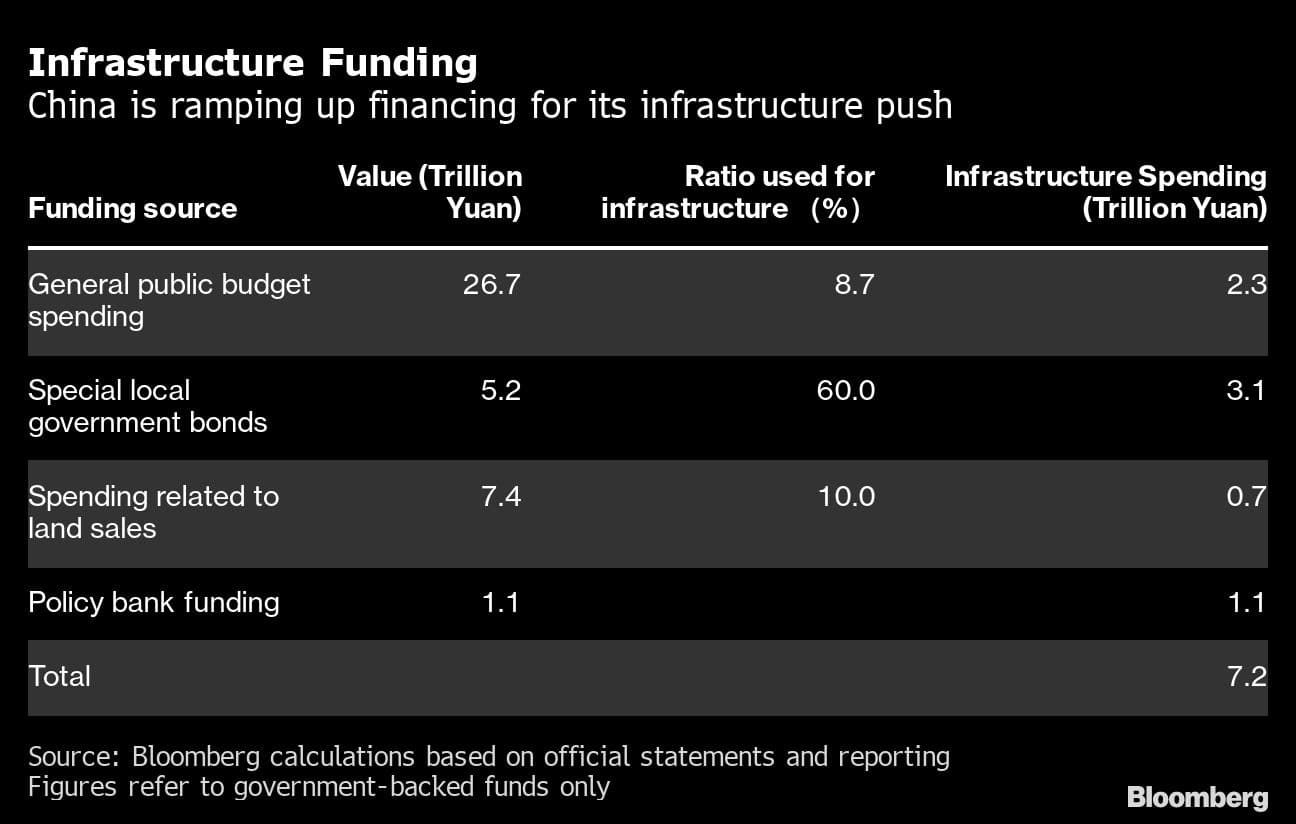

China is making 7.2 trillion yuan ($1.1 trillion) in funds available for infrastructure spending, a decisive shift away from a focus on controlling debt toward supporting a lockdown-ravaged economy.

The figure refers to government-backed funds and is based on Bloomberg News’ analysis of official announcements. It includes an unprecedented 1.5 trillion yuan of “special” bonds, mainly used for infrastructure, that local governments may be allowed to sell in the second half of this year, according to people with knowledge of the discussions.

With the government expanding its funding support, infrastructure investment in 2022 will likely rise 7.7% from last year, according to Citigroup Inc. That would be a major boost to the world’s second-largest economy as Beijing tries to offset the drag from repeated Covid lockdowns and a slump in the property market.

“We have entered a new cycle of infrastructure development,” said Yu Xiangrong, chief China economist at Citigroup. “That’ll be a new normal.”

He estimates overall growth in fixed-asset investment will reach around 6% this year, which would contribute 2 percentage points to China’s gross domestic product growth. “The tendency of shifting away from infrastructure investment due to the deleveraging campaign has come to an end,” he added.

President Xi Jinping has called for an “all out” effort to increase infrastructure spending this year in the hope of fueling economic growth and meeting a GDP growth target of around 5.5%. Local governments have been issuing bonds at a record pace to fund industrial parks, transportation networks, water projects, mobile networks and data centers.

