Ministry of Finance in Lok Sabha on December 4 said that off-shore crypto exchanges such as Binance, Coinbase and others will be required to follow anti-money laundering and countering the financing of terrorism (CFT) guidelines under PMLA besides getting registered in the country to provide service to users.

This comes as a huge relief and win for the Indian crypto exchanges, who have been seeing trading volumes erode from their platforms to offshore exchanges over the past couple of years, as users opt for it in an attempt to evade paying 30 percent taxes on income and gains from virtual digital assets (VDAs) and pay 1 percent TDS on every buy and sell transaction of over Rs 10,000.

Responding to a Member of Lok Sabha, Lavu Sri Krishna Devarayalu’s queries on the registration of offshore crypto entities, junior minister in the Ministery of Finance, Pankaj Chaudhary said, “Yes, the guidelines and reporting requirements are applicable to offshore crypto exchanges servicing the Indian market. The process of registration for the said VDA SPs (Virtual Digital Asset Service Providers) has been initiated.”

He added, “Appropriate action under PMLA shall be initiated in cases of non-compliance by offshore platforms.”

Crypto or virtual asset businesses were brought under the purview of the Prevention of Money Laundering Act, 2002. (PMLA) in March 2023. Following this, the crypto exchanges were required to report any suspicious activity to the Financial Intelligence Unit-India (FIU-IND).

The notification also mandated that crypto exchanges and intermediaries dealing with virtual digital assets (VDAs) must have proper KYC documentation for all customers they onboard.

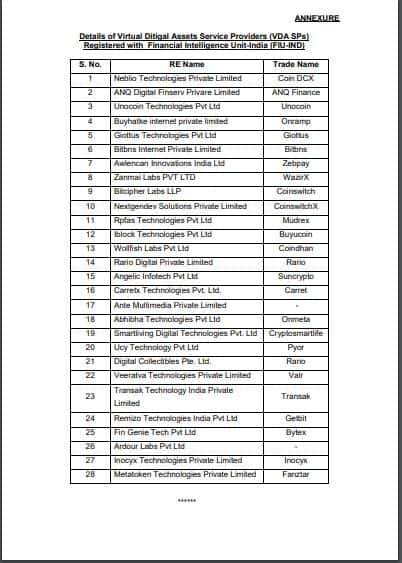

Currently, 28 such entities are registered under FIU-IND.

List of registered crypto entities under FIU-IND

List of registered crypto entities under FIU-INDAccording to Kashif Raza, founder at Bitinning, it is important to note that the government didn’t say that the unregistered entities would be barred.

"It just says that foreign exchanges can operate in India but with a license and probably follow the same rules as Indian exchanges follow. This is good move for Indian exchanges who have been complaining that they didn’t have a level playing field," he told Moneycontrol.

Raza added, "Once we see Coinbase, Binance, Gemini and others getting registered in India, they might even start buying stakes in the Indian entities. Because the FDI policy in India is such that either they have to acquire an Indian entity or do it in a joint venture."

Sumit Gupta, Co-founder, CoinDCX said, "Compliance to PMLA is of utmost importance as the safety and financial integrity of Indians is at risk. Our citizens, unfortunately, when they deal with such non-registered platforms run the risk of dealing with nefarious and malicious actors; thereby jeopardising their current and future finances."

"It is very encouraging to see that the Government is ready to initiate actions in cases of non-compliance by such non-registered offshore entities," he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.