Looking back at 2022: The best and the worst sectoral mutual funds

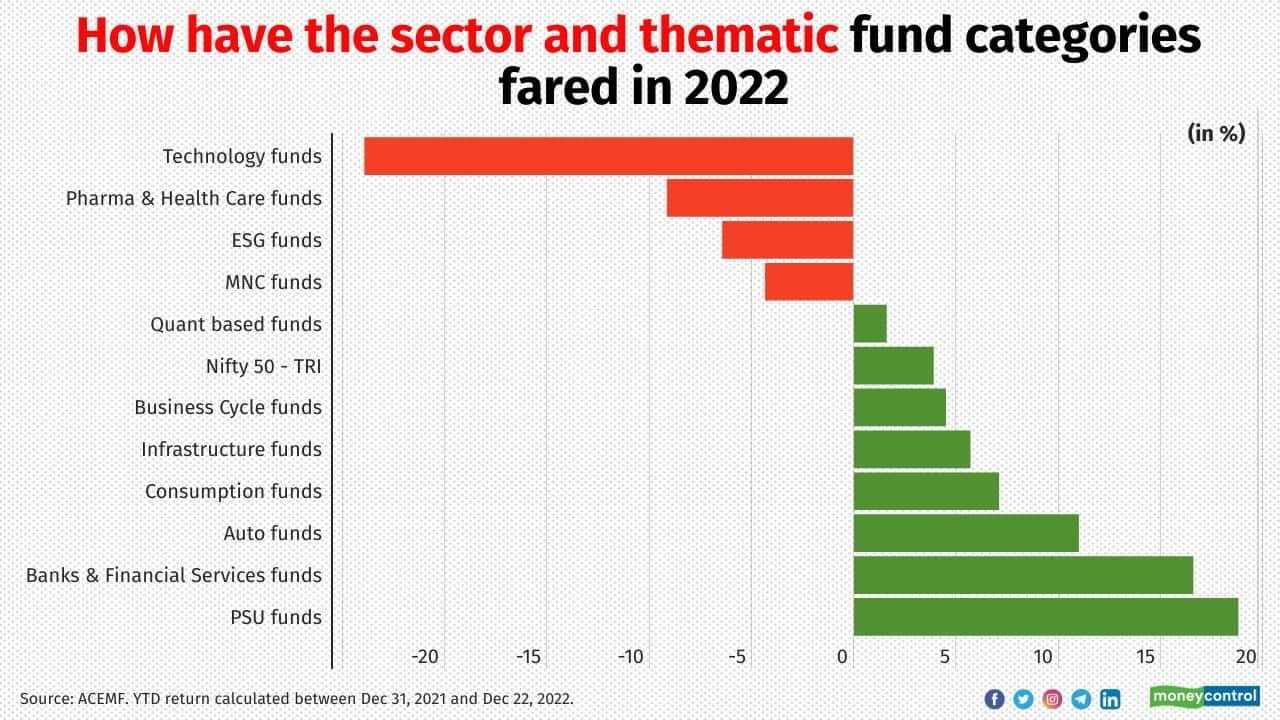

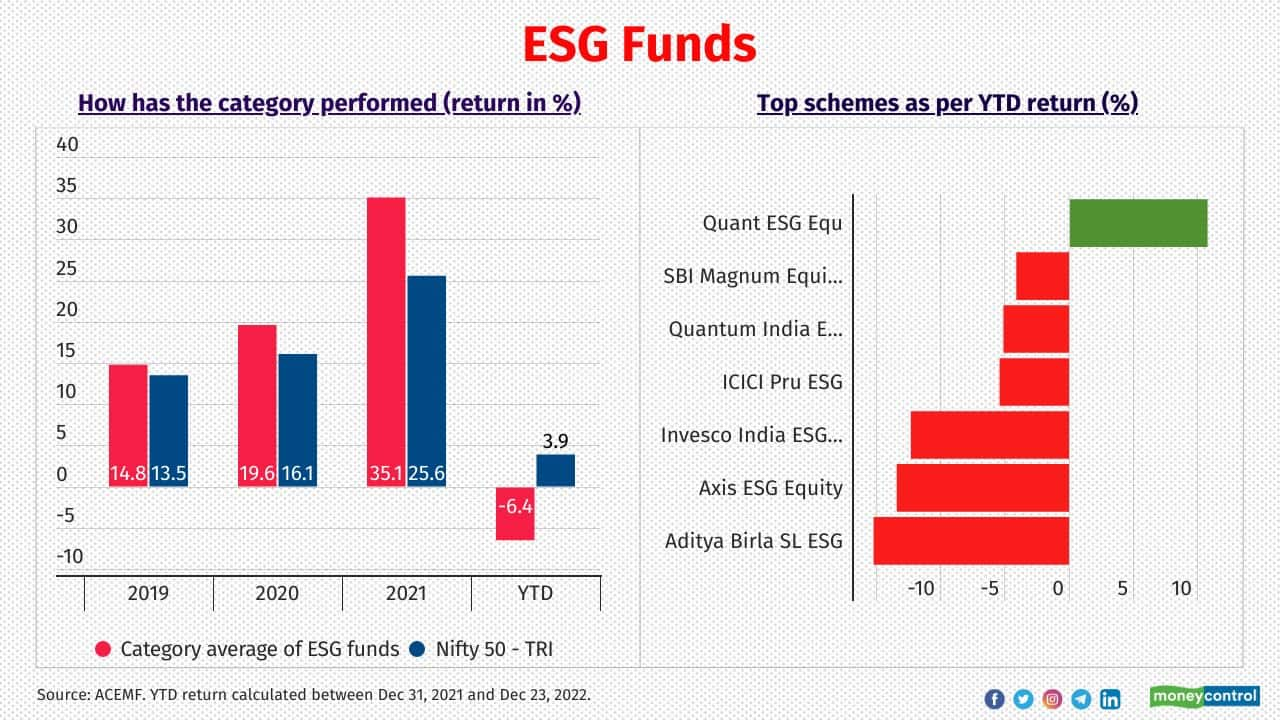

Severe Covid-19 waves, strict lockdowns and return to work took a toll on Technology mutual funds. But funds investing in Public sector firms, banking & financial services and auto stocks were the winners. ESG funds disappointed too.

1/12

Select sectors and thematic funds have turned attractive for retail investors since the pandemic broke out in 2020 as many delivered mouthwatering returns. It resulted in the tripling of their Assets Under Management (AUM) since March 2020 till date. With the change in the market dynamics, returns from many sectoral funds have turned negative lately. Moneycontrol looks at how these sectors and thematic funds fared year to date and what worked well for those sectors and what didn’t. Data source: ACEMF.

2/12

Year to date, PSU equity funds, banks and financial services funds and auto funds were the winners among the sectoral and thematic funds. On the other hand, technology funds, pharma and health care funds, and ESG funds were the laggards during the period

