Power of compounding is a simple yet powerful tool that experts suggest, time and again. But can this concept help you build a Rs 1 crore, or let’s say, a Rs 10 crore portfolio? As per a FundsIndia Research report, the answer could be easier than you think.

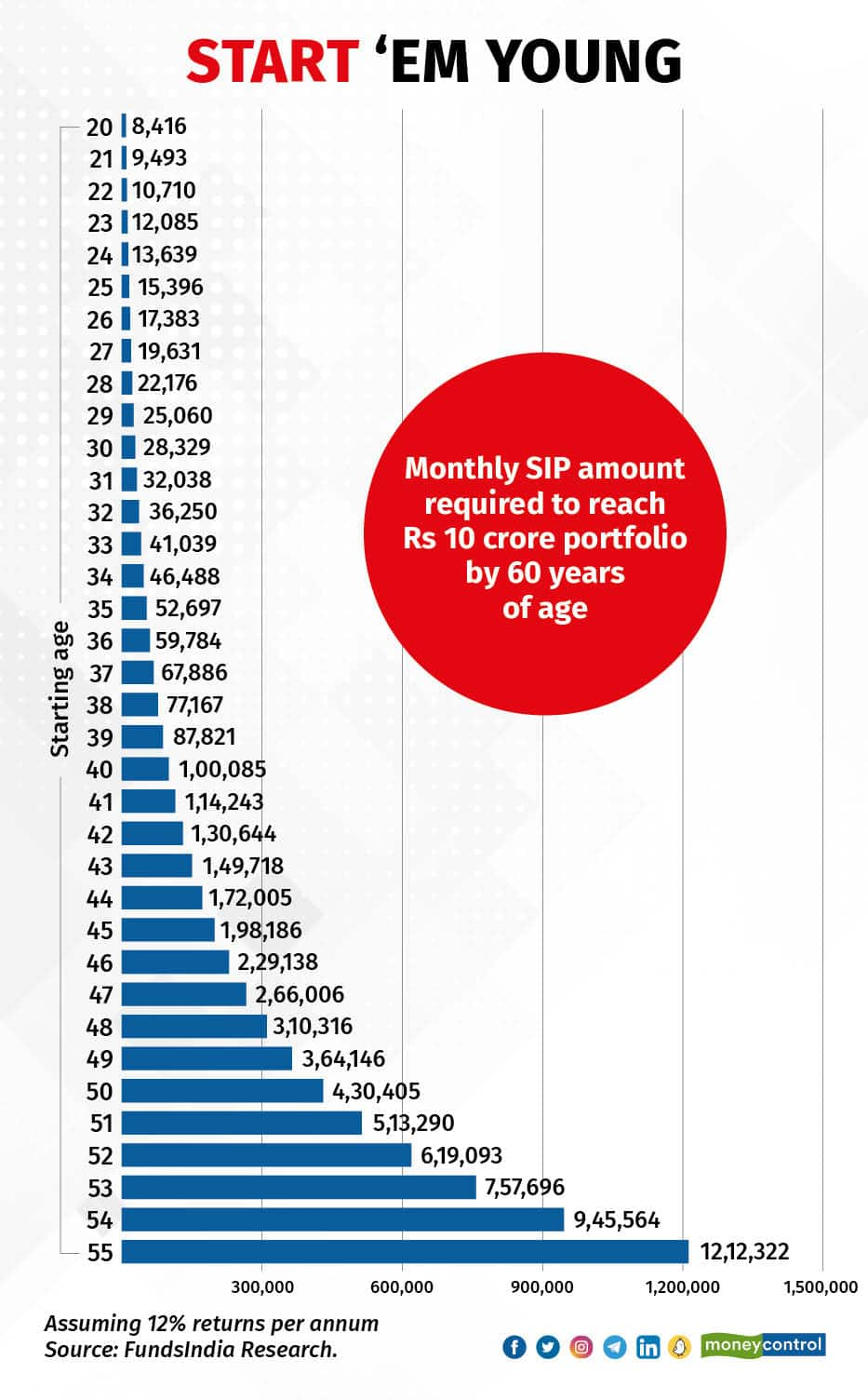

According to the report, for an individual aged 25 years, to build a portfolio of Rs 10 crore by the age of 60 years, all it requires is a monthly instalment of Rs 15,000 through the SIP (systematic investment plan) route. This is assuming an annual return of 12 percent.

Data available with Value Research suggests the large-cap fund category has delivered an average return of 13 percent on a 10-year basis.

However, if you delay your investment and start at the age of 30 years, the monthly SIP required would be two times more -- Rs 28,000 -- to build a Rs 10 crore portfolio.

If you delay it till the age of 40 years, it will require a monthly SIP of six times more –Rs 1 lakh.

