Indian equities typically command a premium. Even now, when investors are nervously marking down their estimates of corporate earnings in emerging markets, they continue to believe that the South Asian nation’s firms will garner reasonably healthy profit growth.

After recent downgrades, stocks comprising the country’s benchmark Nifty Index are forecast to deliver around 15% higher income over the next 12 months than at the start of 2020. This is when expectations for emerging markets as a whole have been scaled back to below pre-pandemic levels. Is this expected outperformance worth the extra price?

India’s valuation gap over other emerging markets is an “eye-watering” 3 standard deviations higher than the historical average, says Aditya Suresh, Macquarie Capital’s head of India research. It isn’t that global investors are tilting their portfolios toward China’s southern neighbor because they’re worried about the mainland’s slowing economy and its growing detachment with the West. Although the selling pressure has eased since July, overseas fund managers have so far this year sold more than $23 billion of Indian equities.

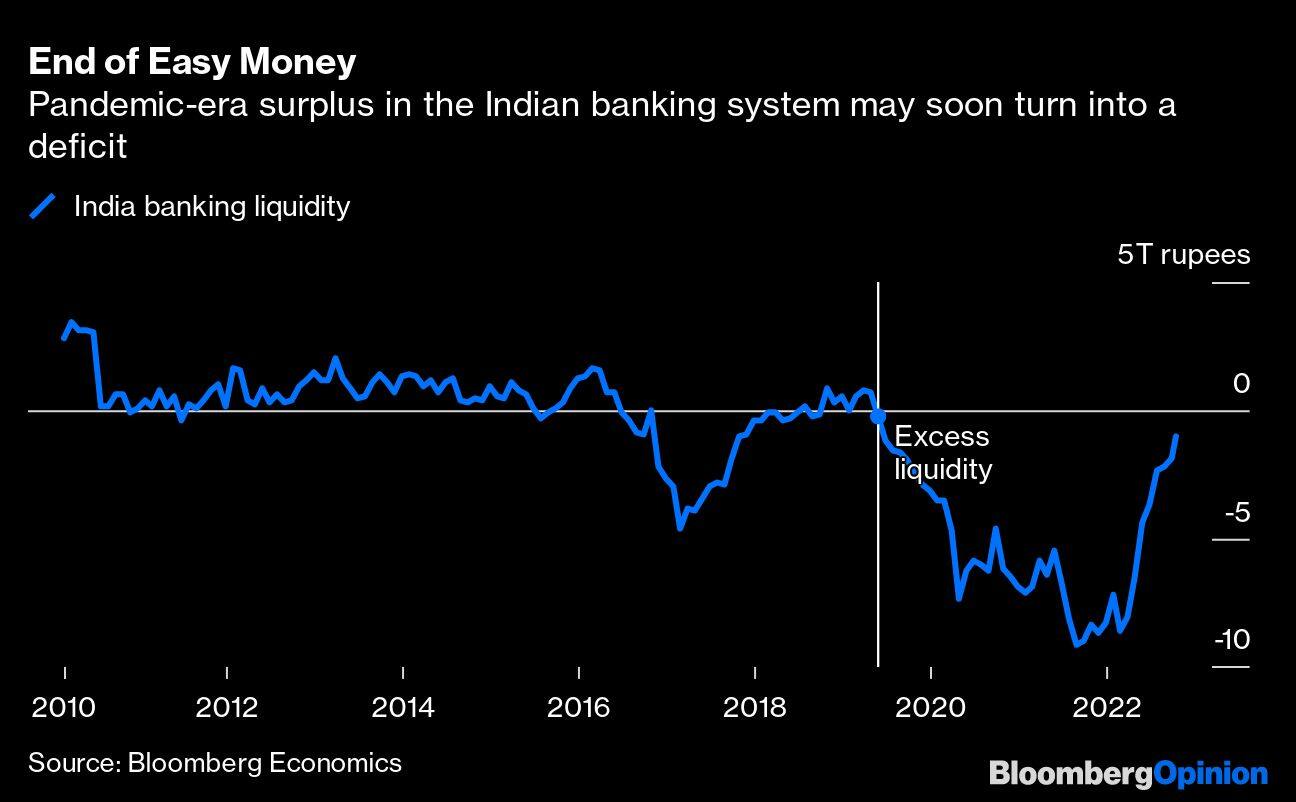

It’s domestic buying that’s powering equities. Where’s the funding coming from? If you look at the aggregate picture of banking, the excess liquidity that the central bank created during the pandemic years has all but disappeared. The Reserve Bank of India has raised its policy interest rate by 1.9 percentage points since May. Yet, the local stock market is still not exposed to the full force of tight money.

To see why, start with what the brokerage HDFC Securities is calling the “changing contours of monetary transmission” in India. In March 2020, less than 10% of floating-rate rupee loans were priced off an external benchmark such as the RBI’s repurchase rate. By June this year, that figure had jumped to 47%. Taking advantage of rising interest rates, lenders have frequently reset loan prices.

When it comes to paying for deposits, however, they’re still holding back. Domestic equity funds have seen 19 straight months of inflows. That’s at least partly because banks aren’t offering a fair compensation to savers in a high-inflation environment. Take the 5.85% offered by the State Bank of India, the country’s largest commercial lender, on a five-year fixed deposit. This is when the current inflation rate is 7.4%, and the Indian government is paying investors between 6.3% and 7.5% to borrow for three months to 10 years.

Not only is the banks’ stinginess toward depositors acting as a source of excess stock-market liquidity, it’s also providing an outlet. With assets repricing faster than liabilities, HDFC Bank Ltd., the most valuable among Indian lenders, recently reported a 19% jump in its net interest income in the September quarter from a year earlier. This is making investors bullish. An index that tracks bank shares on the Bombay Stock Exchange has returned nearly 15% so far this year, compared with 2% gains — including dividends — for the Nifty Index in local-currency terms.

Can the nation’s banks continue to squeeze depositors this way? Loans and advances are rising 16% year-on-year as economic activity rapidly normalizes to its pre-pandemic level, generating credit demand along the way. Systemwide deposits, however, are increasing by only 9%. The divergence is largely because of foreign-exchange outflows — official reserves have fallen by more than $100 billion from their peak in September 2021 as the RBI tried to arrest the decline in the rupee against a surging dollar.

Should credit expansion continue apace, India’s banks may have to compete for liquidity more earnestly by offering to pay better rates, indirectly creating an incentive for capital to move away from the stock market and toward term deposits. “This is the most important risk for Indian equities over the next one year,” says Macquarie’s Suresh. For a sense of when tight money will ultimately reach the Indian stock market, investors will be paying attention to fixed-deposit interest rates.

Andy Mukherjee is a Bloomberg Opinion columnist covering industrial companies and financial services in Asia. Views are personal, and do not represent the stand of this publication.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.