Madhuchanda DeyMoneycontrol Research

The Reserve Bank of India seems to be extra vigilant on private sector banks of late. Some may wonder if this is warranted, given the strong business performance of most of these banks. Perhaps yes. With increasing importance of large private sector banks in the system, it is in the long-term interest of the financial sector and investors to have a strict regulator.

In recent times, large private banks have seen heads rolling at the behest of RBI. Axis Bank is a case in point. But hasn’t the bank done a decent job otherwise?

They definitely have and the numbers speak for themselves. Between FY14 to FY18, Axis Bank’s deposits and advances have shown CAGR of 12.7% and 17.6% respectively beating the system growth by a wide margin and improving market share in deposits by 50 basis points to 4% and in advances by 130 basis points to 5.1%. The quality of liability has also strengthened with an industry leading CASA (low cost current & savings accounts) of 54% at the end of FY18. Business diversification too has been commendable with the share of retail improving to 47% of advances from 36% four years back.

But then why was the CEO asked to go?

The quality of underwriting took a toll on the banks performance. Gross and net NPA that were hovering around 1.34% and 0.44% respectively at the end of FY14 started showing signs of stress from FY16 onwards (the first asset quality review by RBI) and worsened substantially in FY17. The trajectory of slippage that had historically hovered around 1% shot up to 5.8% in FY17 and 7.6% in FY18. This impacted its interest margin, on the back of significant interest reversal.

But didn’t this happen to a whole bunch of corporate lenders?

Yes it did. But what perhaps irked the regulator was the higher divergence from RBI’s opinion in recognising non-performing assets that came to light after the audit of Axis Bank’s FY17 accounts. The highest standard of governance which is hallmark of a great institution got compromised in the race to report better numbers quarter after quarter.

Yes Bank has done a much better job prima facie

Axis Bank’s private sector peer Yes Bank had a much better trajectory and the stock has been rewarded accordingly (340% return from April 14 to date compared to 121% for Axis). On the business front, the performance should silence all critics with deposits and advances showing CAGR of 28% and 38% respectively in the past four years. Consequently, its share in deposits and advances of the system has improved to 1.7% and 2.4% respectively from 0.9% in FY14. The bank has succeeded in taking up the share of low-cost CASA to 37% by end of FY18 from 22% four years back and in the process managed to improve its interest margin as well.

In the past three years while Axis Bank’s profitability has completely collapsed, Yes has managed to double the same.

Then why the hesitation in extending the CEO’s tenure?

Being a corporate focused bank, what has surprised the markets about Yes Bank is its pristine asset quality (gross NPA of 1.28% in FY18) amid the troubled landscape of Indian corporate sector. Nobody knowns the secret recipe for this success and some in the street feels it is too good to be true.

Source: Company

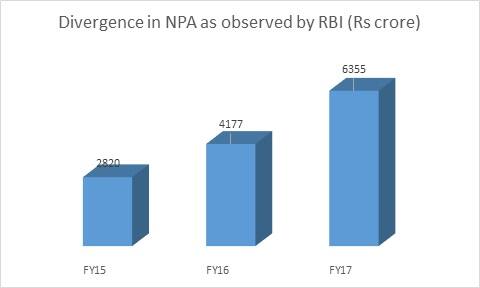

The suspicion turned to fear as a huge divergence came to light after the RBI’s audit of FY17 accounts. The management, nevertheless has downplayed the same sighting the superior track record of recovery in earlier divergences.

But the issue of governance that played its role in Axis has come to the fore once again and seems to be bothering the regulator at a time when it has to give its stamp of approval to extend the term of Yes Bank’s current CEO.

Source: Company

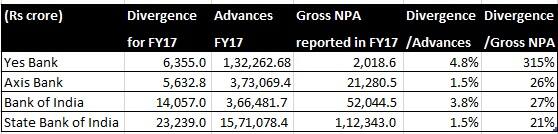

It is pertinent to note that Yes Bank’s divergence is the highest in terms of its share in advances and reported gross non- performing assets.

It is also interesting to observe that while the share of risk weighted assets to balance sheet more or less remained constant for Axis Bank, thereby showing no incremental worsening of risk profile, it had risen from 70% to 82% for Yes Bank in the past four years.

Yes Bank today is a decently large sized bank with a balance sheet in excess of Rs 3.3 lakh crore and hence assumes importance in the system. If the Axis Bank board was shown tough love by the RBI, can the Yes Bank board expect anything different. A lot will depend on the audit of FY18 numbers. Till such time, investors in private banks should draw comfort from the fact that the regulator at the helm is working in the best interest of long-term investors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.