Britannia Industries is likely to report an 11 percent year-on-year rise in Q2FY24 net profit, even on a marginal revenue expansion, led primarily by benign input prices.

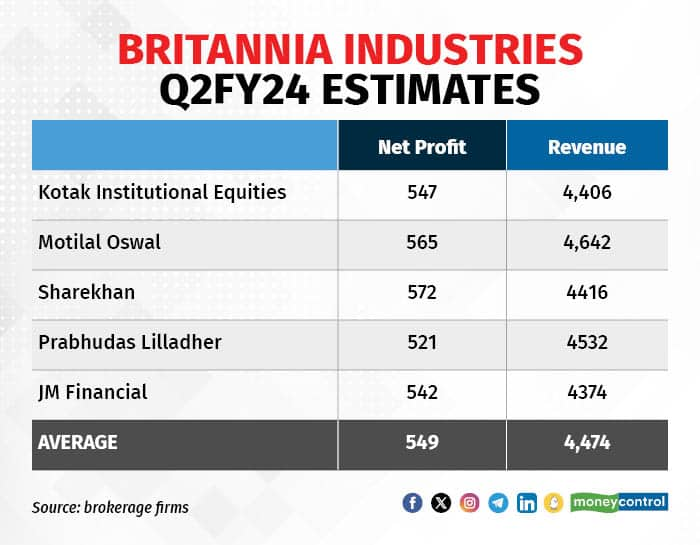

Britannia Industries’ fiscal second quarter net profit is expected to touch Rs 549 crore, according to the average of four brokerage estimates. The dairy, biscuits and FMCG company is likely to report a July-September revenue of Rs 4,474 crore, rising by less than one percent from the same quarter a year ago.

Sequentially, net profit is expected to increase 19.5 percent, while revenue will likely rise 10.1 percent quarter-on-quarter.

Britannia’s Earnings Before Interest Tax Depreciation and Amortisation (EBITDA) margin is expected to increase by 142 basis points on-year to 17.76 percent in the July-to-September quarter.

The company’s gross margin is expected to expand 300 basis points on-year, aided by a correction in input prices. However, operating profit margin rise will be limited to 130 basis points on-year, due to higher employee expenses and other expenses, said brokerage firm Sharekhan.

Also Read: Momentum fund manager says market throwing more ‘sell’ than ‘buy’ signals

Motilal Oswal expects a three percent volume growth in Q2 FY24 for Britannia.

Demand remains weak

Analysts say demand has likely remained weak for Britannia Industries in the July-September quarter. Domestic brokerage firm Prabhudas Liladher expects late Diwali and competition from unorganised players to keep volume growth under check.

“Operating environment is getting tough with pricing growth now off the table while demand is still soft,” said JM Financial in a report.

Also Read: ITC’s cigarette revenue growth takes a drag; should investors be concerned?

Inflation in sugar and wheat

Prices of key raw materials such as wheat and sugar have increased in the last one year. Sugar costs have increased four percent and six percent on a QoQ and YoY basis respectively. Wheat costs have surged six percent sequentially, and seven percent on a YoY basis.

Britannia Industries had increased prices in its cheese portfolio by four percent in June, on the back of rising milk prices. The biscuit category has not seen any significant price hikes over the last six months.

However, Britannia took a steep MRP hike of around 24 percent, along with grammage reduction, in the last six months for Milk Bikis, given the dairy inflation. On the contrary, Britannia took price cuts of around 13 percent in butter in July.

Earlier, in the April-June quarter, the company said that it was witnessing competition from unorganised players, leading to price cuts and grammage hikes, which resulted in a lower-than-expected improvement in margins.

Sharekhan says Britannia Industries is expanding its market share gap versus the number two player and is focusing on scaling up the adjacent categories, including dairy and bakery products to drive consistent growth ahead.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.