Indians may be sweating more than usual this summer, and then there is the looming power crisis. We need electricity, and that too, non-stop – 24x7 reliable and quality supply. That’s a fair demand.

But are we ready to pay more?

Energy inflation has gripped much of the world today. In India, the prices of energy commodities such as petrol, diesel and natural gas, have been on a steep increasing trajectory for some time. But how worried should consumers be about a rise in their electricity bills?

Moneycontrol is doing a special series, the Power Shock, on the power crisis that has forced states to undertake power cuts, with fears that the situation may worsen if allowed to remain unresolved. The series has so far looked at the payment crisis in the power sector, the recurring and deep-rooted issues of the power distribution companies, how the Indian Railways has struggled to keep up with coal production in the country, and if imported coal could help scale up power generation.

In this fifth story of the edition, we analyse and break down for you trends to watch out for over the immediate to medium-term that may have a bearing on your electricity bills.

Pressure on wholesale cost

Electricity bills are driven by two main cost components. First, the cost of ‘supply’, which accounts for almost 60-80 percent of discoms’ yearly revenue. This is primarily the cost of generation and transmission, also referred to as power purchase cost.

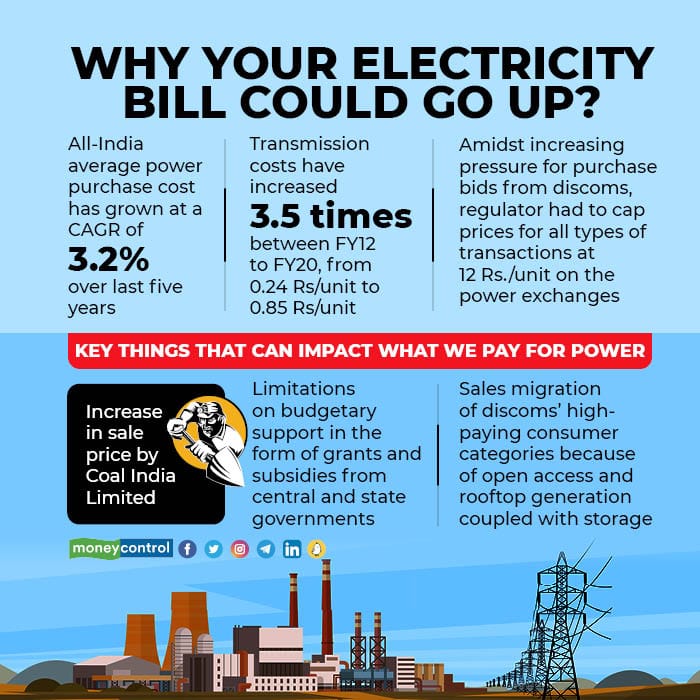

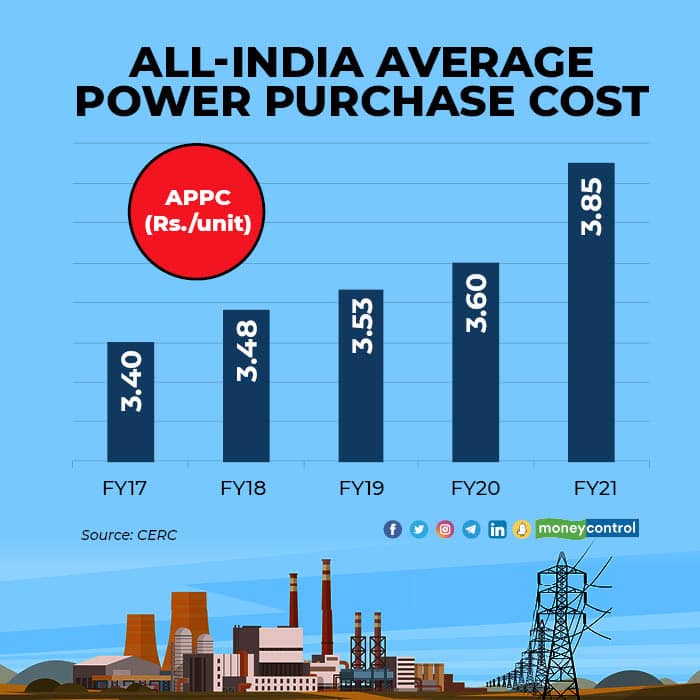

According to the Central Electricity Regulatory Commission (CERC), the all-India average power purchase cost for FY21 was Rs 3.85/unit, and this has grown at a compounded annual growth rate (CAGR) of 3.2 percent over the last five years.

