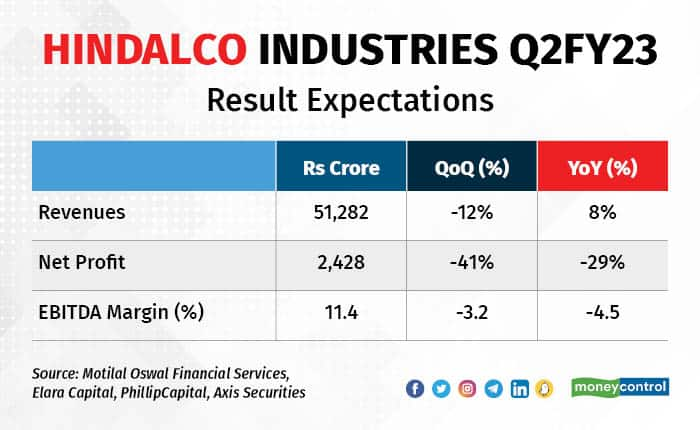

Aluminium major Hindalco Industries Ltd (Hindalco) is expected to report a year-on-year decline of about 30 percent in its consolidated profit after tax (PAT) when it declares its results today for the quarter ended September 2022. On a sequential basis, the decline in profit is likely to be more pronounced at about 40 percent.

Revenues are likely to show a high single-digit growth over the year-ago period. On a sequential basis, however, the revenues are seen decreasing by around 12 percent.

According to a poll of brokerages conducted by Moneycontrol.com, consolidated PAT for the quarter is expected to be around Rs 2,400 crore while the consolidated revenues are likely at Rs 51,280 crore.

The Aditya Birla Group company had registered a PAT of Rs 3,427 crore during the corresponding period last year when it had achieved consolidated revenues of Rs 47,665 crore.

PAT in April–June 2022 stood at Rs 4,119 crore on consolidated revenues of Rs 58,018 crore.

The performance for the quarter was impacted by a nearly 11 percent year-on-year decline in LME aluminium prices while sequentially the prices were down about 17-18 percent. The rise in input costs further impacted performance, but was partially offset by growth in volumes.

Brokerage views

Axis Securities

Axis Securities expect revenues to increase by 3 percent YoY and fall by 15 percent quarter-on-quarter (QoQ). “YoY increase in revenue is led by higher Novelis shipments YoY, partially offset by the drop in the LME prices as average Q2FY23 LME aluminium prices declined to $2,362/tonne, down 11 percent YoY and 18 on quarter,” the brokerage said in its report.

Axis Securities expects the company to report consolidated revenue of Rs 49,260 crore and expects earnings before interest, tax, depreciation and amortisation (EBITDA) to fall 20 percent on year and 27 percent QoQ due to an increase in input costs, especially energy prices.

Consequently, EBITDA margins are likely to contract both on a YoY and sequential basis due lower LME prices and higher input costs.

The brokerage forecasts a PAT of Rs 2,800 crore, which is a decline of 18 percent on year and a fall of 32 percent from the previous quarter.

PhillipCapital

The global brokerage expects volumes to increase 4 percent on quarter while LME prices are down 17 percent sequentially. It expects the company to record consolidated revenues of Rs 51,101 crore and an EBITDA margin of 11.2 percent.

“Novelis EBITDA per ton to normalise around $520/ton (fall of 15 percent QoQ) while volumes are expected to be marginally better,” said a note from the brokerage. “Lower LME prices and an increase of ~20 percent in the cost of production are a big drag on the operating performance for the quarter.”

Motilal Oswal

The brokerage works out consolidated revenues for the quarter at Rs 50,078 crore and expects EBITDA to slip 26.4 percent on year and by 34 percent from the June quarter.

EBITDA margin at 11.1 percent is seen contracting by 470 basis points (bps) YoY and 340 bps on quarter.

The brokerage expects the company to achieve a PAT of Rs 2,300 crore, a drop of 33 percent from the same period last year and a sequential drop of 43 percent.

Key things to focus upon

Experts would be keenly watching the management’s commentary on thermal coal cost and availability of linkages. Another critical aspect is the management’s guidance on Novelis' EBITDA per tonne and demand for downstream products. More clarity on the energy costs and hedges in Europe for Novelis will be crucial and also the guidance on domestic capex and commissioning timelines.

Hindalco shares were currently trading Rs 1.75 lower at Rs 415.35 each at 12.30 pm on Thursday on the National Stock Exchange. The stock has declined by 7.7 percent over the past one year and has been trading flat over the last one month.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.