Jitendra Kumar GuptaMoneycontrol Research

After many years, HCC (Hindustan Construction Company), which has strong capabilities in tunnelling, construction of dams, nuclear plants etc, has crossed Rs 20,000 crore of outstanding order book. Order flows are expected to remain healthy with the estimated increase in spending on nuclear power, hydropower and roads.

“We have seen good traction in transport and water. We think inflows will be good because of an increase in orders from the hydro power, nuclear and transport sectors,” said Praveen Sood, Group CFO, HCC, in an exclusive interview with Moneycontrol.

Strong execution capabilities

The 100-year-old company has constructed 25 percent of India’s hydropower projects and 65 percent of nuclear power generation capabilities. It has constructed close to 320 km of tunnelling and over 365 bridges. Within construction, it has solid capabilities in relatively low competition segments that contributes to higher margin.

While it has several competitive advantages, what is more exciting at the moment is its improving ability to execute orders which will enable it to come out of the past debt crisis, a key concern for the Street.

In FY11, the company reported a negative cash flow of Rs 10 crore. With orders improving, the company notched up Rs 400 crore positive cash flows annually. That apart, it has brought down its working capital requirements in the business from Rs 2,400 crore in FY13 to Rs 1,331 crore in FY16 releasing an extra amount of liquidity to help improve execution.

HCC is now able to sweat its assets better. Fixed asset turnover ratio, which is computed as sales upon fixed assets, has now moved to 6.5 times as against 4.9 times in FY15, which is remarkable and indicates that pace of execution is picking up.

Construction business results in a virtuous cycle - more revenue churns more cash and that, in turn, is ploughed back into the business to generate more revenue. “Our current order book has an execution cycle of about 4.5-5 years, we hope to book a large amount of these orders in FY18 and FY19 helping us improve execution supporting revenue growth,” said Praveen Sood.

What is important is that in the coming years to complete projects the company will now rely less and less on debt. On a standalone basis, the company is reporting a debt of Rs 4,397 crore.

Claims receipt not yet in the price

However, the debt is going to come down substantially due to recovery of claims filed with the government. Historically, its legacy orders have faced cost escalations as a result of delays and changes in the scope of projects. HCC is not alone. The entire sector during the years 2012-14 had faced these challenges. The additional cost incurred by the company was filed with the government as claims in the past, which are now getting repaid.

The government has agreed to release 75 percent or Rs 2,850 crore of the claims worth Rs 3,800 crore (agreed to be paid by government). The company has already received close to Rs 400 crore.

The management expects to get close to Rs 2,400 crore this year (Rs 1,500 crore over the next 2-3 months) for the claims that are filed and accepted by the government and state-owned companies.

The entire money (Rs 2,400 crore) will be used for repaying debt. In addition to this, under the restructuring plan, it will also convert part of its debt (Rs 800 crore) into equity. Effectively, this will bring down its debt-to-equity ratio to a sustainable 0.8 times by the end of fiscal 2018 for the standalone entity.

Valuation

In the meantime, the market is cautiously approaching the stock and building expectations. Decline in debt will improve the company’s financial health and should drive execution, going ahead. We have incorporated a phased receipt of claims money in our estimates; the trajectory of receipt of claims money will determine stock performance.

In case the entire Rs 2,400 crore of claims is received, which is 61 percent of the total market capitalisation of the company, it will have a huge impact on valuations as the market is still not factoring that amount.

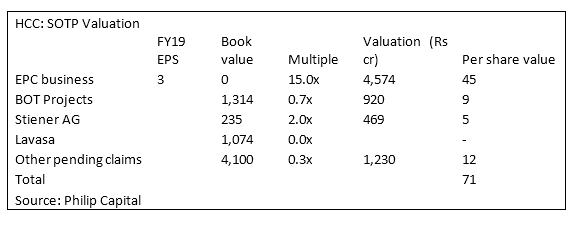

If we try and analyse the impact of the claims on valuation, the numbers tell a story. At a modest multiple of 12-15 times construction business earnings in FY19, the value of HCC per share works out to Rs 36-45 as against market price of Rs 39 a share.

The company has significant amount of equity in subsidiaries -- equity investment (Rs 235 crore) in Steiner AG, equity investment in BOT assets of worth Rs 1300 crore, Rs 1,074 crore of equity in Lavasa and pending claims of Rs 3,800 crore with the government. Even at a steep discount of 40 percent (because of uncertainty) these assets are worth Rs 2,700 crore or Rs 27 a share. If we include the value of the core construction business, it works out to Rs 63-72 a share.

Steiner, which is a Zurich-based leading real estate firm, specialising in the turnkey development, reported Rs 21.7 crore profit in FY17 as against a loss of Rs 6.5 crore in FY16. Its other prominent business Lavasa, the smart city project spread across 20,000 acres, is incurring losses and has turned into a bad loan. Lavasa has defaulted on its loan and the liability is limited with the very remote possibility of losses to the parent company.

While explaining the role of parent company, Praveen Sood, said, "Bankers have some put option and we have given some bank guarantees which together may be around Rs 500 crore. So, theoretically, the parent company liability is limited to that much amount. But that is a very remote possibility. No banker is even thinking about that because the same banks who have exposure to Lavasa also have exposure to HCC.”

Sood could be right. For a small amount no banker would like to jeopardize their funds in the parent company. On the positive side, Sood maintained that they are restructuring the Lavasa loan. Today, the land value of Lavasa itself is close to Rs 8,000 crore as against the Lavasa loan of Rs 4400 crore. The loan has a strong asset back-up. If restructuring works out then there could be a good upside, he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.