Sachin Pal

Moneycontrol Research

Highlights:

- Tiles volumes rose by 10 percent

- Margin improved by 40 bps YoY

- New capacities to go on stream by Q2 FY20- Valuations turn reasonable, post recent correction

-------------------------------------------------

Kajaria Ceramics Q1 earnings for FY20 look healthy and robust. The environment continues to remain challenging for Kajaria, but the company delivered another quarter of resilient operational performance led by double-digit volume growth in the tiles business.

Key result highlights

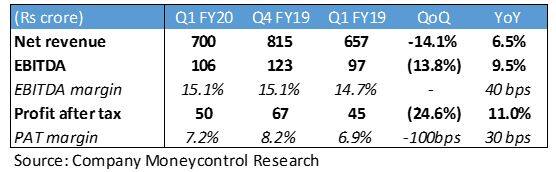

The tile volumes for the quarter stood at 19.7 million square meter (MSM), which implies a growth of 10 percent year-on-year (YoY). Overall realisations were softer in Q1 owing to higher contribution from outsourcing business and pricing pressure across other product segments. Tile revenues increased 5 percent YoY to Rs 650 crore.

Sanitaryware and faucets grew just 4 percent YoY and achieved sales of Rs 41 crore while the plywood business contributed Rs 8 crore to top line. The plywood business had another strong quarter on a favourable base, but sanitaryware and faucets witnessed a sharp decline in sales growth due to high competitive intensity and lacklustre demand environment.

Sanitaryware and faucets grew just 4 percent YoY and achieved sales of Rs 41 crore while the plywood business contributed Rs 8 crore to top line. The plywood business had another strong quarter on a favourable base, but sanitaryware and faucets witnessed a sharp decline in sales growth due to high competitive intensity and lacklustre demand environment.

Consolidated earnings before interest, tax, depreciation and amortisation (EBITDA) for the quarter gone by stood at Rs 106 crore compared to Rs 97 crore in the same period last year. Change in product mix (higher share of low margin products) kept the gross margin under pressure, but EBITDA margin expanded 40 bps YoY owing to lower power and fuel expenses and cost rationalisation measures.

Liquidity challenges post the IL&FS default are affecting the home-building industry and broader housing market. The tile industry has been flat owing to lacklustre demand from real estate and supply pressure.

The management of Kajaria expects tile market to remain flat in FY20 as well. Given the challenging market conditions, the management has adjusted its guidance lower to 12 percent growth, from 15 percent earlier.

The National Green Tribunal order regarding shutdown of all ceramic units in Morbi and Wankaner that run on coal gasifier will force the tile manufacturers to shift to gas for their power and fuel requirements. The new regulatory requirement augurs well for Kajaria and other organised players as it would increase tax compliance and reduce competition in the overall sector.

The capacity expansion in tiles and sanitaryware remains on track. Kajaria’s new 5.0 MSM glazed vitrified tile plant in Andhra Pradesh is expected to be commissioned in Q2 FY20. Besides, capacity augmentation for sanitaryware unit (from 6 lakh to 7.5 lakh pieces) is also expected to be complete in the current quarter.

Outlook and Recommendation

Despite a sluggish industry backdrop, Kajaria has delivered a robust financial performance in the previous 4-6 quarters. Through superior execution, the management has been able to grow volumes in a tough market environment and also protect and maintain its operational margin in an inflationary cost environment.

The stock appears reasonably priced for the short term, but in terms of both quality and valuation, Kajaria is well-positioned for market-beating returns in years ahead. Long-term investors should use dips wisely to accumulate the stock as Kajaria enjoys a market leadership position and strong brand recall.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.