3/12

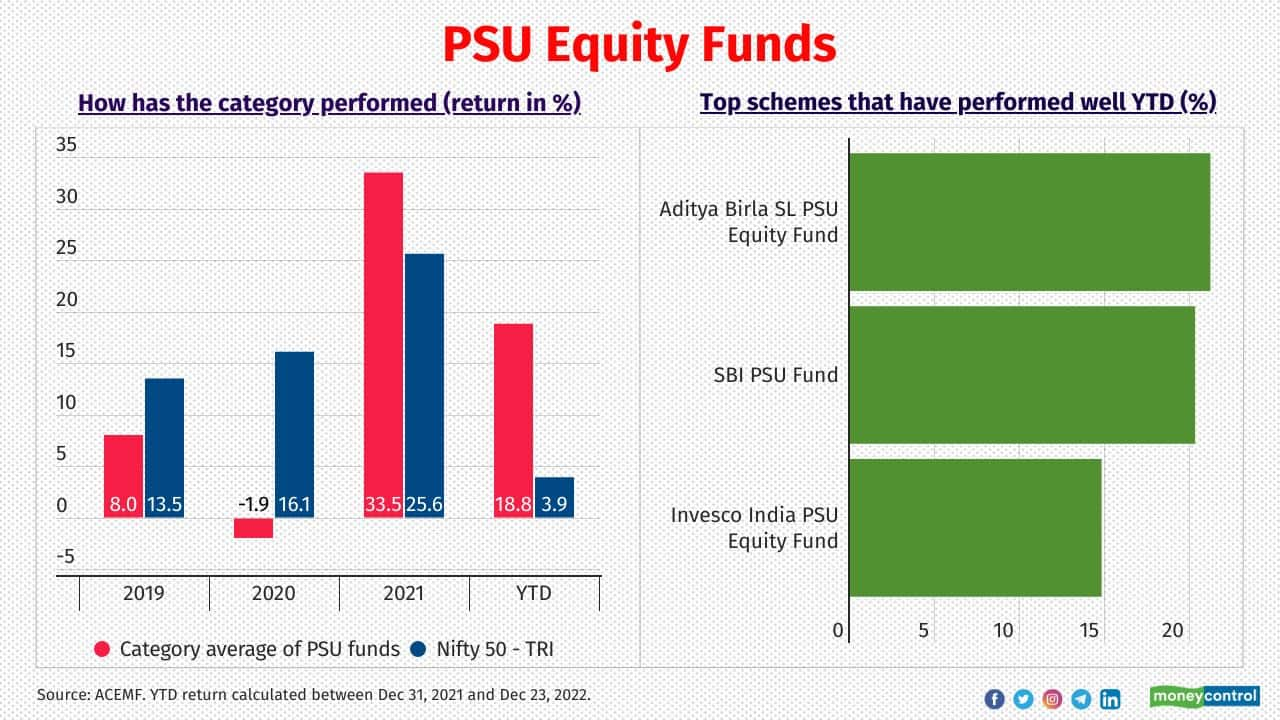

PSU Funds

Equity mutual fund schemes that bet on the state-owned Public Sector Undertakings (PSU) have made a strong comeback in the past year and outperformed all the other equity-oriented mutual fund categories. PSU sector funds such as Aditya Birla SL PSU Equity Fund, SBI PSU Fund and Invesco India PSU Equity Fund delivered better returns YTD. Richard D’souza, fund manager of SBI PSU Fund, says, “PSUs are an idea whose time has come, after nearly two decades. Structural factors like years of underinvestment in metals and energy in face of rising demand coupled with favourable domestic environment for banks and defence stocks formed the foundation of this rally. The initial momentum was driven by technical factors like deep value, under-ownership and dividend yields. This is against a global backdrop of value stocks coming back to fore versus growth”

Equity mutual fund schemes that bet on the state-owned Public Sector Undertakings (PSU) have made a strong comeback in the past year and outperformed all the other equity-oriented mutual fund categories. PSU sector funds such as Aditya Birla SL PSU Equity Fund, SBI PSU Fund and Invesco India PSU Equity Fund delivered better returns YTD. Richard D’souza, fund manager of SBI PSU Fund, says, “PSUs are an idea whose time has come, after nearly two decades. Structural factors like years of underinvestment in metals and energy in face of rising demand coupled with favourable domestic environment for banks and defence stocks formed the foundation of this rally. The initial momentum was driven by technical factors like deep value, under-ownership and dividend yields. This is against a global backdrop of value stocks coming back to fore versus growth”

4/12

Banks and financial services funds

Funds investing predominantly on PSU banks have delivered a return of 56% YTD. PSU banks stocks rallied last year due to improving asset quality and better growth in deposits as well as loan book. Within the active space, Nippon India Banking & Financial Services Fund, LIC MF Banking & Financial Services Fund and Sundaram Fin Serv Opp Fund were the top 3 funds. Vinay Sharma, Equity Fund Manager, Nippon India Mutual Fund, attributed that overweight position in mid and small cap banking stocks including PSU banks paid off for his scheme. Funds that were underweight on insurance and some other para banking sectors delivered better returns