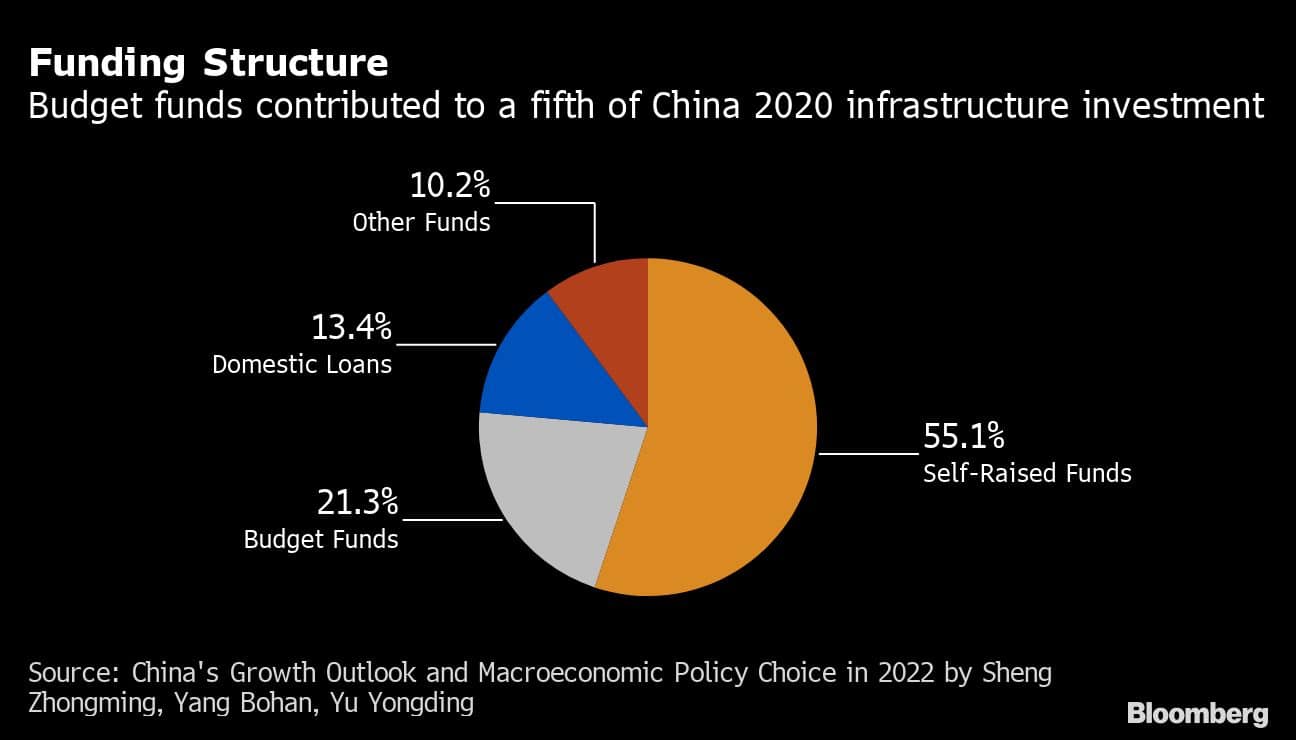

Taking into account financing from private sources and commercial banks, it’s unclear just how much will be spent on infrastructure. Citi’s Yu estimates the number could be 16.5 trillion yuan. Others are more optimistic: Lian Ping, chief economist at ZhiXin Investing Research Institute predicts spending could reach about 19 trillion yuan this year, contributing 3.7 percentage points to China’s GDP growth.

However, there’s a chance that despite the fiscal largess, overall infrastructure investment growth could still disappoint. First, while Beijing is letting local governments issue more bonds, it’s still telling them to reduce so-called “hidden” debt -- off-balance sheet borrowing from banks by state-owned companies, which has financed a large chunk of China’s infrastructure over the last decade.

Second, fiscal funds need to be supplemented by lending from commercial banks and private investors -- both of which may be reluctant to lend in a risky environment. Finally, local governments in recent years struggled to find infrastructure projects that could generate returns large enough to repay the special bonds. Some economists estimate local governments left 2 trillion yuan of funds unspent last year.

While Beijing is telling local authorities to speed up spending, it remains to be seen if attitudes will shift.

“Funds are less of a constraint for infrastructure investment this year, while the bottlenecks lie mainly with project pipelines and government incentives,” Goldman Sachs Group Inc. economists including Xinquan Chen wrote in a note last week. In a sign that the fiscal push is yet to rev up construction, sales of excavators in China have been sinking since April last year. In January-June, the sales plunged 53%.

Most economists think that even with a large infrastructure push, Beijing won’t be able to reach its GDP growth target this year. The second half of the year will likely see continued Covid lockdowns, a property market still in a deep slump, and overseas demand for Chinese goods expected to weaken. The consensus forecast among economists is for growth of 4.1% this year.

Here’s a deeper look at the funds available for infrastructure spending:

Local governments also generate revenue from selling land. About 10% of China’s land sale-related revenue goes into infrastructure, according to a recent report by Chinese researchers including Yu Yongding, a former policy adviser to the People’s Bank of China. However, land sales have plummeted this year due to the slump in property. Based on trends up to the end of May, about 0.7 trillion yuan could be available for infrastructure spending.

Special local government bonds are now the key source of infrastructure funds. Around 60% of the bonds sold by the end of March were spent on infrastructure, according to Bloomberg calculations based on figures provided by Xu Hongcai, a deputy finance minister, at a briefing in April. That means 3.1 trillion yuan could be available for financing infrastructure construction, given this year’s special bond sale quota of 3.65 trillion yuan and the extra issuance being considered.

The policy bank bonds are especially important as the central government will subsidize interest payment of the notes for two years, meaning the tool can be used for projects whose return on investment is too low to be funded by special local government bonds.

The central bank said the policy lenders will use the 300 billion yuan to set up “financial vehicles” to invest the money as equity capital in major projects, suggesting it expects commercial banks and companies to add to the pool of funds.

The bonds are expected to account for up to 10% of total investment in relevant projects, Zou Lan, the head of the PBOC’s monetary policy department, said at a Wednesday briefing. That means they could leverage about 2.7 trillion yuan in funds from the banking sector, capital markets and other channels.

Companies owned by the central government -- such as China Railway Corp and China Mobile Ltd. -- are also key investors of big-ticket projects, with the former allowed to sell 300 billion yuan of railway construction bonds. Private companies can also invest in infrastructure through public-private-partnership projects and newly-launched infrastructure real estate investment trusts.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.