Europe has performed better than the North American market for the top four Indian IT companies including Tata Consultancy Services (TCS), Infosys, HCLTech and Wipro, which reported their December quarter earnings last week, as they continue to bag more projects from the UK and continental Europe region, say experts.

Execution of some large deals and subsiding of the ill-effects caused by the Russia-Ukraine war crisis were some other reasons that drove UK and continental Europe to pip the North American market in terms of growth, experts have said.

They also feel demand is expected to bounce back for IT companies, in general, in the second half of this calendar year 2024.

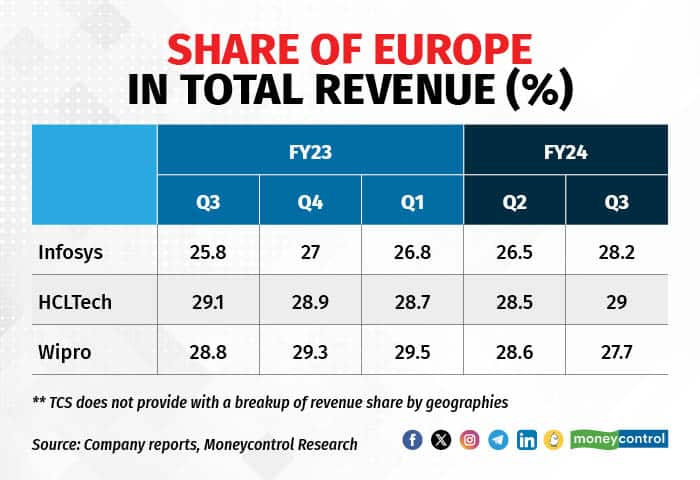

The North American market contributes approximately 60 percent to the total revenue for most IT companies, and Europe in the 30 percent range.

India’s largest IT firm Tata Consultancy Services’ (TCS) United Kingdom market grew 8.1 percent year on year (YoY), while continental Europe grew 0.5 percent in the same period. For the North American market, TCS’ revenue declined by 3 percent YoY in constant currency (CC) terms.

Bengaluru-based Infosys’ share of revenue from the European region grew by over 9 percent YoY to 28.2 percent. In CC terms, the region’s contribution to revenue grew 5 percent. The share of revenue from the North American region grew by 4.7 percent YoY.

“There is… more activity in Europe, most specifically in the UK, to get some large engagements over the line,” said Phil Fersht, CEO, HFS Research.

HCLTech’s revenue share from the region was flat at 29 percent, in a quarter when revenue from Americas increased by 1.6 percent to 64.5 percent. For the American market, HCLTech’s revenue was up 6.7 percent YoY in CC terms. HCLTech doesn't provide the break-up for its North American market.

Wipro’s Chief Executive Officer (CEO) Thierry Delaporte said the company has won four large deals in Europe for the third quarter, despite the continuing economic weakness.

“These new, four transformative deals add up to nearly $300 million in bookings. These deals underscore the success of our strategy in this market,” Delaporte said.

Nonetheless, Wipro posted a decline in revenue share from the European region by almost 4 percent. However, its share of revenue from the American market increased.

“For every service provider, Europe has been doing better than North America,” said Pareekh Jain, Chief Executive Officer and lead analyst at Pareekh Consulting. Companies are winning more cost-takeout deals in an uncertain macroeconomic environment, Jain said.

Cost-takeout is a term used by IT companies to describe deals that are placed with them to increase productivity and reduce spending.

“We see lower traction for digital transformation programmes and more activity for cost and efficiency programmes,” Infosys CEO and MD Salil Parekh said, while addressing a press conference on January 11.

Top Indian IT companies have continued to gain favour among enterprise customers in the Nordic countries of Sweden, Finland, Denmark, Norway and others, according to data accessed by Moneycontrol from market intelligence firm UnearthInsight.

This was despite cuts in tech budgets and macroeconomic weaknesses persisting in the overall European and US markets.

Going forward, the ongoing crisis in the Red Sea might have a sentimental impact on consumer care companies as supply-chain routes continue to remain disrupted, Jain said.

Since the outbreak of the Israel-Hamas war in October, the Red Sea has been in the news for periodic attacks on commercial vessels by Houthi rebels of Yemen. The Red Sea strait is crucial for 30 percent of global container traffic and 12 percent of global trade.

For the December quarter, overall demand remained tepid and experts do not expect any improvement till the fourth quarter of fiscal year 2024.

Kotak Securities’ vice president, fundamental research, Sumit Pokharna, said demand outlook is improving but there's low visibility on a meaningful recovery of discretionary spends.

