Anubhav SahuMoneycontrol Research

In the European Central Bank policy meet on September 7, Mario Draghi hinted that there could be a plan next month for phasing out its QE (quantitative easing) programme. If ECB does so, it would join US Fed in taking steps towards normalizing the monetary policy. Euro/dollar, in turn, has reacted positively and extended its outperformance this year.

On the other hand, while the Fed has moved further in its pursuit of normalization of monetary policy, its immediate policy priorities has shifted to balance sheet unwinding after two rate hikes this year. Further, lower inflation data and lack of policy action in the domestic front have weighted on the dollar index. The recent spate of natural calamities in the US also strengthens the case for a longer pause from the Fed.

Against this backdrop, it would be interesting to look at what’s in store for the rupee particularly when it has appreciated by 6 percent against greenback this year.

Yield differential and fund flows have been key drivers

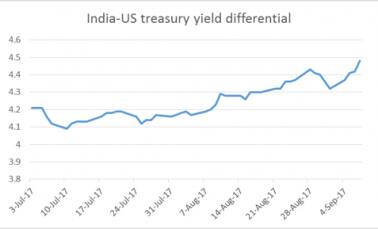

Coming to USD/INR currency pair, which has recently broken a psychological support at 64, it has been one of the best performing Asian currencies in the recent past. While the weakening of dollar on account of policy inaction and lower inflation aided, one of the other factors which guided rupee appreciation has been the favorable and improving differential between India and US treasury yields and the lower currency volatility.

Foreign institutional investors chasing yields have been the key driver resulting in about USD 25.8 billion (of which USD 19.5 billion in debt) inflows in 2017.

While there has been considerable momentum in debt FII inflows, this might moderate as FIIs are nearing exposure limits in the debt market (for both government and corporate securities).

Sterilization: RBI continues to buy dollars despite higher liquidity

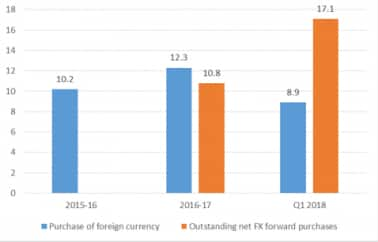

In the recent past, the RBI has resorted to buying a higher supply of dollar into the system.

As per RBI’s latest annual report, the RBI has continued with the management of foreign exchange market operations, aimed at containing excessive volatility and maintaining orderly conditions in the forex market.

RBI's purchase of foreign currency and net outstanding FX forward purchases (USD billion)

The RBI has also resorted to net forward purchases given the prevalent high liquidity in the system. Net forward purchases also lead to increased rupee liquidity at the end of the derivative contract to be managed by the RBI.

RBI might continue to intervene in the market to prevent appreciation that can cause incremental damage to the economy. So far since most emerging market currencies have shown a similar trend of appreciation, our exports were largely shielded.

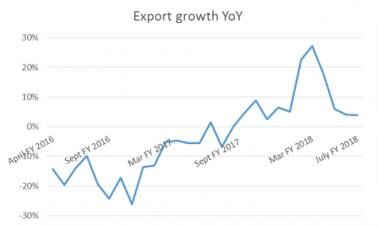

The Indian economy is witnessing a sluggish domestic growth as is borne out by the weak GDP as well as the IIP print; and exports remain a key driver of growth particularly on account of a recovery seen in some of the developed markets. Indian exports growth have witnessed an interesting turnaround since the start of the last fiscal year. However, an elevated rupee level can certainly weigh on India’s export competitiveness. Recent moderation in export growth rate is something to look at.

While the RBI conducts sterilisation to mop up extra liquidity on account of dollar purchase, there is a cost to it. Therefore, it would be interesting to be see to what extent RBI intends to intervene if strong FII inflows continues.

Rupee supported by healthy external account…

Compared to the taper tantrum phase in 2013, when the Fed hinted at the start of rate hike cycle and select EM currencies called fragile 5 (including INR) were impacted, Indian external account is much better now and, therefore, favours rupee stability.

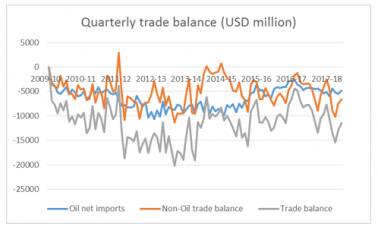

India’s current account deficit has reduced to -0.7 percent of GDP in 2016-17 from the average deficit of -3.3 percent prevailing during 2009-14. Interestingly, a good part of comfort is coming from the lower oil imports on account of lower prevailing prices. Oil net imports in value terms constituted 54 percent of the net trade deficit in FY13 which has got reduced to 44 percent now (last 12 million data). We expect little threat to this as oil prices should continue to remain benign in the foreseeable future.

Quarterly trade balance

Related comfort is also coming from the healthy forex reserves of USD 398 billion which has improved by another USD 39 billion since the start of the CY 2017 and hence now provide a cover of about 11 months of imports.

… but potential hot money outflows can be a risk

The trigger for sharp rupee depreciation could arise due to fund outflows in case of global risk-off events, particularly US-North Korea stand-off, the flare-up in Middle-East crises or change in inflation dynamics in USA leading to a hawkish US Fed outlook.

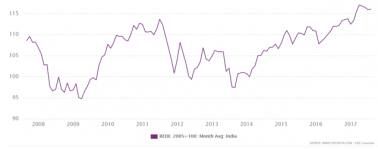

India’s REER (real effective exchange rate) is near its all-time high

Thus, we don’t rule out bouts of rupee depreciation in case of a risk-off phase, particularly when the rupee doesn’t have a valuation comfort when we look at the real effective exchange rate (REER).

In case of euro/rupee currency pair, we expect it to be guided more by the Euro leg. We expect the recent trend of EUR/INR appreciation to continue mainly because of improving fundamentals and the prospects of the end of stimulus programme by ECB.

For more research articles, visit our Moneycontrol Research Page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.