Buy Low Sell High: This is what every investor aspires to do, but while attempting to achieve it he/she may fall into the trap of the “Herd Mentality Bias”.

Herd Mentality Bias refers to an investor’s tendency to follow and copy what other investors are doing. They are largely influenced by emotion and instinct, rather than by their own independent analysis.

How difficult is it to catch the best return days in the market?

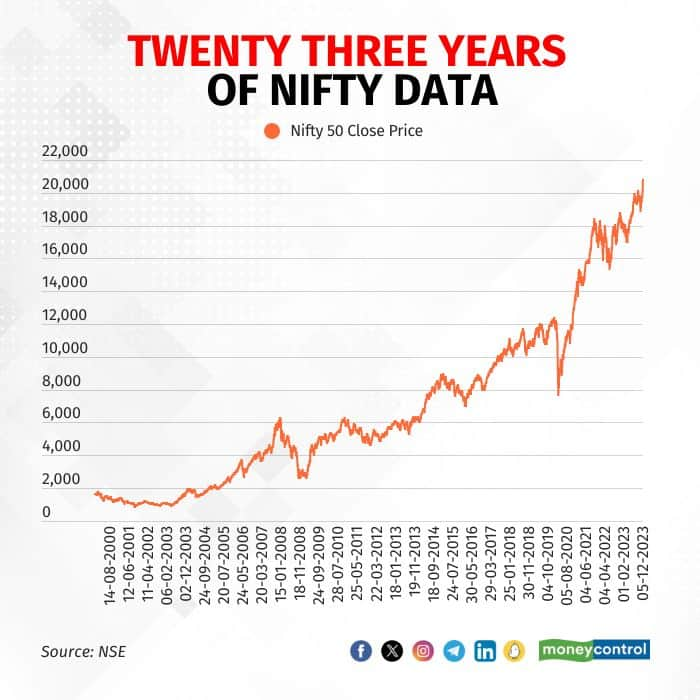

At FinSharpe we analysed 23 years of Nifty 50 data.

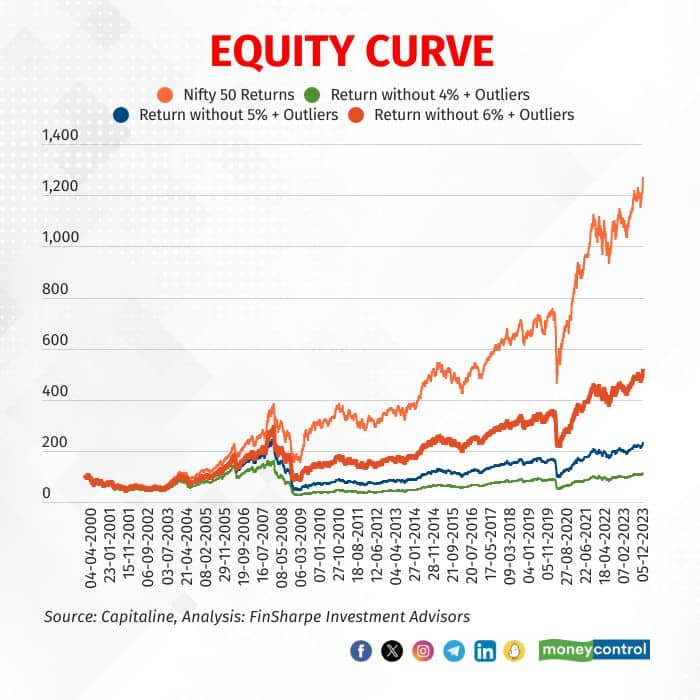

We calculated the extraordinary days when return was greater than 4 percent, greater than 5 percent and greater than 6 percent separately to see how many times these instances had occurred.

The total number of days were 5,950

Instances when return was greater than -

* 4 percent : 43 days (Probability : 0.72 percent)

* 5 percent : 27 days (Probability : 0.45 percent)

* 6 percent : 12 days (Probability : 0.20 percent)

What if you were not invested during these days?

This is how the equity curve would look like:

Basically, if you missed 43 days out of the total 5950 days your investment would give a 1.15x return.

But if you invested and did NOTHING then it would give a 12.7x return.

The chance that you will be able to catch those outlier positive returns is very low as their frequency of occurrence itself is low ~ 0.72 percent in 23 years.

When should I start investing? This another commonly asked question

Starting point of investments does matter. However, predicting the market in the short term is a futile exercise.

If you started investing and experienced a market crash in the initial few years of investing then there is a big difference in the total returns generated.

The 2008 Crash And Two ScenariosLet’s look at two scenarios of Rs 1 lakh invested in Nifty 50.

Scenario 1: September 2007 to September 2022 (15 years)

- Initial Investment: Rs1 lakh

- Final Value: Rs 3.4 lakh

Rs 1 lakh invested increased to ₹3.4 lakh in 15 years.

Scenario 2: Dec 2008 to Dec 2023 (15 years)

- Initial Investment: Rs 1 lakh

- Final Value: Rs 7 lakh

Rs1 lakh invested increased to Rs 7 lakh in 15 years

The difference is significant because of the 2008 financial crisis that was experienced by investor in Scenario 1

What could an investor do to mitigate this risk?

Systematic Investment PlanLets add an SIP of Rs 1,000 per month to Scenario 1

Scenario 1 modified : September 2007 to September 2022 (15 years)

Initial Investment: Rs 1 lakh

Monthly SIP: Rs 1,000

Final Value: Rs 7.7 lakh

Rs 1 lakh invested increased to Rs 7.7 lakh in 15 yearsJust by adding an SIP you can reduce the market timing risk significantly.

Timing the market is a futile exercise.

Investing with an SIP is simple and effective.

Time in the markets > Timing the markets Rohan Borawake is Co-Founder & CEO, Sabir Jana is Co-Founder and Head of Quantitative Research, at FinSharpe Investment Advisors. Views are personal, and do not represent the stand of this publication.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.