Funds investing predominantly on PSU banks have delivered a return of 56% YTD. PSU banks stocks rallied last year due to improving asset quality and better growth in deposits as well as loan book. Within the active space, Nippon India Banking & Financial Services Fund, LIC MF Banking & Financial Services Fund and Sundaram Fin Serv Opp Fund were the top 3 funds. Vinay Sharma, Equity Fund Manager, Nippon India Mutual Fund, attributed that overweight position in mid and small cap banking stocks including PSU banks paid off for his scheme. Funds that were underweight on insurance and some other para banking sectors delivered better returns

5/12

Auto funds

Of the six schemes in the auto sector categories, only UTI Transportation & Logistics Fund has a track record of more than a year. It has demonstrated better return over the last three years. Vetri Subramaniam, Chief Investment Officer, UTI AMC says, “The automobile sector is recovering from a 3-year long demand setback. The combination of attractive valuations in 2021 and recovery in demand in 2022 and our stock picking has driven the performance of the strategy. The sector has headroom to grow volumes and could benefit from operating leverage; valuations are now in the mid cycle”.

Of the six schemes in the auto sector categories, only UTI Transportation & Logistics Fund has a track record of more than a year. It has demonstrated better return over the last three years. Vetri Subramaniam, Chief Investment Officer, UTI AMC says, “The automobile sector is recovering from a 3-year long demand setback. The combination of attractive valuations in 2021 and recovery in demand in 2022 and our stock picking has driven the performance of the strategy. The sector has headroom to grow volumes and could benefit from operating leverage; valuations are now in the mid cycle”.

