Web3 venture capital firm Hashed Emergent, the organisers of the India Blockchain Week (IBW) in Bengaluru, shared a regulatory proposal for Web3 and crypto ecosystem stakeholders and regulators in collaboration with Trilegal on December 4, addressing the biggest concern of the industry in India.

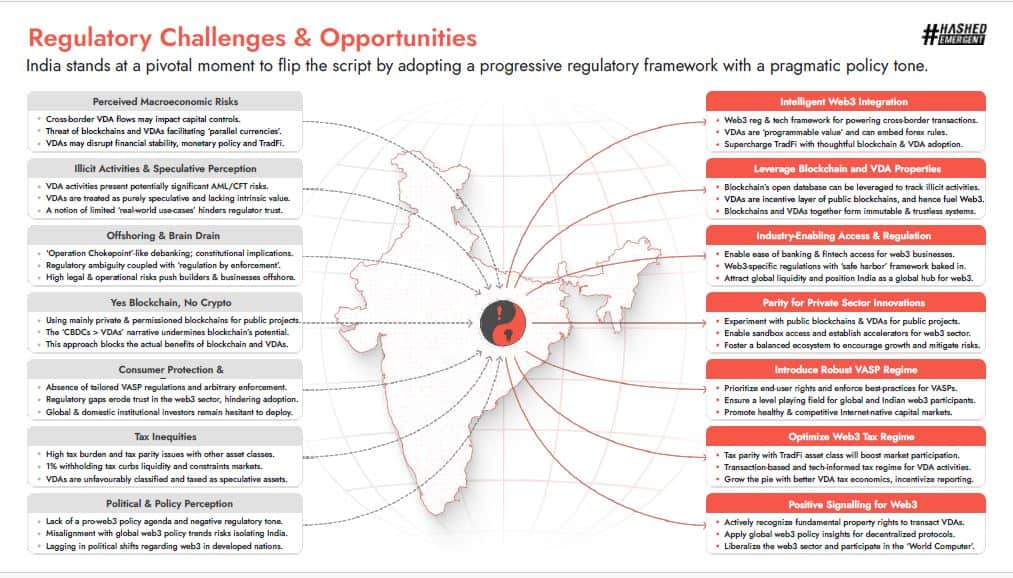

The VC fund urged the regulators to adopt a progressive framework with a pragmatic policy tone.

“We can flip the script right. We can develop sophisticated frameworks for cross-border Web3 transactions. The same blockchain activity that people are blaming for illicit activity, it can actually be used to track payment flows and it can be a much more authentic system for everybody here,” said Sharanya Sahai, Senior Associate Investment, Hashed Emergent.

He added, “We can enable proper banking access and safe harbour papers. And we can position India as a true leader in global Web3 advocacy, policy and position it as a global equity hub. It's very important to have robust Virtual Asset Service Providers (VASP) regulations to build trust and also optimizing our tax regime to boost investor participation…Most importantly, we must align with what's happening all over the globe.”

Sahai highlighted the challenges and lost opportunities the Web3 founders and startups have to face in India. “While this is a genuine concern about digital assets disrupting additional financial controls and stability, our regulatory folks have always looked at the industry with a lot of scepticism and negativity.”

He added, “What's particularly worrying is the operational choke point situation we are seeing. The shadow demarking is pushing the brightest minds and companies offshore.”

Hashed Emergent, a subsidiary of the South Korea based early stage VC Hashed, unveiled the second edition of its India’s Web3 Landscape 2024 report at the event.

According to the report, the first nine months of 2024 saw funding activity into Web3 startups grow by 82 percent YoY to $462 million, a significant improvement from $254 million in the full year of 2023. This, however, is still lower than the $1.4 billion raised by Indian Web3 startups in 2022.

“There was an uptick in the number of deals and average fundraising amount particularly at the seed stage. This surge was led by global web3 funds, accelerators and ecosystem efforts by leading blockchains,” the report said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.