Household consumption rose in the first quarter (April-June) of FY22 despite the second wave of the Covid-19 pandemic, and boosting hopes of a quicker recovery in consumer demand in the months ahead, latest data released by the National Statistics Office (NSO) show.

A significant component of overall Gross Domestic Product (GDP) numbers, Private Final Consumption Expenditure (PFCE) rose by 19.35 percent as compared to Q1 FY21. PFCE is a realistic proxy to gauge household spending and came in at Rs. 17.83 lakh crore. However, when calculated against Q1 of FY20, PFCE remained 11 percent lower.

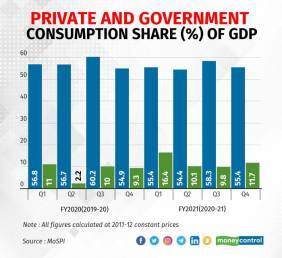

In the first quarter of FY22, PFCE constituted 55.1 percent of GDP, down from 55.4 percent in Q4 FY21.

"Private consumption and investment powered the YoY turnaround in the GDP performance. Nevertheless, all of these sectors remained well below their pre-covid levels in Q1 FY2022. While government consumption expenditure recorded a YoY contraction in Q1 FY2022, emerging as a drag on the pace of growth, it exceeded the pre-Covid level," Aditi Nayar, Chief Economist at ratings agency ICRA, said.

"On a sequential basis, most parameters of GDP have fallen in Q1 FY22, due to the adverse impact of the second wave of the pandemic on the economy. However, the adverse impact of the second wave on Q1 FY22 GDP is relatively muted when compared to the impact of first wave and this is also getting reflected by other high frequency economic indicators," Rajani Sinha, Chief Economist and National Director - Research, Knight Frank India, said.

Private consumption and government expenditure as share of GDP over the previous 2-years

Private consumption and government expenditure as share of GDP over the previous 2-years

Consumption still down

Overall, in FY21, household expenditure had shrunk by 9.1 percent as a result of the pandemic, after rising 5.5 per cent rise in FY20.

The sharp fall in household spending had been one of the most evident predictions by economists for FY21 given the salary cuts in the services sectors and large scale job losses in the manufacturing sector owing to the pandemic and the resultant economic slowdown.

This had prompted households to put off the purchases and save instead while overall consumer confidence was also hit significantly. The not-so-sharp fall in household spending comes in contrast to most economic predictions. A majority of Indian cars and relatively costly consumer durables are bought through loans. Job losses and salary cuts across sectors had crippled a household's means to finance a purchase over a three- to five-year period.

Slow government spending

On the other hand, government expenditure fell by 4.77 percent, after rising 7.8 percent in FY20 even after the Centre announced a slew of schemes hoping to raise demand in the economy.

This comes after the Centre raised levels of public spending to generate more jobs and create demand in the economy. At 4.21 lakh crore, Government Final Consumption Expenditure (GFCE) constituted 13 percent of the GDP, down from 16.4 per cent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.