HDFC Mutual Fund held a 4.37 percent stake in the beleaguered Punjab National Bank as at the end of the October-December quarter. The bank has been hit by fraudulent transactions of over Rs 11,000 crore.

According to data on BSE, Punjab National Bank's total outstanding shares stood at 243 crore, of which HDFC Mutual Fund held 4 percent, or 9.72 crore shares.

HDFC Prudence Fund, HDFC Equity Fund and HDFC Midcap Opportunities Fund all held a significant amount of shares of the public sector bank.

Shares of PNB tanked 22 percent in two days after the fraud of Rs 11,333 crore was unearthed. The falling prices of the shares will directly impact the mutual fund schemes that are holding them.

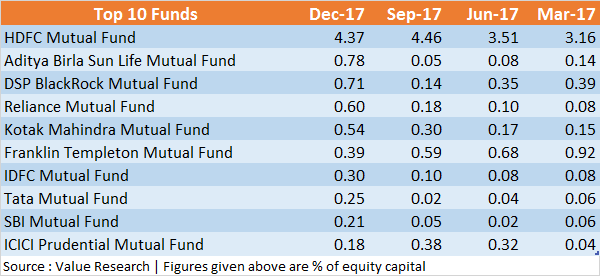

Among the top 10 fund houses, Aditya Birla Sun Life Mutual Fund held 0.78 percent stake in the state-owned lender, while DSP BlakcRock held 0.71 percent, as per the data on Value Research.

Across the 43-player MF industry, the underlined stock was bought by 144 schemes in the December quarter, while it was sold by 51 schemes. Of 42 AMCs, 27 MFs had some stake in PNB.

According to Ace Equity, 73 mutual fund equity schemes hold equity share in Punjab National Bank, comprising a total market value of Rs 2,750 crore.

Commenting on MF holding in the bank, a mutual fund manager said, "We usually have a strategy or a rule book to go by for dealing with such stress in the portfolio, we will wait and watch and then take appropriate action."

Punjab National Bank on Wednesday revealed in a stock exchange filing, fraudulent and unauthorized transactions worth Rs 11,360 crore at one of its Mumbai branches.

The fraudulent transaction amount is 2.55 percent of the bank's total loan book of Rs 4.5 lakh crore (as of December 2017). It is also 8 times the bank's FY17 net profit of Rs 1,324 crore.

The case came to light on January 16, after diamond jeweler Nirav Modi’s company sought a fresh loan early last month. By then, the PNB official they had allegedly been working in collusion with had retired.

The new official who took charge noticed the fraud and wrote to the CBI on January 29, naming two PNB officials. The details are revealed in a complaint by PNB.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.