In recent months, a new form of cybercrime has quietly taken hold across the country, where the perpetrator does not break into homes, but into one's psyche and mind. These so-called “digital arrest” scams weaponise technology, capitalise on fear to rob victims of not just their money, but their sense of safety.

This is the in-person story of one such victim, an elderly man in Chennai, who was trapped for weeks in a nightmare orchestrated entirely through a phone screen.

“Respected sir, we woke up at 6am today as per your orders. We will appear before you at 9:30am. Jai Hind.”

That was the message my wife and I sent every single morning for almost a month. Not to a relative, not to the government, but to someone we had never met, a stranger who called himself an officer of the CBI. A stranger who took over our lives, one message at a time.

I am Vignesh Mohan (name changed), an 81-year-old retired government employee who has lived peacefully in Chennai with my wife for decades. We raised our children with care, our sons live abroad, and our daughter is in Pondicherry. We have lived simply, saving a little from our pensions, visiting the temple, and staying out of trouble.

But on March 15, everything changed.

That morning, I received a call on my mobile. The man on the line asked if I was Vignesh, then accused me of owning another number linked to suspicious activity. He gave an address in Tilak Nagar, Mumbai. I told him he had the wrong person.

He introduced himself as someone from the Telecom Regulatory Authority of India (TRAI). Then he said he was transferring me to the CBI.

Another voice came on the line. Calm, official, firm. "This is Vijay Khanna from the CBI," he said. He told me that an account in ABC Bank, Mumbai, had been opened using my Aadhaar and was being used for money laundering. I told him that could not be true. I live in Chennai. I have never opened a bank account in Mumbai.

He insisted I had. He said this was a serious offence. When I told him I did not understand Hindi properly, he transferred the conversation to someone who spoke Tamil.

That is when I heard the name Prathap.

He told me I was under investigation in a transnational money laundering case linked to now defunct Jet Airways CEO Naresh Goyal. He said the Supreme Court had issued orders for a nationwide crackdown and my name was in it. He even sent a document, with the name of Justice Sanjiv Khanna on it, that said other accused had taken their lives out of shame.

I remember my hands going cold. A strange weight settled in my chest. The thought of being publicly shamed at this age after living an honest life was unbearable.

I was told to tell no one. Not my sons. Not my daughter. Not even my wife. I felt sick.

“You are now under digital arrest,” he said. From that moment, I stopped living a normal life.

They instructed me and my wife to report every morning and evening through a WhatsApp video call. 9:30am and 9:30pm. We had to stand in front of the phone and say we were ready. We had to message them before and after meals. Every message had to end with “Jai Hind.”

It felt like being monitored by a ghost. We were too frightened to ask questions.

There were no handcuffs, no police vans, but we were prisoners. Inside our own home.

On March 17, we were told to go to ABC Bank in Thiruvanmiyur and close all our fixed deposits. The bank was closing for the day, so we went again the next morning. On March 18, we transferred Rs 36 lakh and Rs 23 lakh from two of our accounts to an DEF Bank account in Noida, under the name ISJ Enterprises.

They said it was for verification. That our money would be returned once my name was cleared.

As I pressed ‘confirm’ on each transaction, a voice in my head kept asking...what if this is wrong? But louder than that was another voice, the one on the phone, reminding me that any hesitation could bring harm to my children.

On March 19, they asked us to appear in front of the phone for a “court hearing.” A voice announced, “The honourable judge has arrived.” Another voice said we were being placed under CBI custody for seven days. That we must not talk to anyone, or our children would be arrested too.

We stood straight. We followed orders. We believed every word. There was no judge or a courtroom. But we bowed our heads as if we were guilty and didn't even know what crime we had supposedly committed.

The instructions kept coming. On April 4, they asked us to transfer Rs 1.15 crore to another DEF Bank account, this time in the name of Maa Shitla Enterprises. That same day, we sent another Rs 21 lakh to someone named Manoj at another bank in Ernakulam.

Later, under instructions from another man named Sandip Rao, we sent Rs 14.5 lakh and Rs 11.5 lakh on April 9 and 15 to two more accounts. One belonged to Surajit Gogoi in Guwahati and the other to Sharanjit Kaur at North East Small Finance Bank. These were the last of our savings. We even broke our PPF accounts.

I had spent my whole life planning carefully for the future, for our children, for medical emergencies. And in just weeks, I watched every last rupee disappear into black holes.