6/12

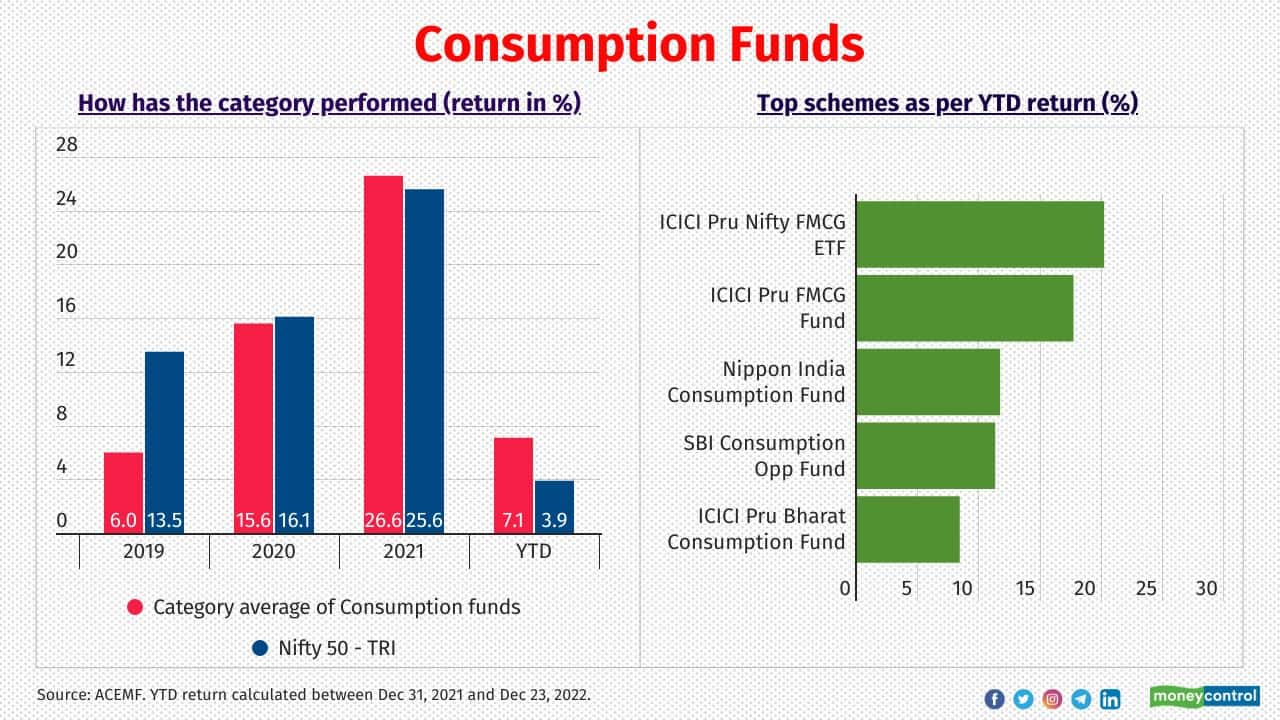

Consumption funds

Of the 18 schemes in the category, ICICI Pru FMCG Fund, Nippon India Consumption Fund and SBI Consumption Opportunities Fund topped the chart YTD. Priyanka Khandelwal, fund manager, ICICI Prudential FMCG Fund, says, “In the last few months we have seen a cooling off in commodity prices, which has created hope of price cuts which in turn will improve consumer demand and also normalize margins for FMCG companies. This has been the key reason for recent performance of FMCG stocks”. Khandelwal is hoping for a price correction in staple goods to aid demand recovery for FMCG stocks. “Rural market forms a material part of revenues for FMCG companies in India and demand has been pretty weak so far. Recovery in rural consumption will also benefit consumer companies” she adds.

Of the 18 schemes in the category, ICICI Pru FMCG Fund, Nippon India Consumption Fund and SBI Consumption Opportunities Fund topped the chart YTD. Priyanka Khandelwal, fund manager, ICICI Prudential FMCG Fund, says, “In the last few months we have seen a cooling off in commodity prices, which has created hope of price cuts which in turn will improve consumer demand and also normalize margins for FMCG companies. This has been the key reason for recent performance of FMCG stocks”. Khandelwal is hoping for a price correction in staple goods to aid demand recovery for FMCG stocks. “Rural market forms a material part of revenues for FMCG companies in India and demand has been pretty weak so far. Recovery in rural consumption will also benefit consumer companies” she adds.

7/12

Infrastructure funds

After putting up a commendable performance in 2021, infrastructure funds ended 2022 with moderate returns of 5.7%. However, funds such as ICICI Pru Infrastructure, HDFC Infrastructure and Kotak Infra & Eco Reform Fund delivered returns of between 12% and 25% in the past year. Ihab Dalwai, fund manager at ICICI Prudential AMC, said allocation to banks, construction and power sector has helped his fund this year

After putting up a commendable performance in 2021, infrastructure funds ended 2022 with moderate returns of 5.7%. However, funds such as ICICI Pru Infrastructure, HDFC Infrastructure and Kotak Infra & Eco Reform Fund delivered returns of between 12% and 25% in the past year. Ihab Dalwai, fund manager at ICICI Prudential AMC, said allocation to banks, construction and power sector has helped his fund this year