Domestic coal remains the dominant fuel for power generation in India, and thus, has the maximum impact on power supply cost. According to Debasish Mishra, Partner & Leader (Energy), Deloitte India, “Factors that have contributed to stabilisation of electricity prices over the last couple of years include little to nil revision in sale price by Coal India, deflationary prices of renewable energy addition and reduced T&D loss levels of discoms.”

However, Coal India Limited is reportedly eager to increase prices amidst pressure for wage hike from trade unions and capital investment commitments required for achieving higher production.

Transportation cost of coal by Railways is yet another factor impacting the cost of power and is known to be explicitly overpriced to compensate for other operations. “Cross-subsidisation in other parts of the power sector value-chain, such as keeping passenger fares under control by overcharging freight, is ultimately borne by electricity end-consumers,” said Raj Pratap Singh, the Chairman at Uttar Pradesh Electricity Regulatory Commission.

Integration and spot purchase cost

Although the share of renewable energy has crossed 10 percent in total power generation portfolio and auction prices have been very competitive, there are costs associated with managing intermittency of renewables and their integration with the grid. Transmission costs have already increased 3.5 times, from Rs 0.24/unit to Rs 0.85/unit between FY12 and FY20.

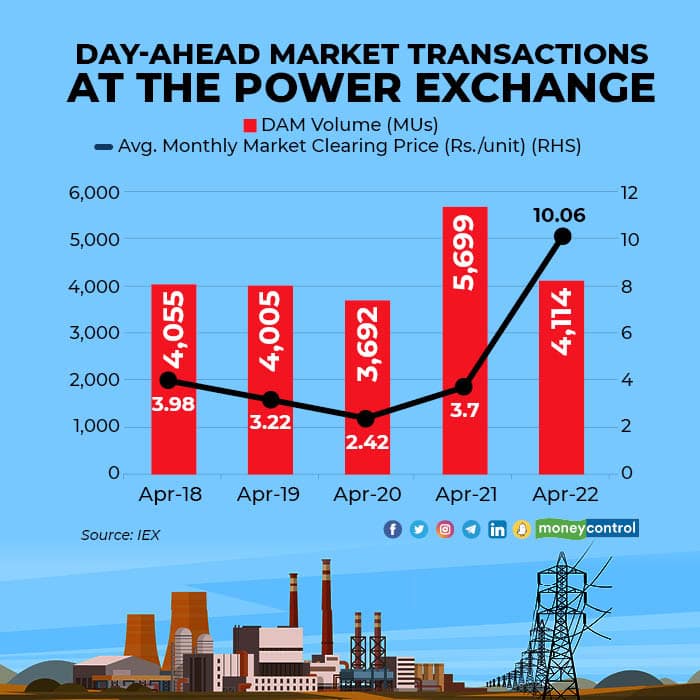

Besides these long-term purchase costs, the ongoing power crisis has put extreme pressure on short-term purchases by discoms. So much so that the central regulator had to cap bid prices for transactions in the real-time and day-ahead market on power exchanges at Rs 12/unit in early April 2022. Last week, this cap was further extended to all types of short-term transactions that take place on the exchange, including term-ahead market.

This burden of higher power purchase costs to meet seasonal demand will be eventually passed on to the consumers.

Retail prices to follow suit

The second cost component of electricity bills is the cost of ‘wires’, which goes into installing and maintaining the distribution assets including transformers, sub-stations, meters, etc. Globally, there is a trend of increase in wires costs, which have more or less nullified cost reductions due to cheaper renewables.

India’s discoms are expected to spend more on automation and new-age technology solutions, including smart meters, reliability and stability measures, electric vehicle charging infrastructure, and such. However, cash-strapped discoms have always found it difficult to invest in network strengthening and grid modernisation, which is crucial for reducing losses and improving collection efficiency. As a result, majority of these investments are made from capital grants received from the central government, thus having little impact on consumer tariff.

Discoms have to also recover already accumulated regulatory assets before they reach unsustainable levels. The Ministry of Power has been advocating states and regulators to not make regulatory assets a common practice and instead let tariff revisions take place frequently.

