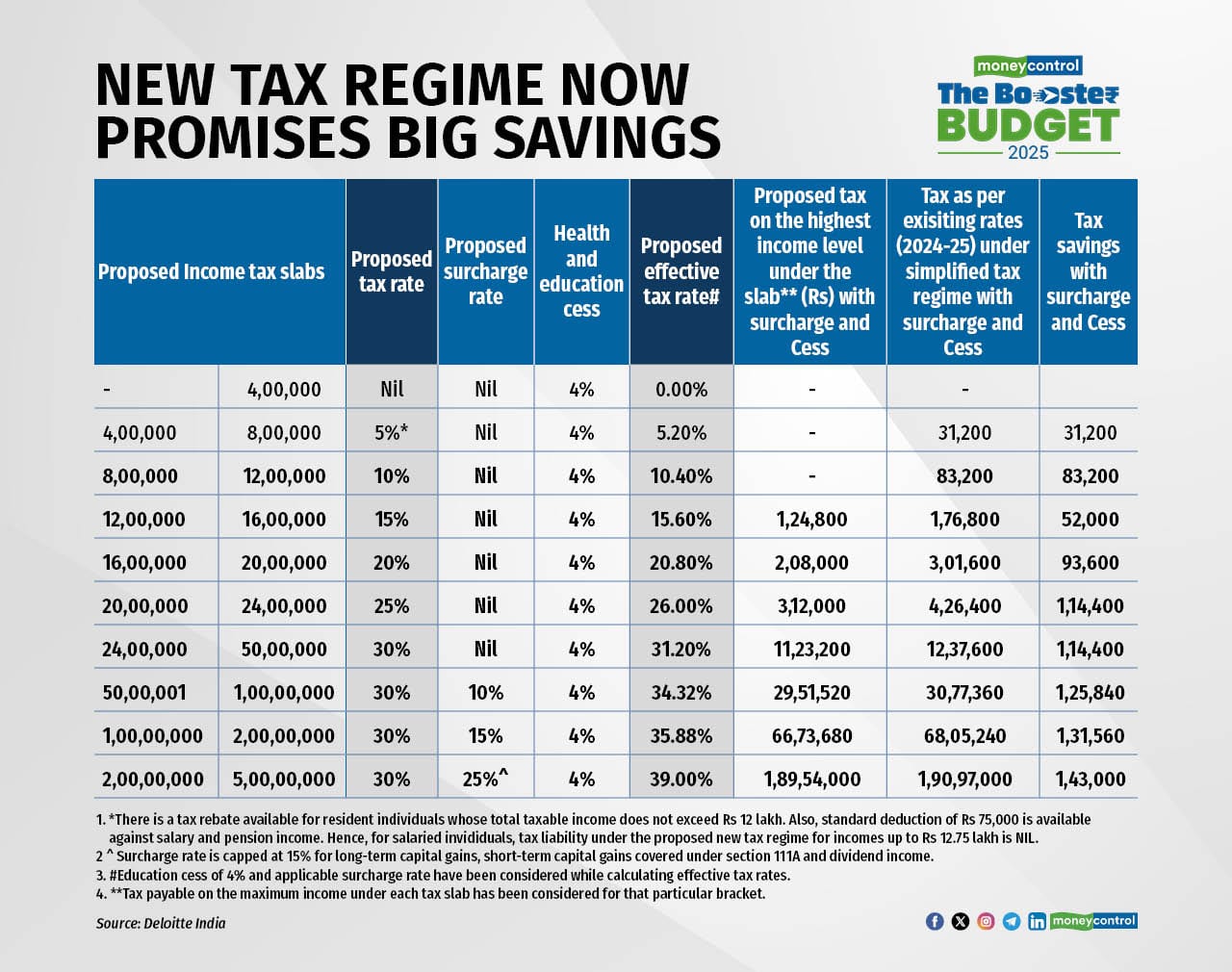

She has also raised the basic exemption limit under the new tax regime from Rs 3 lakh to Rs 4 lakh, besides rejigging the income tax slabs. Unlike tax rebate, these two moves will benefit taxpayers across slabs.

According to Deloitte India’s calculations, a salaried individual with an income of Rs 12 lakh will see her tax outgo being reduced by Rs 83,200 (inclusive of cess). A taxpayer with an income of Rs 16 lakh will now save Rs 52,000 post the changes. This is assuming that she had chosen the new regime in 2024-25 as well.

Likewise, someone earning Rs 1 crore will save Rs 1,25,840, while those with incomes of Rs 2 crore will see their tax payable going down by Rs 1,31,560 in the financial year 2025-26.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.