When I said the bank might question me, they told me to lie. “Say your daughter sent you the money to buy land”. I didn’t want to lie, but I was terrified of disobeying.

That was the cruelest part, they made me complicit in my own destruction. Every single day, my wife and I sent messages like clockwork.

“Respected Sir, taken dinner. Going to sleep. Will appear tomorrow morning. Jai Hind.” “Sir, we are awake. We will be ready at 9:30am. Jai Hind.”

If we delayed even once, they would say our surveillance was on hold and that we must come online immediately. We were afraid to step out of the house, kept the curtains closed and didn’t tell a soul.

It was like living in a bunker. We walked softly, whispered. We were 81, and terrified like schoolchildren facing a principal.

On April 26, they asked me to arrange another Rs 20 lakh. I told them we had nothing left. They said to ask our children and lie about buying land. That was the final crack.

I called my son-in-law in Pondicherry. I told him I was under CBI custody. I told him to come to Chennai but not to tell anyone. When he arrived, I explained everything. The court, the calls, the transfers.

He looked horrified. He dragged me to the cyber crime headquarters. Only then did I learn the truth. There was no CBI case. No Supreme Court order. No surveillance. Just a gang of criminals who had stolen our entire life’s savings. The total amount we lost was Rs 2.27 crore.

What we lost was not just money. We lost our trust. Our dignity. Our peace of mind. Even now, when the phone rings unexpectedly, I jump. When someone says "CBI", my hands tremble. I still wake up at 6am. My wife and I still look at the phone around 9:30am. Our minds have been rewired.

I believed I was a criminal. That my wife and I were under arrest. That one mistake would get our children into trouble.

They made us prisoners inside our own home. They made us type “Jai Hind” every day as if we owed them our loyalty. And the worst part is, we believed we did.

They used the flag, the court, the government and our fear and took everything. They didn’t just loot our savings but colonised our minds. Now I am left with one truth. I did nothing wrong. But I am the one who was punished.

Not an isolated case but a disturbing pattern

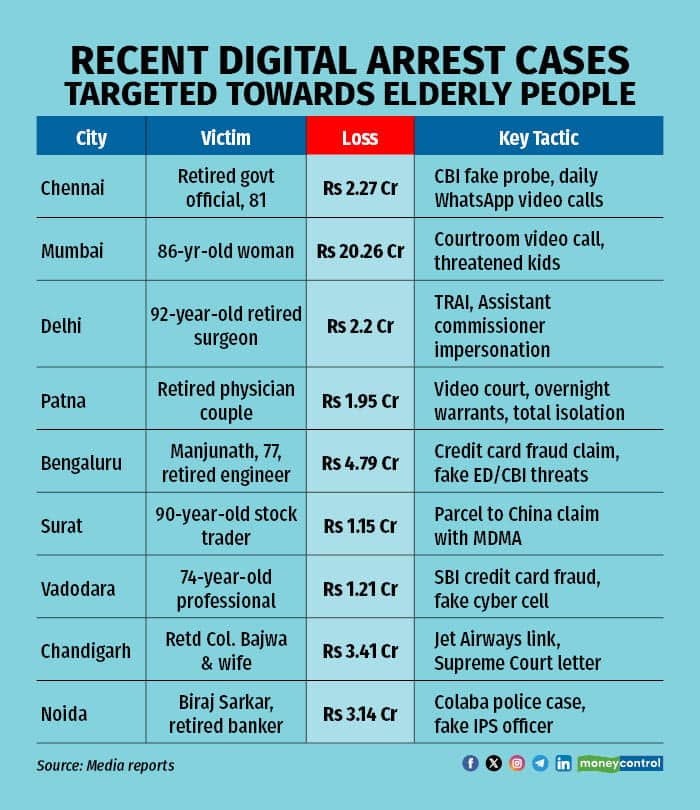

What happened to Mohan and his wife is not an isolated tragedy. It is part of a silent epidemic sweeping across India, where fear, technology and impersonation come together to prey on the elderly.

Cybercrime incidents have grown sharply over the past decade, but digital arrest scams in particular have exploded in recent years. In 2024 alone, there were 1,23,672 reported digital arrest cases which more than double the 60,676 in 2023 and triple the 39,925 in 2022. This data, shared by Minister of State for Home Affairs Bandi Sanjay Kumar in Parliament in March, reveals how quickly this new form of psychological captivity is spreading.

The financial toll is staggering. In 2024, the defrauded amount from these cases crossed Rs 1,935 crore, a massive spike from Rs 339 crore in 2023 and Rs 91 crore the year before.

