The underdog won and the favourite disappointed.

On December 26, Moneycontrol carried an in-depth analysis of how sector and thematic funds did in 2022. Two sectors, banking and Information Technology (IT), stood out. But contrary to expectations, technology funds delivered a disappointing performance in 2022. Whereas banking sector funds topped the charts, after a stressful period during the first two waves of Covid.

Also read | The best and worst of mutual funds of 2022

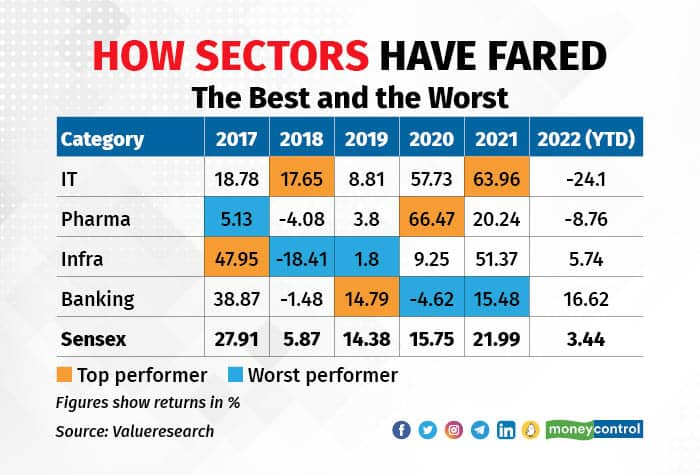

Broadly, there are four sectoral funds in the Rs 40 trillion Indian mutual funds (MF) industry. They are banking, IT, infrastructure, and pharma. While infra and pharma funds performed largely in line with the BSE Sensex (up 3.5 percent YTD), banking funds have risen 17 percent this year. However, IT funds have slumped around 24 percent since the start of the year.

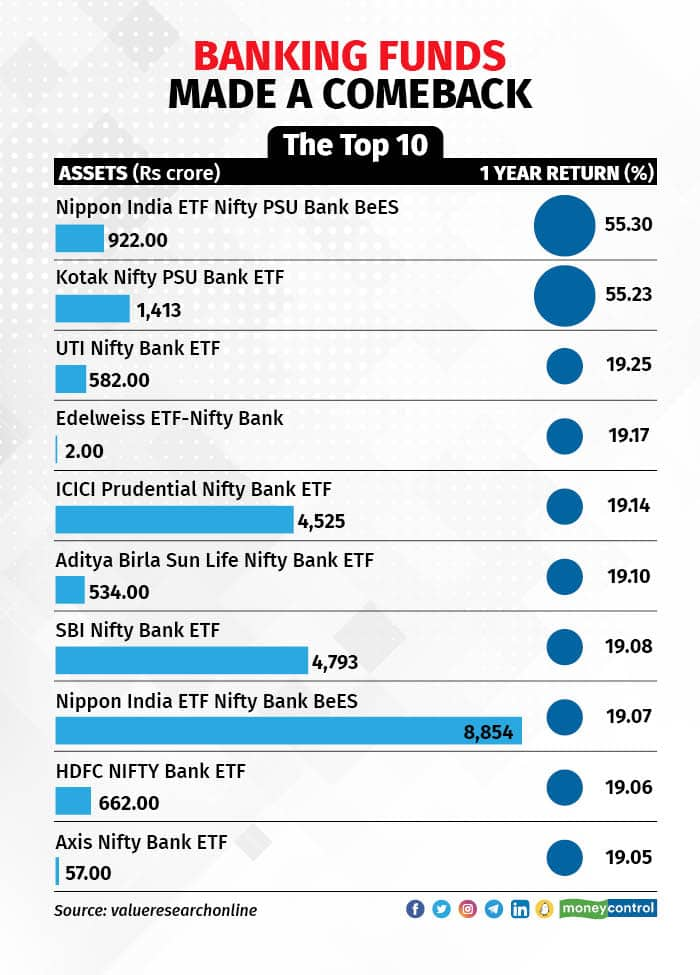

To be sure, fund houses have variations of banking sector funds. Some focus on the private sector, some on public-sector banks, while some invest in both.

