Motilal Oswal

For the third consecutive quarter, all consumer companies under the coverage of Motilal Oswal which have a rural reach of over 30 percent have stated that rural growth has outpaced urban growth.

Rural demand had been the fulcrum of the strong volumes witnessed by the sector in the years leading up to FY14 but had slowed down in FY15 and FY16 because of drought, and in FY17 because the impact of demonetization had negated the potential positive benefits of a normal monsoon.

While urban volume growth has remained fairly resilient at mid-single-digit levels, rural growth, which was growing at the 1.5-2x urban growth in the years leading up to FY14, declined to flat and even negative levels in the years that followed.

Factors which are fuelling rural growth are normal monsoon in FY18, low base effect, increase in MSP in FY18, an increase in rural allocation in recent budgets.

There are four factors in particular which brighten the prospects of a further recovery in rural demand to earlier high levels:

Five key trends are particularly relevant for Hindustan Unilever, resulting in an elevation in its earnings growth trajectory compared to the past:

Motilal Oswal believes Emami remains a credible long-term play due to:

While Britannia is currently an urban company because rural is only around 20 percent of sales, a combination of:

Motilal Oswal is optimistic on Colgate Palmolive’s earnings prospects, given:

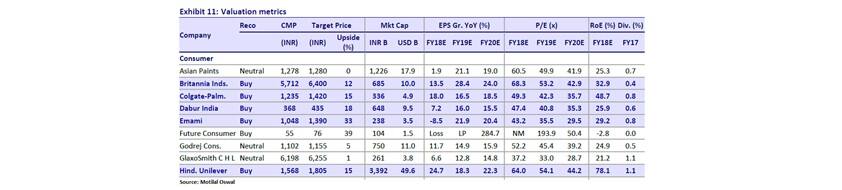

The much-vaunted earnings revival in the sector appears poised to come through, and rural-dependent plays are likely to be at the vanguard in FY19.

Dabur has addressed the market share loss issue in its two key categories of Juices and Honey, while Oral Care continues to do very well. With an expected EPS CAGR of 16 percent going forward (v/s less than 12 percent CAGR over FY14-17), Motilal Oswal values the stock at 42x March 2020E EPS (10 percent premium to three-year average) and derive a target price of Rs 435.

Relative to other three rural plays, DABUR has a much more diversified product portfolio and is not dominant in many of them. Weaker competitive advantage, therefore, results in some risks to earnings projections. RoE is also weaker than the peers mentioned above.

Disclaimer: The article is extracted from Motilal Oswal’s report on the consumer sector. The views and investment tips expressed by investment expert on Moneycontrol.com are Motilal Oswal’s own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.