Krishna KarwaMoneycontrol Research

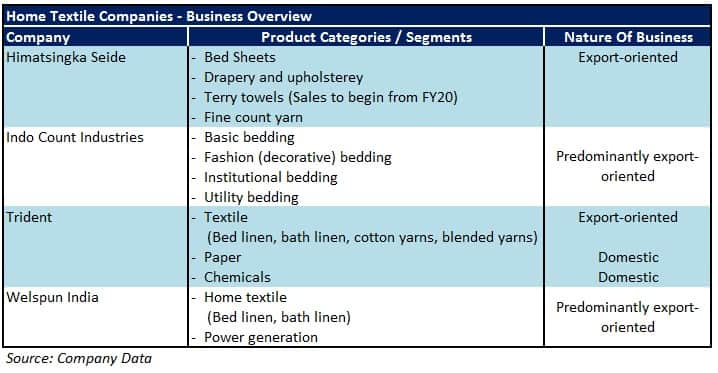

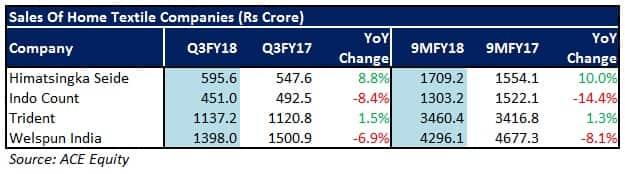

Most of India’s leading home textile majors faced headwinds in the quarter ended December 2017. While their export arms struggled due to delays in receipt of incentives and exchange rate fluctuations, raw material price hikes and delayed recovery post-GST impacted their domestic operations.

Barring Himatsingka Seide, there wasn’t much to cheer about.

Himatsingka Seide

Himatsingka’s impressive Q3 performance was attributable to operationalisation of the expanded bed sheeting capacity, a better product mix, and traction in branded portfolio (contribution from brands stood at Rs 1,100 crore on December 31, 2017 versus Rs 750 crore as of December 31, 2016).

An increase in utilisation rate at the 23 million metre per annum sheeting plant commissioned in H2FY17 (from 40-45 percent during 9MFY18 to 50 percent or more from FY19 onwards), coupled with the operationalisation of the 25,000 metric ton terry towel manufacturing capacity from FY20, will boost Himatsingka’s top-line noticeably.

Commencement of backward integration processes (yarn manufacturing) in Q4FY18 should enable Himatsingka to save substantial raw material procurement costs, thus aiding gross margin accretion and facilitating operating leverage. Measures undertaken by the company to augment the reach of its private label brands of cotton-made bed linen may be an added shot in the arm.

Indo Count Industries

Currency volatility, increase in captive consumption of yarn (for manufacturing bedding products), and an increase in raw material prices (due to pest attacks on the cotton crop in the past few months) led to a weak set of quarterly numbers for Indo Count.

Bed sheet sale volumes are likely to remain under pressure in the near-term owing to weak demand and delays in ramping up utilisation at the 90 million metre bedding manufacturing facility. The capacity is expected to get fully utilised by FY21-end as against the management’s guidance of 56 million metres for FY18. The company is expanding its offline and online presence of its ‘Boutique Living’ brand in India.

Indo Count’s Rs 240 crore phase 2 capex, which entails modernisation of the spinning and weaving capacities, is tentatively scheduled to be completed by the end of FY19, which could lead to higher operating efficiencies. To improve margins, the company intends to boost the share of premium value-added products to total revenues from 13 percent at present to 30 percent by FY20 end.

Trident

Operating margins of Trident’s textile segment bore the brunt of high input costs and destocking by some large customers based out of North America. Realisations were flat for the paper segment and low for the chemicals segment, thus resulting in marginally lower margins in both segments.

Trident’s revenue prospects in the upcoming fiscals will be largely dependent on how utilisation levels at its home textile segment subdivisions scale up.

Moreover, Trident has been stressing on selling high-value ‘Copier’ branded paper, that fetches superior realisations and earn better margins vis-à-vis regular paper. The company targets to gradually increase the proportion of ‘Copier’ paper sales to total paper sales (from 60 percent in FY17). Debt repayment and employee expense rationalisation measures will work in favour of the company as well.

Welspun India

Sale volume degrowth (due to a weak demand environment in the US), a strong rupee, working capital blockages, and high cotton costs were the primary causes for Welspun’s lacklustre show in Q3.

Considering the boom in online retail in the US, Welspun has been strengthening supply channels with its American retailers. This will ensure that the company’s brands, especially in-house ones, will gain better visibility on websites of their clients. For now, the company isn’t too focused on exploring partnership opportunities with American online retail majors such as Amazon since it’s margin-diminutive.

Stability in cotton prices in the near future could ease margin pressure. Conclusion of a significant part of Welspun’s capital expenditure in the home textile segment should improve the cash flows from the division. However, the company will incur nearly Rs 700 crore as capex for its carpet manufacturing unit in the next 15-18 months. The capacity of this project is anticipated to scale up over the next 3 to 5 years.

Which stocks should you choose?

India’s export-oriented home textile majors, despite taking a series of steps to boost their profitability, are going through a turbulent phase. Adverse exchange rate scenario may linger on for a while. Overdependence on US markets remains a key concern and warrants risk mitigation through geographic diversification.

Destocking and slower off-take at the US customers’ end, that has been pretty pronounced of late, needs to be closely monitored and resolved. Competitive risks from other nations (China, Pakistan, Bangladesh and Turkey) continue to persist, thus necessitating constant product innovation and better terms of engagement with overseas buyers.

Though valuations of all stocks appear undemanding, we are particularly bullish on the possibility of a re-rating in case of Himatsingka Seide and Trident (trading at 10.1/7.1x FY20 projected earnings, respectively) given their ability to tackle headwinds better than their peers, good fundamentals, and strong execution competencies. Investors may, therefore, consider going long on these names.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.