September quarter corporate earnings suggested an improvement in GDP as our correlation exercise had established a strong correlation between the two. As expected, the economy showed signs of revival with an uptick in the GVA (gross value added) performance at 6.1 percent vs 5.6 percent in Q1FY18.

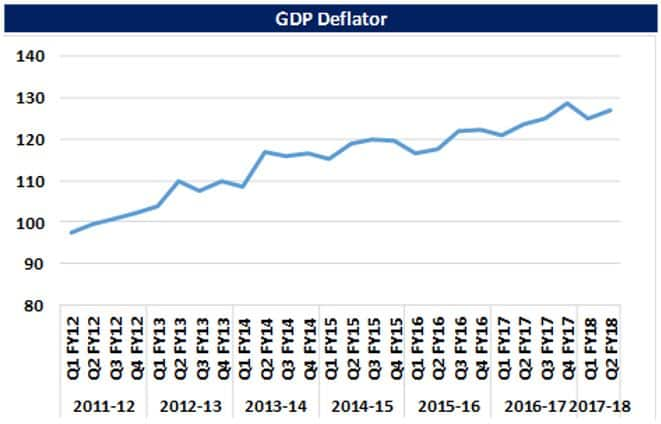

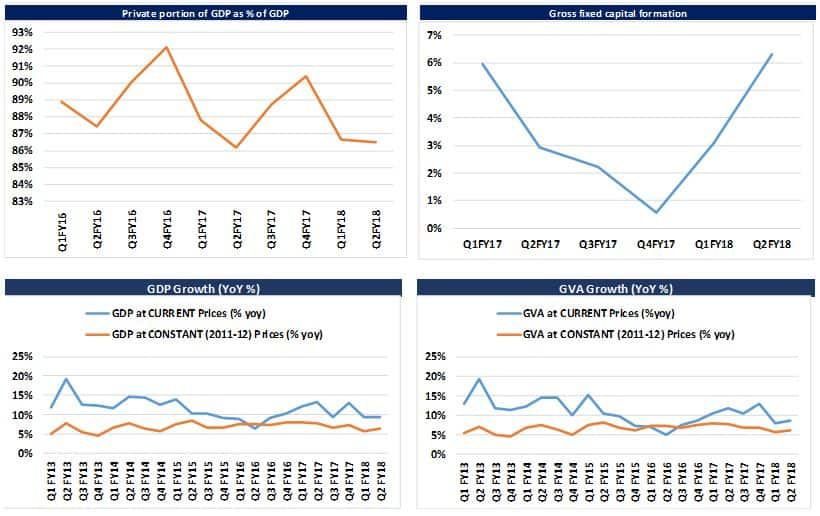

Gross domestic product (GDP calculated by adding net indirect taxes to GVA) also showed a recovery at 6.3 percent vs 5.7 in Q1FY18. A closer look at the GDP deflator (a surrogate for the price level) shows that while there is a sequential rise, it is still lower than its peak and thereby hinting at sub-optimal demand in the system.

However, the data was not devoid of its green shoots. Also, some of the distortions could be attributed to GST as this was the first quarter post GST. Not every data could be gathered and the GST collections weren’t up to the mark in different sectors.

Industry – leading or is it a GST-led revival?The revival was majorly led by an improvement in the industrial sector while agriculture and services sectors remained subdued.

The improvement in industry was driven by mining (thanks to the low base) as well as manufacturing. Normalization of inventories post GST contributed significantly to growth. Agriculture growth remained muted due to a sharp weakness in Kharif output year-on-year. Services sector was muted with a sharp decline in real estate, financial and public administrative sector. The hiccups and lack of clarity post GST could have contributed to the same.

However, a notable positive was growth in the investment rate (gross fixed capital formation), the highest in the past six quarters. However, it may be premature to celebrate as the overall investment rate remains in the twenties. A couple of other trends worth noting were the decline in government expenditure (perhaps due to the front-loading that happened at the beginning of the year) and the pick-up in private demand as seen from the growth in the non-government portion of the GDP.

Private consumption while lower than before, nevertheless, held up.

With agriculture and services on a slow lane, it can be concluded that major growth has been derived from the urban sector. The rural demand still remains sluggish.

With normalization of the impact of GST and demonetization along with numerous policy initiatives, we expect rural demand to improve in the coming quarters. Schemes like Bharat Mala and low-cost housing along with a good upcoming rabi season, are expected to provide much-awaited momentum to rural demand.

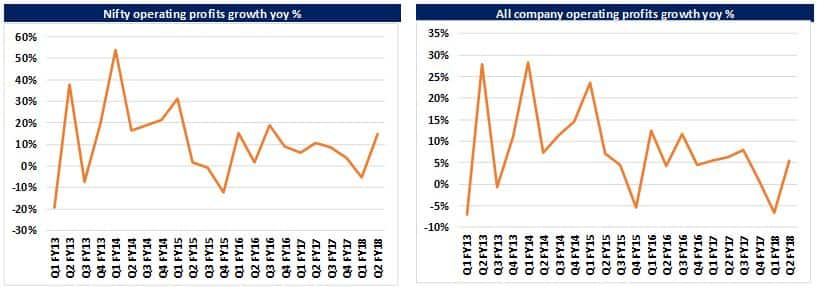

Correlation – remains strongIn continuation to our correlation analysis last quarter, this growth was expected given that we saw significant growth in the GST adjusted sales and profitability for the aggregate of all listed companies and Nifty companies.

The growth in sales of companies has a very high correlation with the growth in GVA. The correlation coefficient between GVA growth and sales growth of Nifty companies is 0.81. Furthermore, the degree of correlation stands at 0.67 when compared to aggregate sales growth of all listed companies during the same period.

While it is premature to deduce much from the early green shoots of the GDP data, the base effect of demonetization in the year-ago second half should lift corporate earnings growth in the coming two quarters. The waning impact of demonetization and the end of the post GST hiccup should also support this trend.

With markets trading at 21x FY18 projected earnings and pinning hopes on low teens earnings growth in FY18 and high double-digit growth in FY19, can it draw comfort from the green shoots?

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.