The elderly have become prime targets. In just one city, Bengaluru, over 2,370 senior citizens have filed cybercrime complaints in the past 38 months, collectively losing more than Rs 257 crore, as per data from Bengaluru City Cyber Crime Police. Many more victims remain silent out of shame, confusion or the sheer trauma of being deceived.

The tools may be new, WhatsApp, fake FIRs, even deepfake courtrooms, but the weapon remains the same: fear. Fear of shame, of arrest, of dragging your children into trouble.

Scammers no longer break into homes. They arrive through a screen, speak in legalese, and build invisible prisons out of guilt and silence.

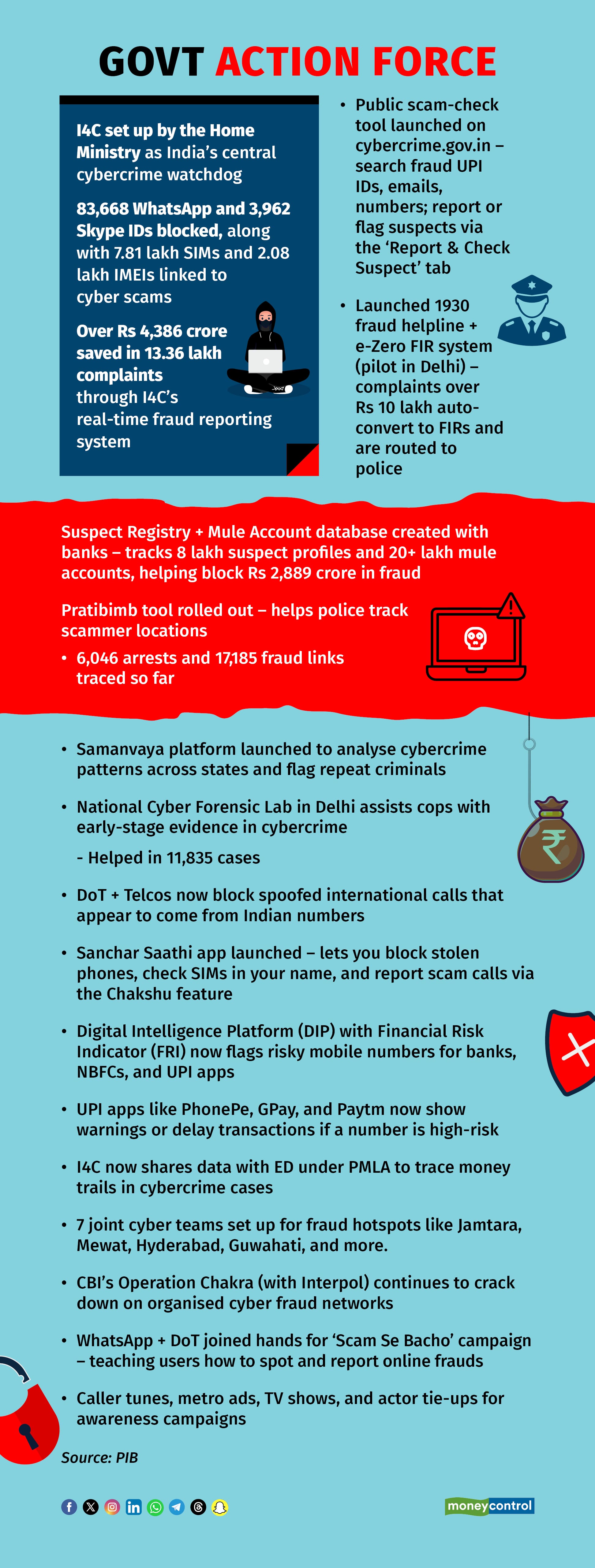

To combat this wave, the government has launched awareness campaigns, blocked thousands of fake digital IDs, and strengthened reporting systems, but the response is still evolving. Meanwhile, grassroots organisations like HelpAge India and Nightingales Medical Trust are stepping up.

“We work closely with local clubs like Rotary to reach elders across the city,” says Dr Radha S Murthy, managing trustee of Nightingales. Their joint initiative with Bengaluru City Police — Elders Helpline — recently launched DigiSafe 60+, a training programme to equip seniors with the basics of digital security and scam prevention.

For every Mohan who speaks up, many others don’t. Some are too afraid, some too late, and some still believe they are being watched.

What elderly citizens should keep in mind

Do’s:

Don’ts:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!