The Centre has gone all out in pushing electric vehicles as the best choice for future mobility.

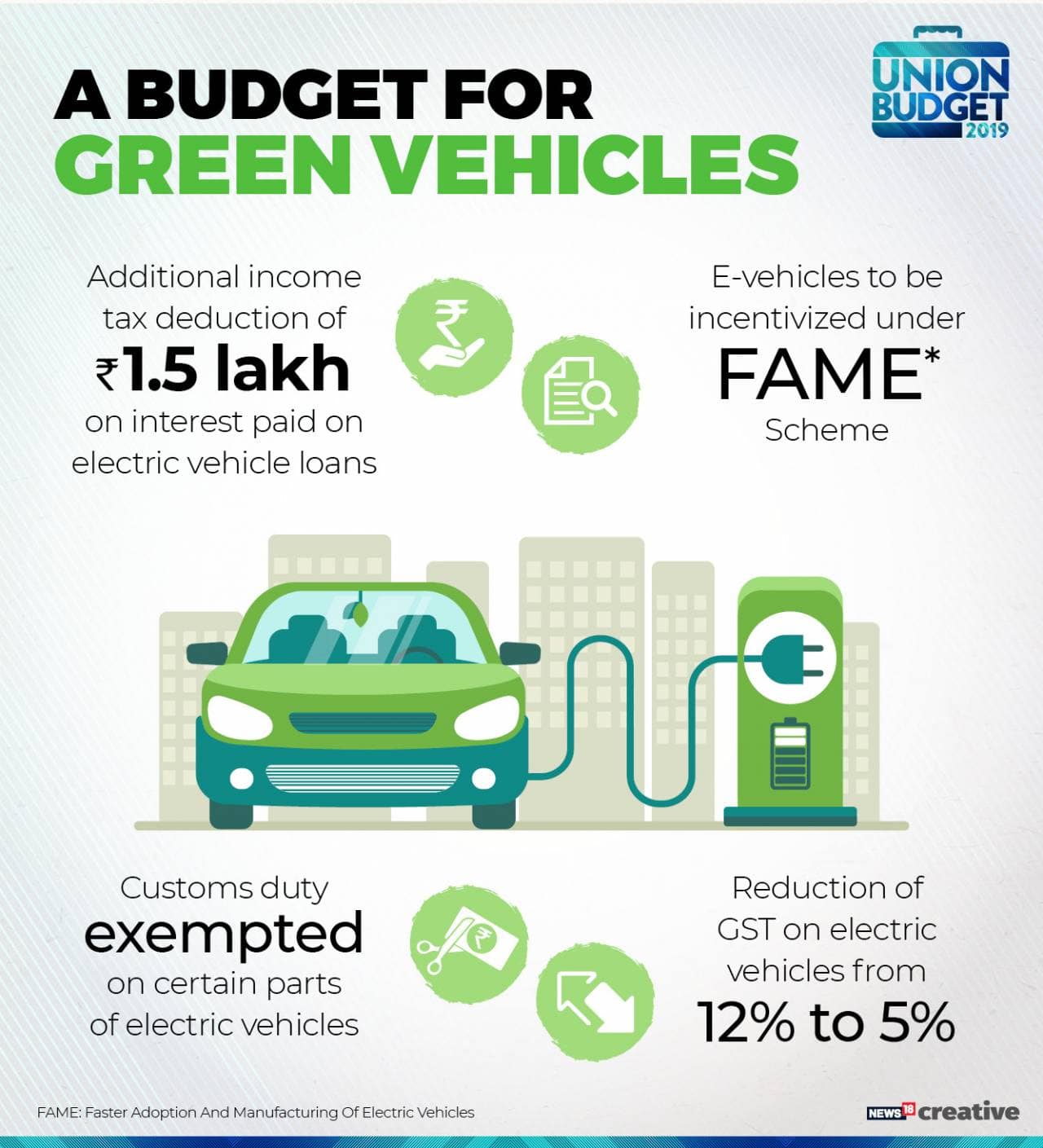

In an effort to make electric vehicles more affordable, Finance Minister Nirmala Sitharaman has proposed to provide an income tax deduction of Rs 1.5 lakh on the interest paid on loan taken to buy EVs.

This is the first time that electric vehicles have been proposed to become a direct tax beneficiary. The buyer of an EV can enjoy a total benefit of Rs 2.5 lakh over the purchase period, Sitharaman added.

The Finance Minister also mentioned that the government has already moved Goods and Services Tax (GST) council to lower GST on electric vehicles from 12 percent to 5 percent.

The deduction in income tax is being looked at as a major boost for EVs, considering demand for such vehicles have been below expectations in recent months, especially after the government’s decision to withdraw benefits to vehicles not powered by lithium-ion batteries.

As per data shared by the Society of Manufacturers of Electric Vehicles (SMEV), sales of electric vehicles in FY19 grew to 7.59 lakh units from 56,000 units clocked in FY18. A majority of these came from electric three-wheelers, which saw sales of 6.3 lakh units.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!