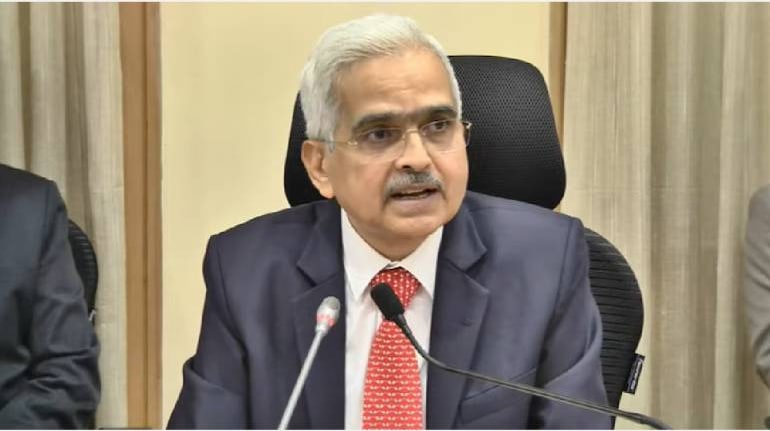

Well, this was a decision that could have gone either way. So, it was only mildly surprising that the monetary policy committee (MPC) of the Reserve Bank of India chose to pause instead of hiking rates by another 25 basis points.

At the same time, RBI Governor Shaktikanta Das was at pains to emphasise that the fight against inflation is not over yet. Core inflation is still high and no one is under any illusion that inflation will fall soon. In that context, you could call the MPC’s decision pragmatic. Some would perhaps term it confusing.

Still, the case for a pause is quite clear. There are global financial stability concerns and developed market central banks are staying off hikes or going slow. This means that RBI doesn’t quite need to play catch-up to maintain India’s interest differential with developed markets.

Growth concerns abound too as we wait for lagged effect of cumulative rate hikes to show up. In India’s case, this is 250 basis points in 11 months. What’s more, even at a 6.5 percent repo rate, the one-year ahead real repo rate would be 130 bps, given RBI’s projections of consumer price inflation of 5.2 percent for the fourth quarter of the current financial year.

The central bank also expects inflation to soften in the coming months. It has also slightly lowered its forecast for consumer price inflation for FY23-24 to 5.2 percent now from 5.3 percent earlier, citing falling commodity prices and a moderation of inflation expectations of households, among other things.

Finally, there is some comfort in India’s external sector outlook with forex reserves rebounding and the current account deficit projected at manageable levels for FY22-23 and FY23-24.

“On the whole, the RBI’s decision and accompanying hawkish statement seem to be the best course of action for now,” writes my colleague Aparna Iyer. “But will it have the desired effect to temper inflationary expectations and optimism just enough for it to not hurt demand more through more rate hikes?” Click here to find the answers.

Investing insights from our research teamIs the fight for deposits yielding results for banks?

Godrej Consumer Products: Poised for higher growth on many initiatives

Star Health or ICICI Lombard: Which insurer’s stock offers better risk-reward?

What else are we reading?FMCG earnings updates signal healthier margins, but sales growth a mixed bag

The impact of key near-term events on the markets

Global asset returns show true market risk lies in its complacency

SAT's decision on Arshad Warsi case shines spotlight on SEBI's cavalier attitude on restraint orders

MSME loans a weak spot in banks’ strong asset quality

Chart of the Day: Cotton mills set to spin a happier tale in FY24

Services exports the new hope, but not for all

Marketing Musings: Maggi’s time-tested lessons

How Nvidia rebounded from the tech meltdown

India’s battery manufacturing plans will need a secure nickel supply chain

Start-up Street: Will ‘down rounds’ be the next phase in Indian start-ups?

What I learnt from three banking crises (republished from the FT)

Millennials are not as badly-off as they think — but success is bittersweet (republished from the FT)

Personal Finance: Bitcoin deserves 'some' space in your portfolio

India's trade policy weaknesses will undercut its economic rise

Sri Lanka Debt Crisis: It would be sheer folly to underestimate China's machinations

Ukraine war has provided valuable lessons for fighting hunger and foodgrains shortage

Technical Picks: Lead, Axis Bank, Sun Pharma, LTI Mindtree and ITC (These are published every trading day before markets open and can be read on the app).

Ravi Krishnan Moneycontrol ProDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.