Here’s a glimpse of the future:

Not the sort of futuristic vision associated with the likes of Elon Musk, but Musk-adjacent nonetheless: It’s a portent of electric vehicles taking over.

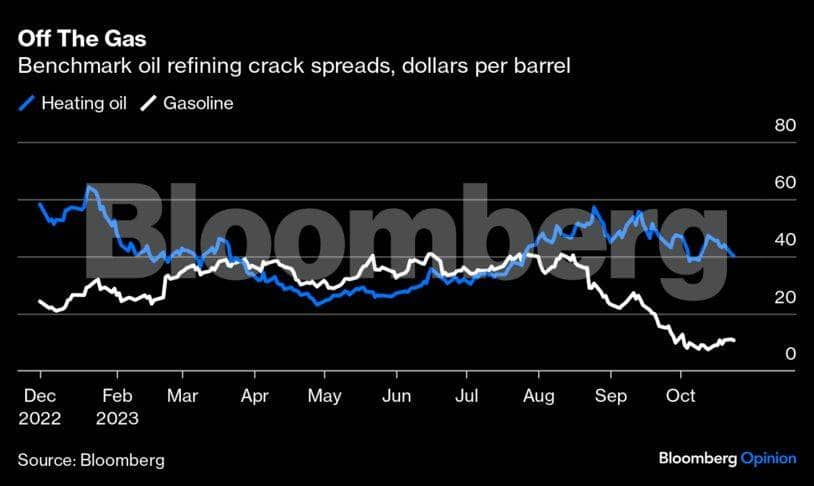

The business of producing gasoline has soured of late. Benchmark gasoline crack spreads — the price difference between a barrel of crude oil and a barrel of gasoline, a proxy for gross margins — have slumped since August. At the same time, the heating oil crack, which includes diesel, has stayed relatively strong, hitting six times that of gasoline earlier this month, the widest gap in more than a decade (barring the wild swings at the start of the pandemic). The gap has come in a bit since but is still almost four times.

There are some idiosyncratic reasons at play. Refining margins blew out as the pandemic eased, so some reversion to the mean is inevitable. Meanwhile, Russia’s recent ban on diesel exports, now mostly lifted, juiced heating oil cracks.

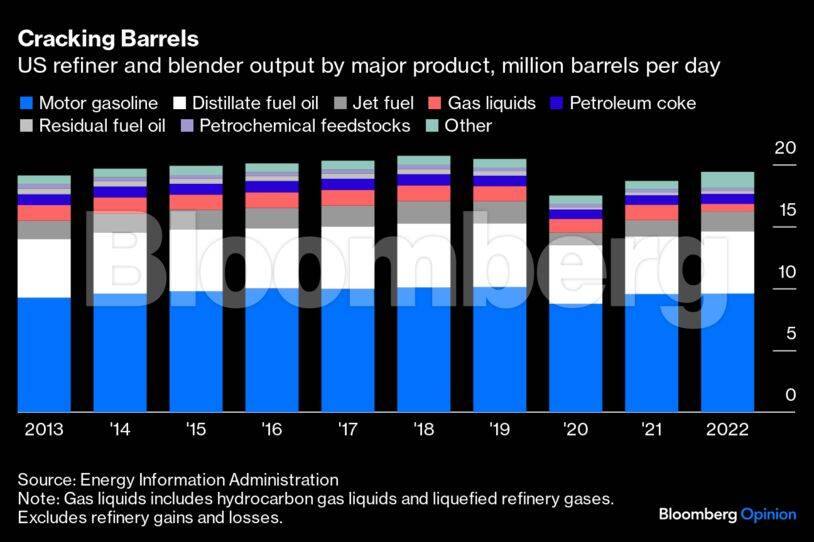

Yet the current divergence in margins offers a taste of things to come for gasoline, which accounts for roughly a quarter of global refinery output and almost half for US refineries.

