Investors just don’t fancy European banks. This distaste has left valuations languishing at levels low enough to imply imminent financial disaster. While this view is far too bleak, the industry’s third-quarter results in coming weeks aren’t likely to change anyone’s mind.

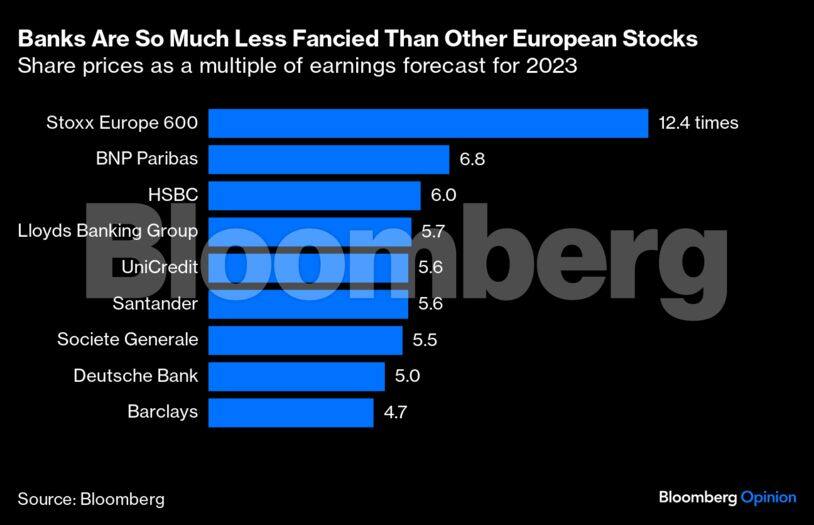

That’s a shame because there are potentially real bargains to be had for bold investors – if the UK and Europe follow the US in heading for the kind of soft economic landing that markets are starting to anticipate. The price-to-earnings ratios of big banks are far below other stocks. BNP Paribas SA, one of the best valued, trades at 6.8-times forecast 2023 earnings, according to Bloomberg data; Barclays Plc and Deutsche Bank AG are both at less than 5. The Stoxx Europe 600 index has a P/E ratio of 12.4. Across the sector, price-to-earnings multiples are about half that for the market as a whole, according to UBS Group AG analysts.

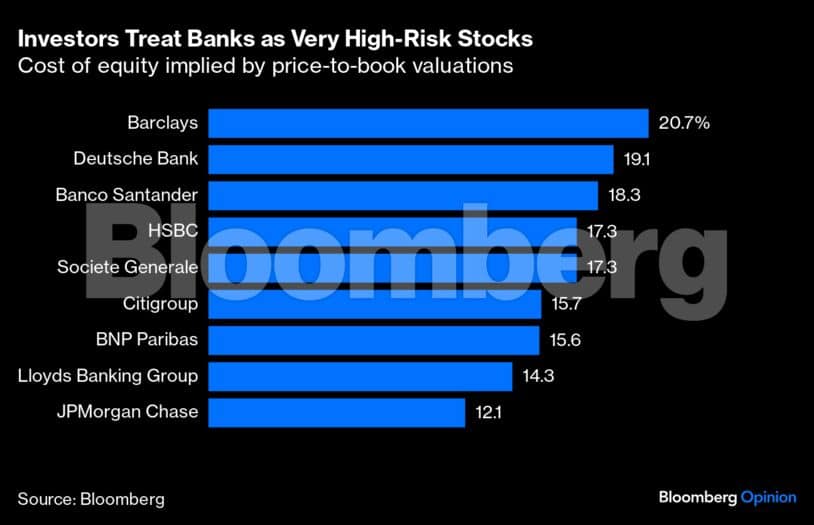

Almost all European banks trade at deep discounts to their net-asset value, which suggests they are either habitually burning money or seen by investors as at risk of suffering huge losses. Looked at another way, their implied costs of equity are set at punitively high levels. Traditionally, banks are expected to have a cost of equity of about 10 percent, and they should be producing returns above that to create value for shareholders. Right now, the implied cost for Barclays is more than 20 percent, Deutsche is at about 19 percent and even BNP is more than 15 percent. For comparison, JPMorgan Chase & Co is at 12 percent.

There is plenty that makes European banks unsexy, but little that makes them so dangerous. Just as in the US, growth in net interest income is soon to peak, as European interest rates stop rising and depositors hunt for better savings rates, squeezing banks’ margins.

European economic growth is definitely weaker than in the US: The UK, Italy and France are all expected to record real expansion in gross domestic product of less than 1 percent this year, and Germany’s economy is set to shrink fractionally, while the US is set to grow by 2.1 percent, according to Bloomberg data. For banks, high interest rates and low growth can be a deadly combination. Losses on bad loans have been rising, but this is still mostly about normalising from very low rates in recent years.

Many companies and households exploited the central bank stimulus rolled out during the Covid-19 pandemic to shore up their own balance sheets. This left them better able to deal with inflation and an economic slowdown. Households with the lowest incomes and companies with the highest debt levels are suffering far more from rising costs than most.

In the UK, worries could grow over younger and more recent mortgage borrowers, or anyone coming off a fixed-rate deal who is suddenly paying sharply higher interest, especially as house prices have dropped in the past few months. And in the euro zone, investors are slightly concerned about the possibility of governments raiding the sector for tax as both the Netherlands and Italy are doing.

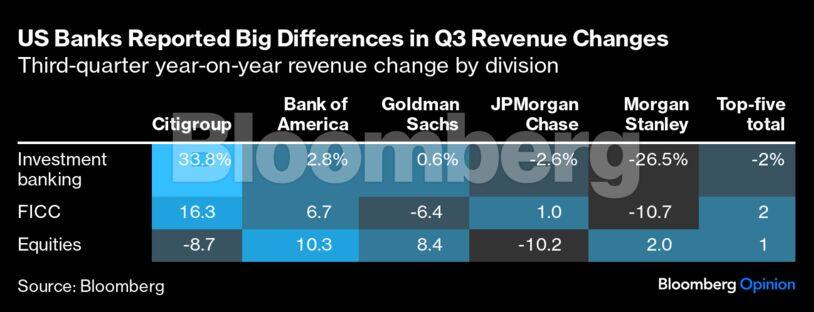

Where there is good news, it could come from the investment banks. Trading revenue held up well for the Americans in the third quarter as a group, although there was a wide variety of outcomes. In fixed-income, currency and commodity trading, Goldman Sachs Group Inc. saw a big drop from last year due to the commodities volatility in 2022, but Citigroup Inc. and JPMorgan did well. Deutsche Bank and Barclays are more similar to the latter pair than to Goldman, which bodes well for them, as Alison Williams at Bloomberg Intelligence has noted.

Advisory fees for takeovers and capital raising have been deeply depressed for at least six quarters in the US, and Europe will be no different. But, again, Deutsche Bank has a chance of surprising the market positively because it has seen the best trends among peers globally in the third quarter, according to analysts at RBC Capital Markets.

Things are rarely as bad as they seem – and that’s true for many European bank stocks. But if you’re waiting for a big rebound in investor confidence, don’t hold your breath.

Paul J. Davies is a Bloomberg Opinion columnist covering banking and finance. Views are personal and do not represent the stand of this publication.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.