How compounding works

According to the report, if you are investing Rs 30,000 per month, assuming 12 percent annual returns, it will take you eight years to reach a portfolio amount of Rs 50 lakh.

However, from there onwards, it will take only four years for the second Rs 50 lakh, and three years for the third Rs 50 lakh.

Also read: Axis Bank devalues five credits cards, including co-branded card with Flipkart

By the time you reach the 20th year of investment, you will be adding Rs 50 lakh almost every year.

If you increase the SIP amount to Rs 50,000 every month, the incremental rise in your portfolio would be by Rs 80 lakh, and by the 20th year of your investment, you would be adding Rs 80 lakh almost every year.

A faster way to build portfolio

While the percentage of your investment can vary, depending on your income, savings, and debt, ideally, one should invest somewhere around 15–25 percent of one’s post-tax income to build that conformable retirement nest.

What quantum of investment will make you reach your retirement sooner? Let’s take a look.

Also read: ITR filing: How to file income from capital gains or set off capital losses

As per the report, if you invest Rs 10,000 per month, it will take you 20 years to build a Rs 1-crore portfolio, and around 39 years to build a corpus of Rs 10 crore. This is assuming that there is no annual increase in the SIP amount.

With the same investment parameters, and assuming 12 percent annual returns, the time gets shortened to 12 years and four months with an SIP of Rs 30,000. Further, with this investment, it will take you around 30 years to build a Rs 10-crore portfolio.

Additionally, if you increase your SIP amount by 10 percent annually, a Rs 10,000 SIP will take you to Rs 1 crore portfolio in around 16 years and to a Rs 10-crore corpus in 31 years.

Should you worry about crashes?

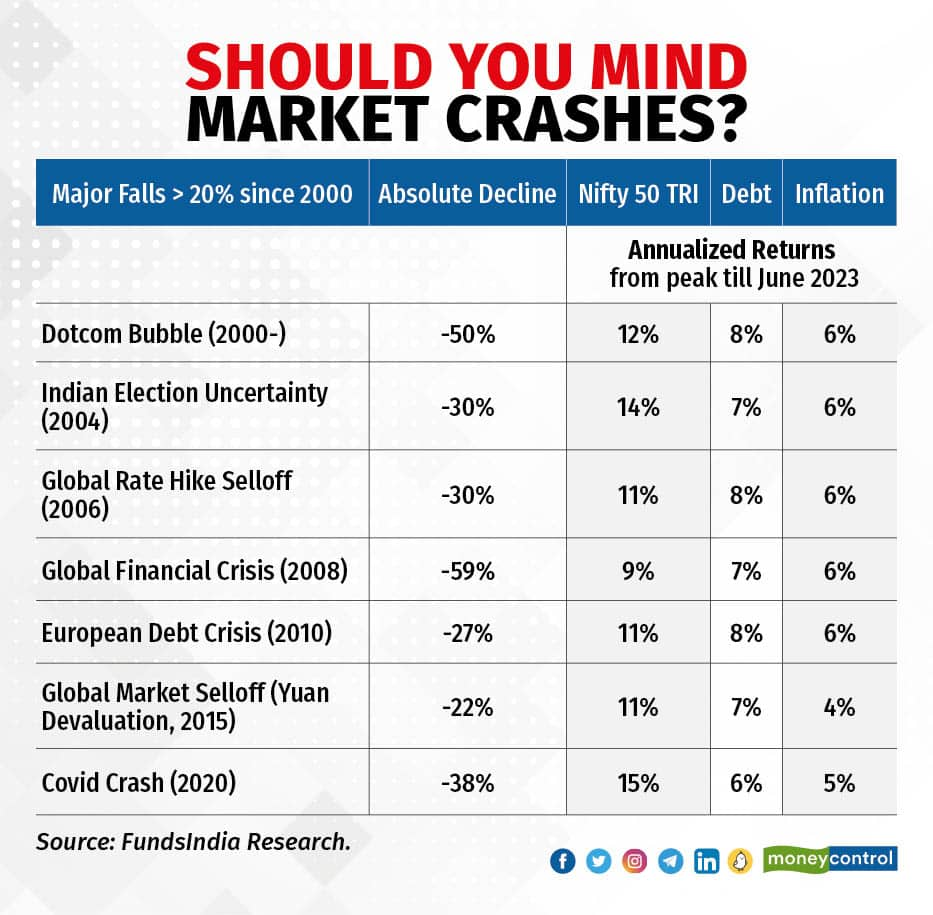

A key worry that pulls back people from investing is possible market crashes. However, the report noted that historical data shows that those who had invested prior to previous major market crashes still received decent returns.