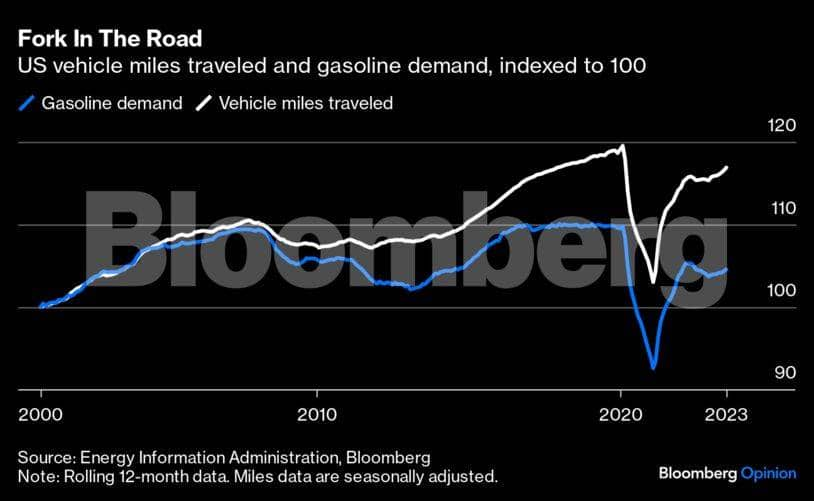

US gasoline demand accounts for roughly one-in-ten of every barrel of crude oil refined. A shock report in late September indicated demand had slumped to a 2 percent-year seasonal low (barring the pandemic). Such weekly estimates are subject to revision, but even the more robust monthly data indicate structural change. While Americans are back to driving almost as much as before the pandemic, gasoline demand remains stubbornly subdued.

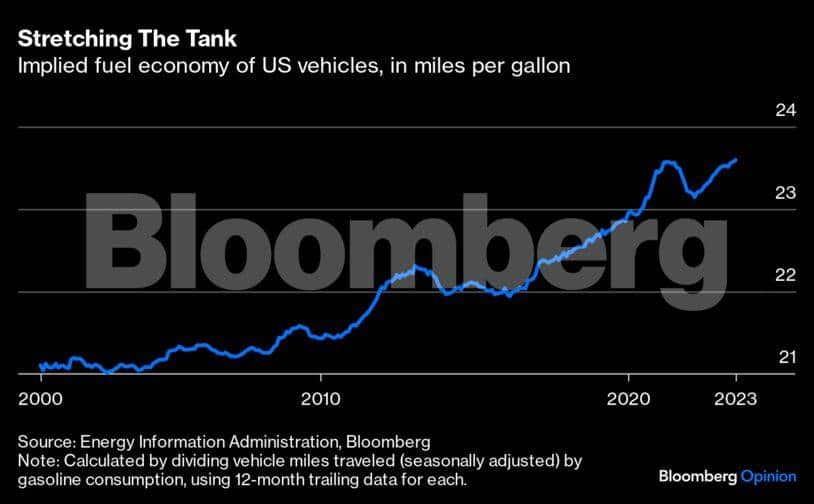

The likeliest explanation is rising fuel efficiency and, of late and at the margin, more electric models on the road. Dividing the two series offers a crude measure of average fuel economy, with half the gain so far this century occurring in just the past six years.

It takes a lot of batteries to drain US gasoline demand: on average, a million EVs displacing traditional vehicles cuts consumption by about 34,000 barrels a day, or just 0.4%.However, and notwithstanding signs of softer growth in EV demand this year, momentum for electrification in the form of investment, new models, subsidies and policy targets remains formidable.

Bloomberg NEF’s base case has electric vehicles displacing 1.1 million barrels a day of US oil demand by 2030, up from about 76,000 barrels a day in 2022. That would be a huge demand shock in the context of a global oil market that historically grows by about 1-2 million barrels a day per year. Zooming out, the International Energy Agency’s latest World Energy Outlook, released this week, has global gasoline demand dropping by 1.7 million barrels a day by 2030 even under its least ambitious scenario. Assume governments make good on current pledges, and that decline is 3.7 million barrels a day, accelerating from there.