8/12

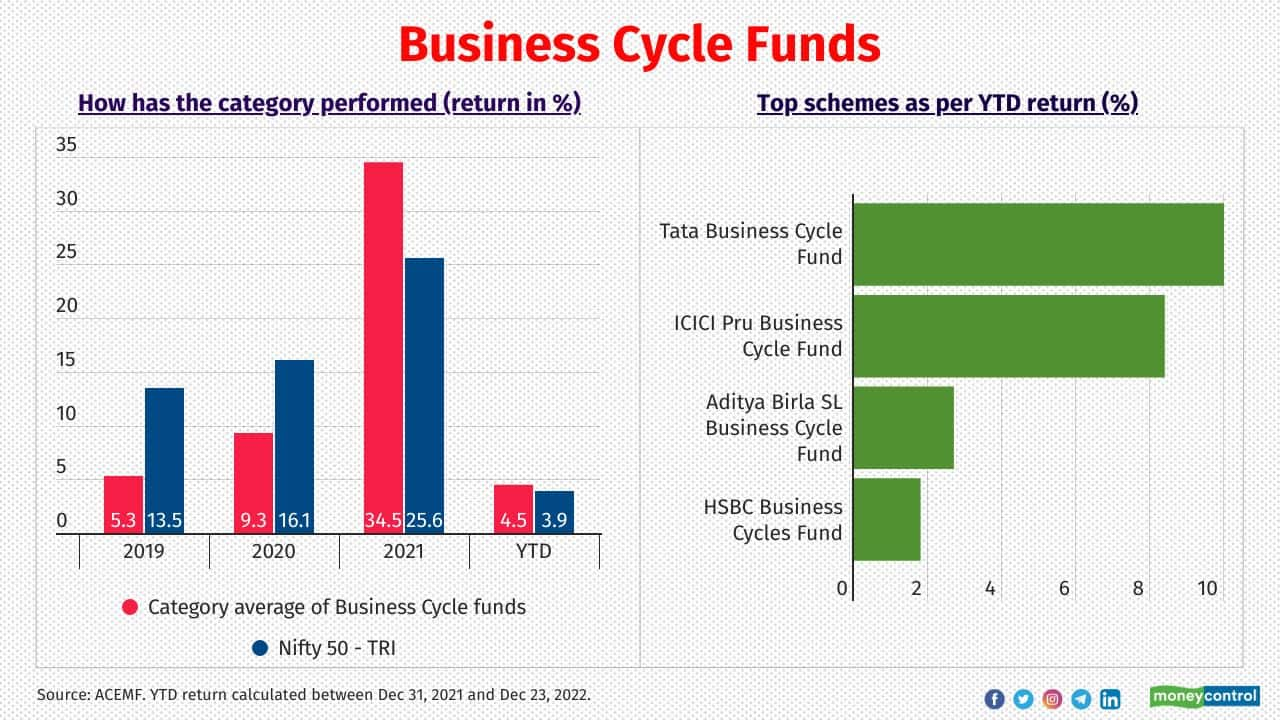

Business Cycle funds

Fund managers of business cycle funds try to identify fluctuations in economic activities, and invest in sectors and stocks that are likely to outperform from the changing trends. Tata Business Cycle Fund topped the chart followed by ICICI Pru Business Cycle Fund. Explaining the factors that contributed to his fund’s performance, Rahul Singh, investment chief of equities at Tata Mutual Fund says, “The fund was positioned for recovery in investment cycle with overweight on capital goods, industrials, real estate and power sectors. In addition, we remain constructive in banks with a mix of large private sector banks, mid-size private banks and PSUs. There has also been underlying focus on valuation and growth at reasonable price as a philosophy which has been in favour in 2022 due to higher interest rates”

Fund managers of business cycle funds try to identify fluctuations in economic activities, and invest in sectors and stocks that are likely to outperform from the changing trends. Tata Business Cycle Fund topped the chart followed by ICICI Pru Business Cycle Fund. Explaining the factors that contributed to his fund’s performance, Rahul Singh, investment chief of equities at Tata Mutual Fund says, “The fund was positioned for recovery in investment cycle with overweight on capital goods, industrials, real estate and power sectors. In addition, we remain constructive in banks with a mix of large private sector banks, mid-size private banks and PSUs. There has also been underlying focus on valuation and growth at reasonable price as a philosophy which has been in favour in 2022 due to higher interest rates”

9/12

MNC funds

MNC funds delivered negative returns YTD. ICICI Pru MNC contained the fall relatively well within the category. MNC Funds that held higher exposure to the stocks including Mphasis, Divi's Laboratories, GlaxoSmithkline Pharmaceuticals and Kansai Nerolac Paints failed to deliver positive returns. Roshan Chutkey, fund manager of ICICI Pru MNC Fund, explained that higher exposure to the specialty pharma, capital goods companies helped the fund to contain the fall

MNC funds delivered negative returns YTD. ICICI Pru MNC contained the fall relatively well within the category. MNC Funds that held higher exposure to the stocks including Mphasis, Divi's Laboratories, GlaxoSmithkline Pharmaceuticals and Kansai Nerolac Paints failed to deliver positive returns. Roshan Chutkey, fund manager of ICICI Pru MNC Fund, explained that higher exposure to the specialty pharma, capital goods companies helped the fund to contain the fall

