The market extended its northward journey for a second consecutive session on February 15 led by a late-hour rally and closed above the psychological 18,000 mark on the Nifty50 for the first time since January 24 this year. The rally was driven by most of the key sectors barring FMCG.

The BSE Sensex climbed 243 points to 61,275, while the Nifty50 rose 86 points to 18,016 and moved above the downward sloping resistance trendline as well as 50 DEMA (days exponential moving average 17,960), forming yet another bullish candlestick pattern on the daily charts.

"The Nifty surpassed the crucial hurdle of downsloping trend line (connected lower tops) around 17,950 levels and closed higher. This pattern indicates a sustainable upside breakout of the crucial overhead resistance. This is a positive indication," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

He says the short-term trend of Nifty continues to be positive.

The upside breakout of important resistance of the down trendline and overall positive chart set-up could result in further upside towards the next key resistance of 18,250 levels in the short term, while the immediate support is placed at the 17,850 level, the market expert said.

The broader markets also gained momentum in late trade with the Nifty Midcap 100 and Smallcap 100 indices rising 0.6 percent and 0.3 percent respectively, while the volatility index India VIX fell by 4.4 percent to 12.86 level, from 13.45 level.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the Nifty has support at 17,899 followed by 17,856 and then 17,788. If the index moves up, the key resistance levels to watch out for are 18,037, followed by 18,079 and 18,148.

The Nifty Bank rose 83 points to 41,731 after rangebound trade and formed a small-bodied bullish candle with a long lower shadow on the daily charts, indicating buying at lower levels. It continued to make higher high higher low formation for the second straight session.

"The bulls managed to hold the support of 41,400. The index remains in a buy-on-dip mode, and once it surpasses the level of 42,000, a sharp short-covering towards the 43,000-43,500 levels will be witnessed," Kunal Shah, Senior Technical Analyst at LKP Securities said.

The important pivot level, which will act as a support, is at 41,531 followed by 41,451 and 41,321. On the upside, key resistance levels are 41,790, followed by 41,871, and 42,000.

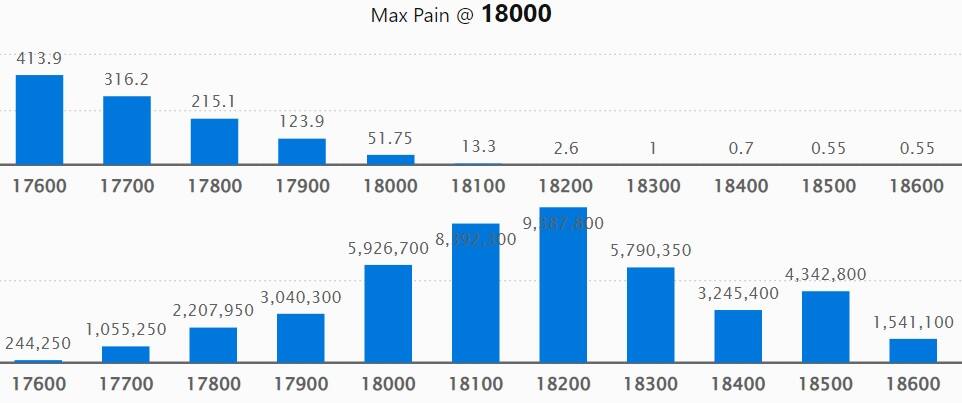

On a weekly basis, the maximum Call open interest (OI) remained at 18,200 strike, with 93.87 lakh contracts, which may be a crucial resistance in the coming sessions.

This is followed by an 18,100 strike, comprising 83.92 lakh contracts, and an 18,000 strike, where there are more than 59.26 lakh contracts.

Call writing was seen at 18,100 strike, which added 20.66 lakh contracts, followed by 18,200 strike which added 18.36 lakh contracts and 18,300 strike which added 3.99 lakh contracts.

We have seen Call unwinding in 17,900 strike, which shed 17.33 lakh contracts, followed by 18,500 strike, which shed 13.13 lakh contracts, and 17,800 strike which shed 10.06 lakh contracts.

On a weekly basis, the maximum Put OI is at 17,800 strike, with 1.22 crore contracts, which is expected to act as a crucial support area for the Nifty50 in coming sessions.

This is followed by the 17,900 strike, comprising 1.08 crore contracts, and the 17,500 strike, where we have 78.12 lakh contracts.

