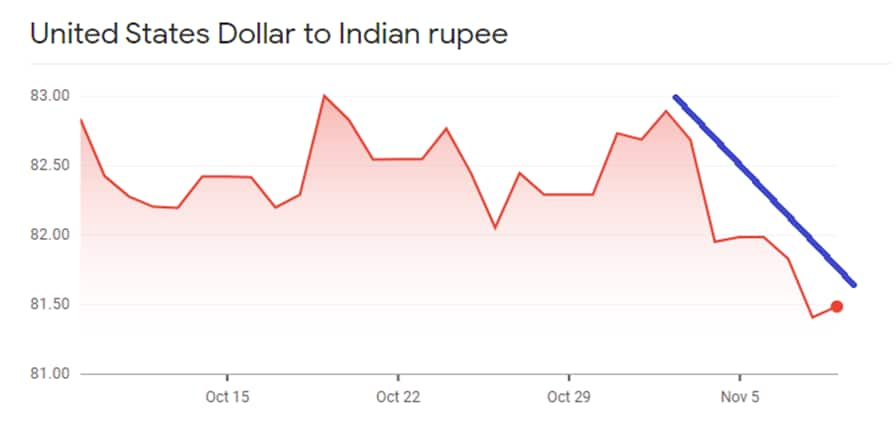

Yesterday, some media reports indicated that according to an internal assessment by the finance ministry "India balance of payment (BoP) is likely to slip into a $45-50 billion deficit in the current fiscal year." This is obviously not a good news for the INR exchange rate. Nonetheless, USDINR has rallied to its best level in almost two months, in the past two days.

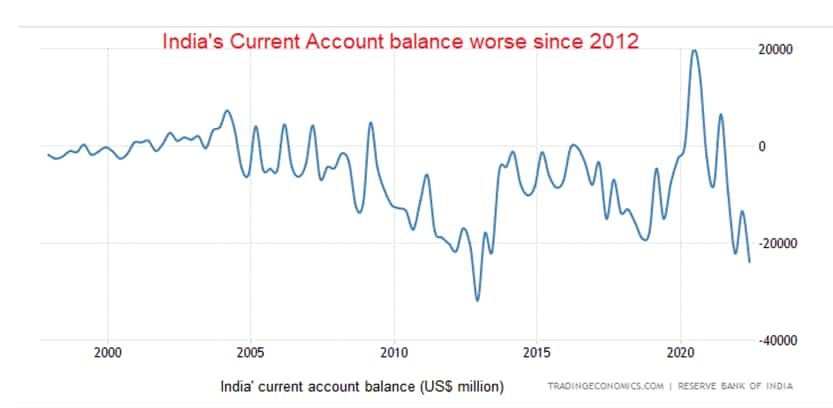

It is pertinent to note that India’s current account has remained mostly negative since the global financial crisis (2008), with a brief period of surplus during Covid-19 pandemic. India’s current account deficit was $23.9 billion in the quarter ended June 2022, the worst since the last quarter of 2012. India had witnessed a serious current account crisis in 2013 that required the RBI and government to initiate some drastic measures like reducing limits under LRS. Of course, the present situation is not as dire as 2013, since we have a much stronger forex reserve position now as compared to 2013. Nonetheless a close watch is warranted on the foreign flows, both portfolio and capital account. In the first nine months of the calendar year 2022, RBI has drained over $100 billion from the forex reserves. The RBI has specified that this reduction in forex reserve is due to two factors – (i) valuation adjustment (fall in value of non-INR denominated bonds and fall the relative value of Non-USD currencies in the forex reserve); and (ii) intervention in Fx market to support INR exchange rate.

Catch live market updates here

Various analysts have estimated that over 50 percent of drawdown in the reserves could be attributable to the valuation adjustment and the rest to the RBI’s forex market intervention.

As of this morning, there are little indications to suggest that this trend of fall in reserves, either due to valuation adjustment or market operations, may not continue for at least next 6-7 months; given the forecasts of a deeper recession in Europe (more fall in the value of EUR, GBP, CHF and European treasuries); persistent weakness in JPY; and slowdown in the US economy. Poor export growth and thinner FPI/FDI flows might keep India’s current account and Balance of payment under pressure.

The private sector capex is showing no sign of a significant pickup. Most of the capex so far seems related to maintenance, upgrades, debottlenecking etc. The outlook for exports is also not very encouraging.

The government has frontloaded capex, especially in roads, defense and railways. 2HFY23 might witness some slowdown in government capex as the fiscal position tightens (1HFY23 fiscal deficit has been higher due to front loaded capex despite buoyant tax collections).

Overall, we may have some strong macro headwinds for markets in 2023. Investors need to remain watchful and not get carried away by the recent recovery in benchmark indices.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.