“The pick-up in discretionary spending can aid the overall return to industry growth. The long-term growth prospects for the sector remain strong,” he said.

Deal wins

Nonetheless, the Street expects IT companies to close many large deals over the next two quarters or six months, at a time when deal wins did not impress experts.

“There are a host of large deals in the market being discussed and there is definitely a more positive view on more deals coming to fruition over the next couple of quarters,” said Phil Fersht, CEO, HFS Research.

Ashutosh Sharma, vice president and research director at Forrester, said that there are some mega deals in the pipeline right now, but those are all invariably vendor consolidation projects.

“So what's happening right now is that there's a lot of spending reallocation that the clients are doing in the hope of optimising their overall spend. I spoke to a couple of firms. One firm said that 100 percent of their loads pretty much were vendor consolidation (deals),” Sharma said.

Vendor consolidation deals are undertaken primarily to reduce costs and increase efficiency.

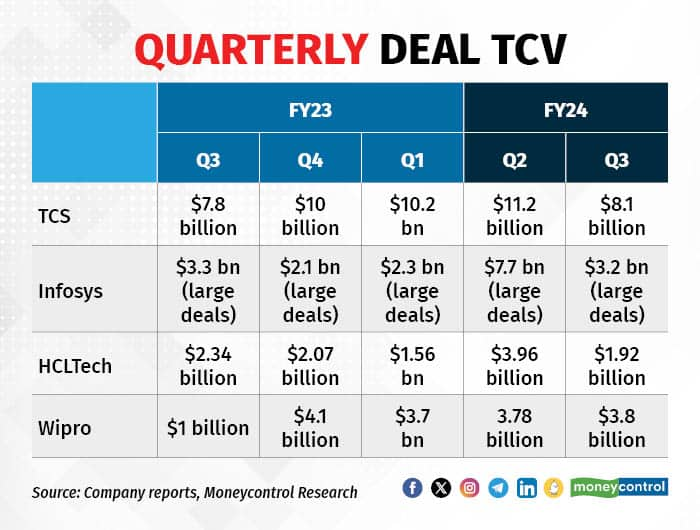

The top four Indian IT companies reported sequentially low deal wins, for the quarter that ended in December 31, with the exception of Wipro. To be sure, the number of deal wins were in line with the Street’s predictions.

This came after an all-time high total contract value (TCV) for most of these companies. In Q3, TCS’ TCV stood at $8.1 billion, without winning a single large deal during the quarter. Infosys won large deals worth $3.2 billion, of which 71 percent was net new deals. It was still significantly low as compared to $7.7 billion in large deals last quarter.

HCLTech’s quarterly TCV dropped to $1.92 billion, down both on a YoY basis and sequentially. Wipro was the only exception, which saw a slightly higher TCV at $3.8 billion.

Demand recovery and rate cut

Most analysts are of the view that demand will bounce back by the second half of this calendar year. Peter Bendor-Samuel, CEO of market intelligence and research firm Everest Group, believes that whether interest rates in the US are cut or not, the IT services business will see a possible rebound soon.

He is not alone.

According to Jain, early signs show that the weakness has bottomed out and that demand should improve from the second half onwards.

“If interest rates are cut, it will impact all secondary industries. This is because people will be more interested to invest in discretionary spends,” Jain told Moneycontrol.

While the median projection by US Federal Reserve officials highlights that interest rates will be 50 basis points lower than projections made earlier, companies say the impact or optimism stemming from expectations of rate cuts are yet to be seen in the form of client spending.

"The optimism around interest rates has not resulted in a reduction of the uncertainty that we see in decision making. The sentiments have remained the same, so I don’t think we are not ready to say that it will recover by Q4,” K Krithivasan, CEO and MD, TCS, said during the company’s earnings conference on January 11.

HCLTech CEO and MD C Vijayakumar, concurred, saying his company is facing a similar situation.

Also read: Discretionary spending remains same as Q2, don’t see an uptick: HCLTech CEO

“There is significant political pressure to cut rates but a premature move could be very expensive in the long run. We believe that the possible start of a rebound in two quarters will likely move forward with or without rate cuts,” Bendor-Samuel said.

However, going by the recent jump in ADRs (American Depository Receipts) of Infosys and Wipro, despite a cautious commentary on demand, it could be inferred that investors believe recovery for the sector is on the horizon.

“As we look to Q4, the tailwinds are being driven but a generally more positive economic outlook, declining inflation, and a determination from some leading providers to include more value in selected engagement bids to close business,” Fersht said.

Also read: Headcount in India’s top 3 IT firms drop by over 16,000 in Q3, HCL Tech bucks trend

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!