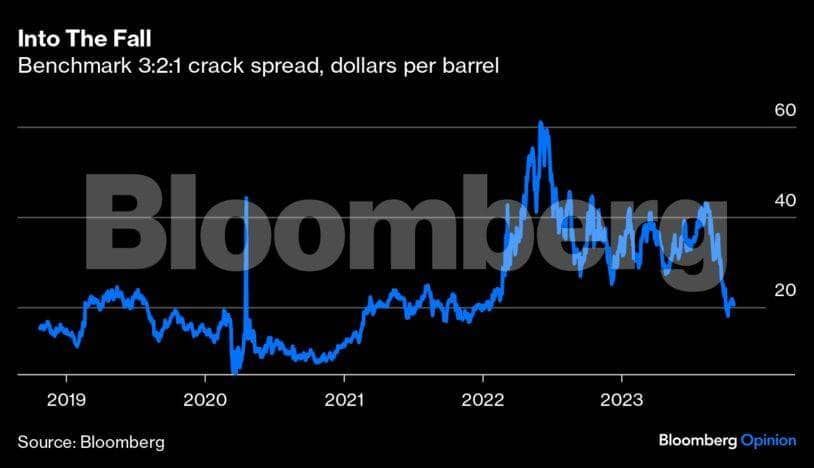

Oil refiners are on the front line of this. As it stands, resilient diesel means margins overall — for example, the so-called 3:2:1 crack spread — remain high relative to history, despite having halved since August. But as electrification takes hold, it will get harder to offset the damage done to a product accounting for a significant chunk of the oil barrel.

A US gasoline shock would, in the first instance, probably be more of a problem across the Atlantic. When Wood Mackenzie, an energy analytics firm, gamed out a drop in US gasoline demand of one million barrels a day a couple of years ago, European refiners’ modeled output fell by 400,000 barrels a day, compared with just 2 percent0,000 for US refineries. European refineries produce a surplus of gasoline, with much of it traditionally exported to the US East Coast. These are also less sophisticated plants on average, relative to US competitors, limiting their ability to shift the yields of various products from each barrel of crude oil.

Clearly, disruptions to regional demand don’t stay local, as barrels seek an outlet. The refineries best able to adapt will be diversified both in terms of the ability to shift product yields and/or access different markets; the US Gulf Coast refining complex comes to mind. More sophisticated refineries can maximise output of naphtha (for petrochemicals) and distillate for diesel and jet fuel, while minimising gasoline production — indeed, Exxon Mobil Corp. recently mapped out a vision for its downstream business along these lines.

Even so, all the flights and plastics in the world wouldn’t offset a terminal decline in road fuels, especially with natural gas competing in chemicals production and electrification also encroaching on diesel-fueled haulage. Falling gasoline demand ultimately means falling oil demand overall. Under the IEA’s scenario of governments fulfilling current pledges — which is, importantly, less ambitious than an outright net-zero scenario — oil demand falls by four million barrels a day by 2030, compared with 2022. Yet global refining capacity is set to expand by more than that, net of closures, within just the next five years. After an unusually profitable period, global refining may be entering a renewed period of overcapacity, exacerbated by the challenge of EVs.

The economically rational response would be to close less competitive refineries, leaving room for the largest, most advanced plants to run profitably. But 50 years on from an attack on Israel that sparked the first oil crisis, and with the Middle East in turmoil once more, economic rationality counts for only so much in a world where energy security is again in focus. Pressure on gasoline margins will challenge governments as much as it will refiners themselves.

The need to keep fuel pumps adequately, and affordably, supplied even as electrification takes hold will be made more challenging as some refineries simply shut down rather than run unprofitably. In theory, countries can turn to neighbours to fill the gap; in practice, relying on even allies for tankers of vital fuels is apt to give politicians nightmares. Subsidies for EVs may yet be matched by subsidies to keep refineries open (temporarily, of course), thereby exacerbating excess capacity and pressuring margins further. Cheap gasoline, the logical consequence of energy transition, will also complicate its progress.

Liam Denning is a Bloomberg Opinion columnist covering energy. Views are personal and do not represent the stand of this publication.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.