Shweta Jain

Markets are bullish- Time to stop SIPs? Markets are bearish- Time to stop SIPs? Markets are not going anywhere- Time to stop SIPs?

I get these questions depending on what kind of phase we are in at the time. So, let’s see if SIPs do make sense and in what kind of market conditions.

And this behaviour is seen in the inflow data from mutual funds (DIIs) where the maximum money comes in when the equity market is expensive (greed) and outflows happen when the market goes through a correction or turns cheap (fear).

And how do we deal with this behavioural shortcoming? The tried and tested systematic investment plan (SIP) route which encourages disciplined investing. But here again, we forget two things:

1. It takes time for compounding to kick in and work

2. Markets may not always react in the same way we expect it to in a defined time period

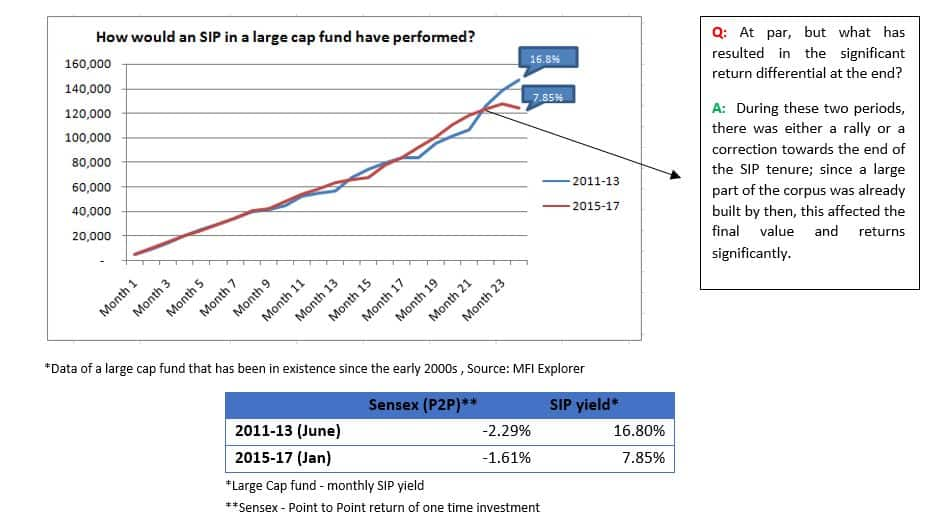

Let’s take a look at how an SIP in a large cap fund would have performed. Covering two time periods, from Jan 2011 - Jan 2013 and also Jan 2015 – Jan 2017 (which included demonetisation); even though the point-to-point (P2P) returns from the Sensex were similar during these periods, the SIP returns from a fund varied significantly.

Here’s Why You Should Invest In Equity Mutual Funds

What you should be doing is link your SIPs to goals- so you know exactly what you’re investing for and very importantly, stay invested. It is the time in the market and not the timing that matters.

What you should be doing is link your SIPs to goals- so you know exactly what you’re investing for and very importantly, stay invested. It is the time in the market and not the timing that matters.

(The writer is International Money Matters)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.