In case where states are concerned about the higher burden on economically weaker sections, it is suggested to shift to a direct benefit transfer of retail tariff subsidy. According to Singh of Uttar Pradesh Electricity Regulatory Commission, “Ideally electricity bill should not be more than 5 percent of a residential household’s monthly wallet share. Higher tariffs increase the input costs for industries, thus making them uncompetitive in international markets. Governments will have to think of these aspects while deciding tariff subsidy for end-users.”

Shrinking pie of cross-subsidy

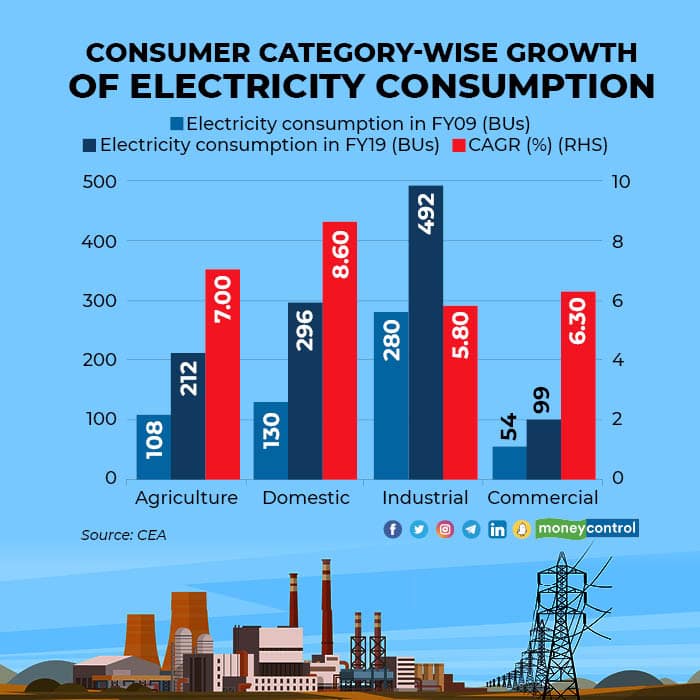

Industrial and commercial consumers pay higher tariffs than their actual cost of supply to provide for lower revenue recoveries from other categories such as agriculture and low-consumption domestic consumers. In short, industrial and commercial consumers represent cross-subsidising category that make up for lower recoveries from the remaining consumer categories.

Retail tariff is telescopic in nature, which means higher the units consumed, higher the rate charged per unit. Further majority of retail tariff is designed to be variable, thereby higher consumption leads to higher bill. As a result of this, any shortfall in sales – especially from the cross-subsidising category, and for units above a certain threshold limit – has a more than normal impact on discom revenues and profitability.

Historical data from the Central Electricity Authority (CEA) suggests that consumption by high-paying industrial and commercial categories has grown at a slower rate as compared to other categories. Further, the last two years of subdued economic activity due to lockdowns, have impacted consumption by industrial and commercial consumers. Although the exact nature of this impact is not fully known yet, it will become clear once discoms file their tariff revision petitions. According to Maharashtra discom, MSEDCL, the lockdown had badly hampered its revenue cycle, and its revenue collection in March 2020 was about Rs 600 crore less than a year ago.

In addition, there is a growing trend of net-zero commitments by several industries and establishments that are looking at self-generation opportunities offered by cheap renewables, along with energy storage. Rooftop solar is especially economical to these consumers, even in the absence of any subsidy, according to the Ministry of New and Renewable Energy. Rising tariff fastens the migration of balance consumers, as their payback period further reduces, thus kicking in a death spiral for discoms.

Subsidies, any more?

The trifecta of increase in wholesale cost, retail capital expenditure and self-generation by high-paying consumers will necessitate an increase in discom tariffs. Given the self-created political pressure for free power, when and how much tariff increase is possible is a big question.

“Commercial and industrial consumers are already paying very high tariffs and do not have the ability to pay for more cross subsidy support. Agriculture and other economically weaker sections require deep subsidies. That leaves only the residential or domestic consumption. If they too are promised free power, it will lead to economic collapse of the power sector,” said Mishra of Deloitte.

Consumers are the first to complain about power cuts, and rightfully so. India needs to resolve some of the deep-rooted issues in the sector, but that will come at a price. Then there are the macro environment factors too, which indicate that an upward pressure on prices is here to stay. Sooner or later, these things will reflect on our bills. The question is, are we ready for it?

(Rasika Athawale is the founder of India Energy Insights)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.