10/12

ESG funds

Within the eight funds in the category, only Quant ESG Equity Fund posted positive return YTD. ESG funds invest in companies demonstrating sustainable practices across Environmental, Social and Governance (ESG) parameters. Ankit Pande, fund manager, Quant MF, says, “ESG framework in emerging markets like India is still evolving and most of the companies do not provide proper ESG scores or ESG audits. Therefore, we use our own internal database for evaluating ESG parameters and deploying them in our framework. Hence, the outcome of our investment process presents a more balanced picture of ESG scores”

Within the eight funds in the category, only Quant ESG Equity Fund posted positive return YTD. ESG funds invest in companies demonstrating sustainable practices across Environmental, Social and Governance (ESG) parameters. Ankit Pande, fund manager, Quant MF, says, “ESG framework in emerging markets like India is still evolving and most of the companies do not provide proper ESG scores or ESG audits. Therefore, we use our own internal database for evaluating ESG parameters and deploying them in our framework. Hence, the outcome of our investment process presents a more balanced picture of ESG scores”

11/12

Pharma & Health Care funds

After a prolonged underperformance in 2016-2020, pharma stocks staged a comeback in 2020 post the outbreak of the COVID pandemic. However, they demonstrated a tepid performance lately as the sentiment faded. Many pharma stocks have corrected notably in the last one year. Pharma funds that contained the fall relatively well include SBI Healthcare Opp, DSP Healthcare and Tata India Pharma & Healthcare Fund. Chirag Dagli, Fund Manager, DSP Investment Managers, says, “Most of these fallen angels had earnings from unsustainable opportunities which were being extrapolated into the future, leading to a sharp cut in their earnings estimates”

After a prolonged underperformance in 2016-2020, pharma stocks staged a comeback in 2020 post the outbreak of the COVID pandemic. However, they demonstrated a tepid performance lately as the sentiment faded. Many pharma stocks have corrected notably in the last one year. Pharma funds that contained the fall relatively well include SBI Healthcare Opp, DSP Healthcare and Tata India Pharma & Healthcare Fund. Chirag Dagli, Fund Manager, DSP Investment Managers, says, “Most of these fallen angels had earnings from unsustainable opportunities which were being extrapolated into the future, leading to a sharp cut in their earnings estimates”

12/12

Technology funds

Information Technology funds were the lowest performers among the sectoral funds in 2022. After a notable performance in 2020 and 2021, IT stocks have been under pressure for the last one year mainly due to the macro headwinds in global markets including US and Europe impacting the revenue of IT stocks. Schemes including SBI Technology Opp, Franklin India Technology and Aditya Birla SL Digital India Fund contained the fall relatively well. Mahesh Patil, CIO of Aditya Birla Sun Life AMC, says, “we were cautious since April, driven by an expected global slowdown, rising interest rates and supply side-led margin pressure for IT companies. Thus, in ABSL Digital India Fund, we increased cash position (~5%) and exposure to large cap by ~6%, benefitting the fund’s performance. Additionally, exposure to companies in niche IT segment (automotive ER&D, digital signatures, hardware distribution) worked well, while mid-tier IT services companies saw valuation compression”

Information Technology funds were the lowest performers among the sectoral funds in 2022. After a notable performance in 2020 and 2021, IT stocks have been under pressure for the last one year mainly due to the macro headwinds in global markets including US and Europe impacting the revenue of IT stocks. Schemes including SBI Technology Opp, Franklin India Technology and Aditya Birla SL Digital India Fund contained the fall relatively well. Mahesh Patil, CIO of Aditya Birla Sun Life AMC, says, “we were cautious since April, driven by an expected global slowdown, rising interest rates and supply side-led margin pressure for IT companies. Thus, in ABSL Digital India Fund, we increased cash position (~5%) and exposure to large cap by ~6%, benefitting the fund’s performance. Additionally, exposure to companies in niche IT segment (automotive ER&D, digital signatures, hardware distribution) worked well, while mid-tier IT services companies saw valuation compression”

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!