Also read: Shridatta Bhandwaldar reveals Canara Robeco MF’s success mantra: Avoid cowboyish fund managers

A case in point is that the annualised returns of the Nifty 50 Total Return Index (TRI) since the Dotcom crash in 2000 is around 12 percent. Even post the COVID-19 crash of 2020, the index has delivered a return of 15 percent.

In fact, data shows that Nifty 50 TRI has beaten S&P 500 TRI (rupee terms), gold, real estate and debt investments.

In the past 20 years, till June 2023, Nifty TRI is up 16.7 percent, S&P 500 TRI is up 13.2 percent, and gold is 12.1 percent higher. On the other hand, real estate, as measured by the NHB Residex, is up 9 percent during this period.

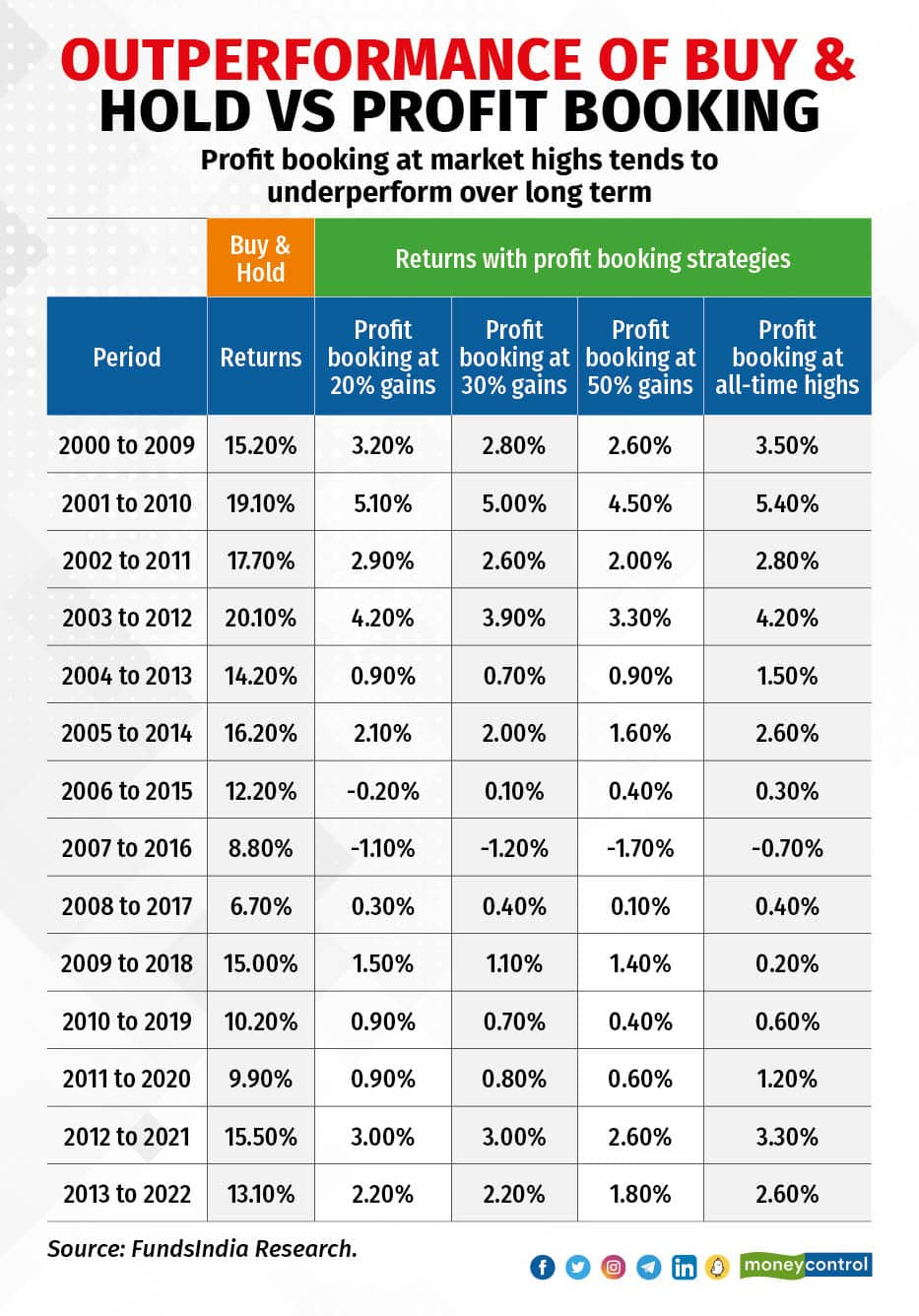

The key takeaway from the FundsIndia report has been that, over the long term period (10-15 years), equity has provided returns well above inflation. While 10-20 percent decline happens almost every year, 30-60 percent decline should be a part of the expectation for every seven to 10 years. Therefore, stick to your asset allocation and keep investing regularly.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.