Over the last couple of years banking credit growth in India has been steadily declining, from around 14 percent in Q1 FY19 to around 5.5 percent currently. Despite significant cuts in policy interest rates, credit growth has remained anaemic — and that’s a cause of concern.

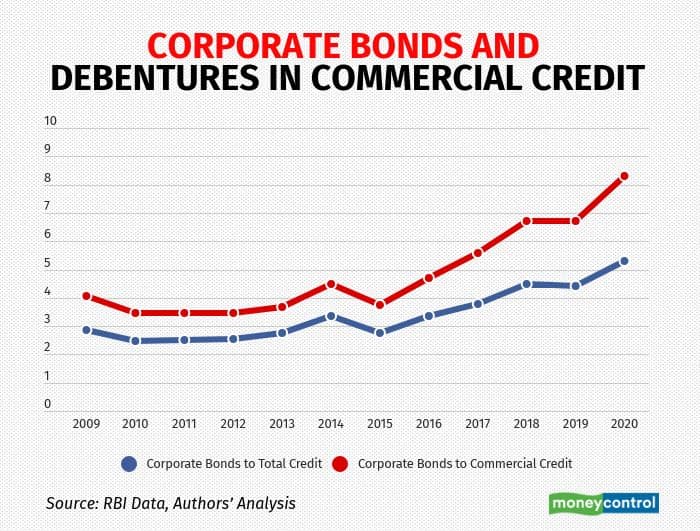

Amidst this weak credit growth, an interesting trend has emerged — since 2016, banks’ investment in corporate bonds and debentures has seen a sharp increase. The chart below depicts the share of corporate bonds and debentures in commercial credit and the total credit extended by banks.

Corporate bonds and debentures’ share in commercial credit (ie credit to companies and not individuals) has increased from 4.5 percent in 2016 to more than 8 percent in 2020. Their share in total bank credit has increased from 3 percent to 5 percent in the same period.

Loans And Bonds

There are two mechanisms through which banks can provide credit to borrowers: give loans, or invest in the bonds/debt securities. From the borrower’s standpoint, the form of borrowing — bonds or loans, does not matter as much unless the frictions associated with one are much higher than that for the other. For instance, given the same cost of borrowing, borrowers will prefer loans over bonds if the compliance and procedural requirements are lower for loans than bonds. Conversely, if the frictions associated with the two instruments are the same, borrowers will pick the one with the lower cost.

Banks too will pick the instrument that delivers them the highest returns at the lowest levels of friction. The greatest advantage that bonds offer is tradeability (the ability to sell). However, if the market for bonds is illiquid, banks may not find giving credit via bonds desirable as compliance norms and market frictions associated with illiquidity may impose costs on them without the tradeability advantage.

In India, banking regulation requires banks to classify their portfolio of bonds into the ‘Available for Sell (AFS)’ or ‘Held For Trading (HFT)’ part of the bank’s investment book. They have to be ‘marked to market’, that is, banks must account for changes in the value of bonds with the movement in interest rates. Thus, bonds expose banks to this interest rate risk.

Most loans, on the other hand, have interest rates linked to some reference rate linked to policy interest rates. This reduces the interest rate risk on these instruments to a large extent. Bonds also lose value much faster in the case of a credit downgrade. Loans allow banks access to a greater level of private information about the borrower. Loan contracts are customised and banks can add clauses that can provide them some protection against loss of credit quality of the customer. Bond covenants tend to be much more standardised and generally do not have clauses that protect the investors in the event of a downgrade. Essentially, banks can renegotiate loans using the loan covenants much more than what bondholders can.

Thus, for banks, the choice between extending credit through bonds or loans is essentially a trade-off between higher returns, greater flexibility in exiting the credit facility when needed, and differential levels of interest rate risk and credit risk across the two instruments. Traditionally, this has stacked the banking system in favour of the loan route. That is why we believe that the trend observed is significant. It shows that for a long time the share of bonds in commercial credit remained under 4 percent before starting to rise in 2016, and is maintaining a steady uptrend since then.

Bond Uptrend

We believe that there are several explanations for this trend:

The bank-NBFC bond nexus: In the last few years (since FY2015) the growth rate of credit from the banking system has been lacklustre. Credit to industry has been especially tepid with declining growth rate. Overall credit growth of the banking sector has been driven largely by credit to the non-banking finance companies (NBFCs) and to consumers. On the other hand, deposit growth at banks has remained fairly stable with some uptick after demonetisation.

It is likely that banks are deploying some of this deposit corpus into investment in corporate bonds, which offer a higher return than government securities. On the supply side, the NBFCs have been steady issuers on bonds and their frequent and repeat issuance pattern has created a semblance of liquidity in the market for NBFC bonds. It helps that most of these NBFC bonds have been highly rated instruments, at least at the point of issuance.

Stable interest rate regime, low interest rates: Interest rates witnessed a secular decline from mid-2013 till mid-2017. The new monetary policy framework, adopted in 2016, created a predictable interest rate regime linked to inflation levels. These developments, along with a declining GDP growth trend during this period, may have created confidence among bankers about the persistence of low interest rates. This, in turn, would have improved the appeal of corporate bonds as with higher yields (relative to government bonds) and lower interest risk from low and stable interest rates.

A stronger creditor rights framework: The implementation of the Insolvency and Bankruptcy Code from 2016 created a stronger creditors’ rights regime for all creditors, including bondholders. In the pre-IBC world, bondholders stood at a disadvantage to banks in their recovery and resolution rights. It is likely that the passage of the IBC contributed to the banks’ increased appetite for bonds. However, since the IBC functioned only for non-financial borrowers and the bond market is made up largely of NBFC bonds, the extent of impact of this reform may be relatively small.

SEBI’s push on bond issuances: In 2018, SEBI mandated that large corporates have to raise 25 percent of their debt requirements from the bond market. This may have encouraged the supply of bonds in the market to increase. Together with demand side factors, this may have resulted in an overall push in the level of activity in the bond markets. Banks as the largest lender in the economy may have contributed to this increased activity as investors.

Why The Bond Uptrend Matters

Given the paucity of publicly available information, it is difficult to discern the pattern in the bond investments by banks including aspects such as the sectoral and the rating composition of these bonds, their maturity profile, etc.

However, while we may not know which bonds banks are buying or why they are buying them, banks’ increased participation in the bond market is a welcome trend. For decades, India’s corporate bond market has been growing slowly. However, its growth has just kept pace with the growth in overall credit to the commercial sector, making its share in commercial credit stagnant over time.

Banks are by far the largest pool of capital (through their privileged access to household savings) in the economy. They can provide the much-needed stable and reliable liquidity support that has been missing in the corporate bond market in India. Experts and practitioners have suggested measures such as corporate bond repos to solve for this liquidity constraint. With banks stepping into the bond market in a larger way over time, some of these constraints may be alleviated naturally.

Discussions on the development of bond market in India is often misplaced as a choice between bank loans and the bond market. This is because banks are thought to be synonymous with loans. It is critical to note, as evidenced by this trend, that banks can become an important player in the bond market. When banks step in with demand, it creates the space for greater supply and an overall enhancement in the bond market ecosystem.

Harsh Vardhan is Executive-in-Residence at the Center for Financial Studies of the SP Jain Institute of Management and Research. Anjali Sharma is Senior Research Consultant with the Finance Research Group. Views are personal.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!