The public issue of state-run Cochin Shipyard will open for subscription on August 1, which comprises of fresh issue as well as offer for sale.

Bids can be made for minimum 30 equity shares and in multiples of 30 shares thereafter. The issue will close on August 3.

Equity shares are proposed to be listed on BSE and National Stock Exchange. The book running lead managers to the issue are SBI Capital Markets, Edelweiss Financial Services and JM Financial Institutional Securities.

Here are 10 things you should know before subscribing the issue:-

About the Issue

The state-owned shipyard company will enter the primary market with a public issue of 3.3984 crore equity shares on August 1. The price band for the issue is fixed at Rs 424-432 per share.

The issue consists of a fresh issue of 2.2656 crore shares and an offer for sale of 1.1328 crore shares by The President of India. The issue will constitute 25 percent of the post issue paid-up equity share capital.

The company targets to raise Rs 1,440.92 crore at lower end of price band and Rs 1,468.11 crore at higher end of price band.

Cochin Shipyard will receive Rs 978.74 crore through the fresh issue of shares.

It is a part of divestment programme announced by the government in Budget.

Objects of the Issue

The proceeds of the offer for sale will be received by the selling shareholder - The Government of India. Company will not receive any proceeds from the offer for sale.

The shipyard company has proposed to utilise fresh issue proceeds for setting up of a new dry dock within the existing premises (around Rs 443 crore); setting up of an international ship repair facility at Cochin Port Trust area (around Rs 229.5 crore); and general corporate purposes.

Company Profile

Incorporated in March 1972, Cochin Shipyard is the largest public sector shipyard in India in terms of dock capacity, as of March 31, 2015, according to the CRISIL Report.

It caters to clients engaged in defence sector in India and clients engaged in commercial sector worldwide. In addition to shipbuilding and ship repair, it also offers marine engineering training.

As of May 2017, it has two docks – dock number one, primarily used for ship repair and dock number two, primarily used for shipbuilding.

The company is in the process of constructing a new dock, a ‘stepped’ dry dock that will enable longer vessels to fill length of the dock and wider, shorter vessels and rigs to be built or repaired at the wider part. It is also in the process of setting up an International Ship Repair Facility (ISRF), which includes setting up a shiplift and transfer system.

Its key shipbuilding clients include the Indian Navy, the Indian Coast Guard and the SCI. It has also exported 45 ships to various commercial clients outside India such as NPCC, the Clipper Group (Bahamas) and Vroon Offshore (Netherlands) and SIGBA AS (Norway).

Orderbook

Its current shipbuilding order book includes Phase-II of the IAC for the Indian Navy, two 500 passenger cum 150 ton cargo vessels and two 1,200 passenger cum 1,000 ton cargo vessels for the Andaman and Nicobar Administration and a vessel for one of the Government of India's projects.

Current ship repair order book includes vessels from key clients.

Financials

Company has posted profits continuously in last five fiscals. Total income and profit has increased from Rs 1,660.45 crore and Rs 69.28 crore, respectively, in fiscal 2015 to Rs 2,208.50 crore and Rs 312.18 crore, respectively, in fiscal 2017 at a CAGR of 15.33 percent and 112.27 percent, respectively.

Revenues from shipbuilding and ship repair operations in recent fiscals:-

Top customers - the Indian Navy and the Indian Coast Guard - together accounted for 82.43 percent, 89.92 percent and 84.57 percent of revenue from operations in fiscals 2015, 2016 and 2017,

respectively.

Strong liquidity position in terms of total cash and bank balance of Rs 2,003.2 crore as of June 30, 2017, enables the company to continue to stay invested in business and to consistently pay suppliers on time and benefit from supplier goodwill.

Strategies

Expand our capabilities through our proposed Dry Dock and International Ship Repair Facility

Build a strong order book by bidding vigorously for projects to be awarded by the Indian PSUs and defence sector pursuant to ‘Make in India’ initiative

Continue to enhance our construction quality and delivery time and enhance our price competitiveness in order to increase our market share

Strengthen our market leadership by continuously adding upgraded and new vessel models to our offerings and expanding customer services

Continue to leverage our market position and our relationships with customers, suppliers and other business partners to support our growth and improve our competitiveness

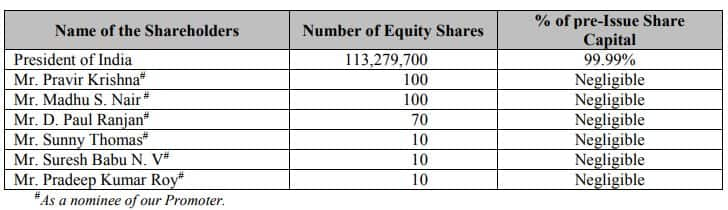

Shareholding Pattern

Promoter is the President of India acting through the Ministry of Shipping.

Promoter, along with its nominees, currently holds 100 percent of the pre-issue paid-up equity share capital of the company.

After this issue, promoter will hold 75 percent stake in the company, which as per SEBI's minimum shareholding norms.

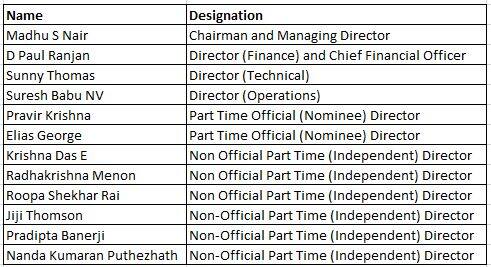

Management

Cochin Shipyard currently has twelve directors, of which six are independent directors.

Management Organisation Structure

Dividend Policy

As per CPSE Capital Restructuring Guidelines, all central public sector enterprises are required to pay a minimum annual dividend of 30 percent of profit after tax or 5 percent of the net-worth, whichever is higher.

Dividend declared by the company and dividend tax thereon for the last five fiscals:-

Risks

Brokerage houses listed out some risks that one has to consider before subscribing the issue:-

> The shipyard business is highly dependent on global economic conditions

> The entire business operations of the company is based out of a single shipyard at Kochi

> Business is subject to extensive government regulation

> The company is dependent on the Cochin Port Trust for certain basic services required for daily operations.

> Nature of fixed price contracts

> Loss of any of the company's major customers or a reduction in their orders

> Failure to succeed in tendering for shipbuilding or ship repair projects for the Indian Navy in the future

> Weak tendering activity for ship building/repairs (from the Indian Navy and the Indian Coast Guard who account for 85 percent of revenue) could impact the business

> Delay in commercial operations of Dry Dock project or project completions could result in cost overruns

> Volatility in raw material prices like steel could hamper operating margins

> Commercial shipbuilding industry is highly cyclical in nature

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.