When it comes to IT funds, data available with Valueresearch showed that the Nippon India ETF Nifty IT has performed the worst with a negative return of 26.48 percent since the start of the year, while the SBI Technology Opportunities Fund, with a year-to-date (YTD) return of -15.37 percent till 23 December took the smallest hit.

On the other hand, the Nippon India ETF Nifty PSU Bank BeES with a YTD return of 53.01 percent was the best banking fund in India.

The winners and losers in sector mutual funds keep changing, year-on-year

The winners and losers in sector mutual funds keep changing, year-on-year

Banks soar

The Indian banking sector performed well in 2022 with a further uptick in loan growth, sharp sequential net interest margin (NIM) improvement, and continued reduction in stress levels. The improvement in asset quality was led by lower slippages and relatively stable recoveries and / or upgrades.

Overall, banking funds are on course to put up their best performance since 2017. “The sector continues to remain in a sweet spot with sustained, strong growth and relatively better asset quality,” said Haitong International, a global brokerage.

Within the banking sector, public sector banks took a big leap in terms of returns this year. In fact, the top two performing banking funds are PSU bank exchange-traded funds (ETFs) by Nippon India MF and Kotak Mahindra MF.

Banking sector funds made a comeback in 2022

Banking sector funds made a comeback in 2022

Harish Krishnan, Senior EVP and fund manager (equity), Kotak Mahindra AMC, believes that in the past 12 months PSU banks have benefitted from the revival of credit growth, as well as improved asset quality with fewer non-performing assets (NPA).

Also read | Overseas mutual funds are accepting money again. Here's what you should do

“Larger PSU banks which have a strong deposit franchise have good long term prospects. However, for many of the smaller names, the run up was primarily on depressed valuations, or news regarding privatisation, low public float, etc. In banking, growing deposits is easier. The key is prudent underwriting. It is too early to form a view whether many of these PSU banks (especially smaller ones) have seen a material reset in their underwriting practices,” said Krishnan.

IT’s depressing

IT funds are at risk of putting up their worst yearly performance since the recession of 2008.

Return to work from Covid-19 related lockdowns and global economic conditions led to the fall in technology stocks in 2022

Return to work from Covid-19 related lockdowns and global economic conditions led to the fall in technology stocks in 2022

Globally, macroeconomic challenges have worsened over the past few months, which has led to IT players experiencing elongated sales cycles, reduction in revenue guidance, and slowing hiring.

In a recent report, Nirmal Bang Securities said that signs of weakening demand were beginning to show up.

Per ICICI Prudential Mutual fund, the global macroeconomic climate is still unclear due to inflation in the US and the European Union. This might have an impact on the IT spend of large firms in 2024.

“However, we believe that the drop in tech spends would most likely be temporary and would start to show in the first half of 2024. Growth will be slightly muted over the upcoming quarters, which will be challenging, but on the positive side, we should see pressure on margins gradually ease,” said Vaibhav Dusad, Fund Manager, ICICI Prudential Technology Fund.

What should investors do?On banking, Jiten Parmar, Co-Founder, Aurum Capital, said, “The NPA crisis is behind us, credit growth is happening, balance sheets are good, and private capex is growing. This sector will see 15-20 percent credit growth over the next few years. NPAs are very much in control and down-trending. Banks were also able to actually make recoveries on a lot of previous bad loans. We continue to remain positive on this sector.”

Also read | Which sectors are India's top mutual fund managers betting on in 2023?

On IT, Parmar said that the growth will moderate a bit and there will be a 15-20 percent correction from this point.

An encore? Don’t bank on it

From an asset allocation perspective, financial advisors advise retail investors to be cautious of sectoral or thematic funds as these are highly risky. If an investor is new to equity investing, they say it is better to start off with a diversified equity fund.

“We don't give sectoral views because we have a broader asset allocation perspective. Indian markets are expensive relative to the rest of the world. So, maybe it is time to be a little cautious. That being said, maybe there is still room for financials to move up a bit more,” said Rishad Manekia, Founder and MD, Kairos Capital.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.