Put writing was seen at 18,000 strike, which added 51.96 lakh contracts, followed by 17,900 strike, which added 43.82 lakh contracts, and 17,800 strike which added 29.90 lakh contracts.

Put unwinding was seen at 17,200 strike, which shed 2.51 lakh contracts, followed by 17,100 strike, which shed 81,700 contracts, and 18,400 strike, which shed 12,050 contracts.

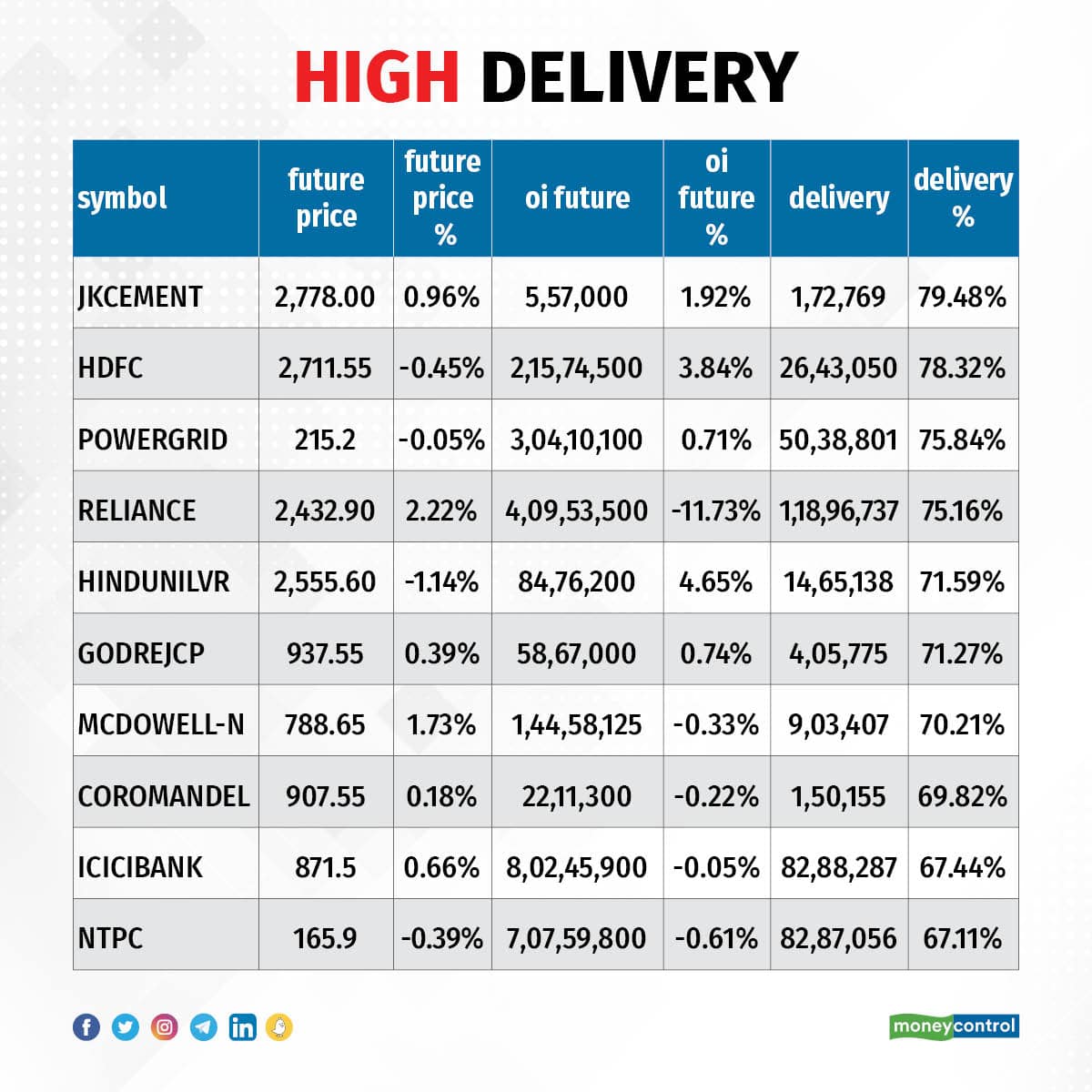

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in JK Cement, HDFC, Power Grid Corporation of India, Reliance Industries, and Hindustan Unilever, among others.

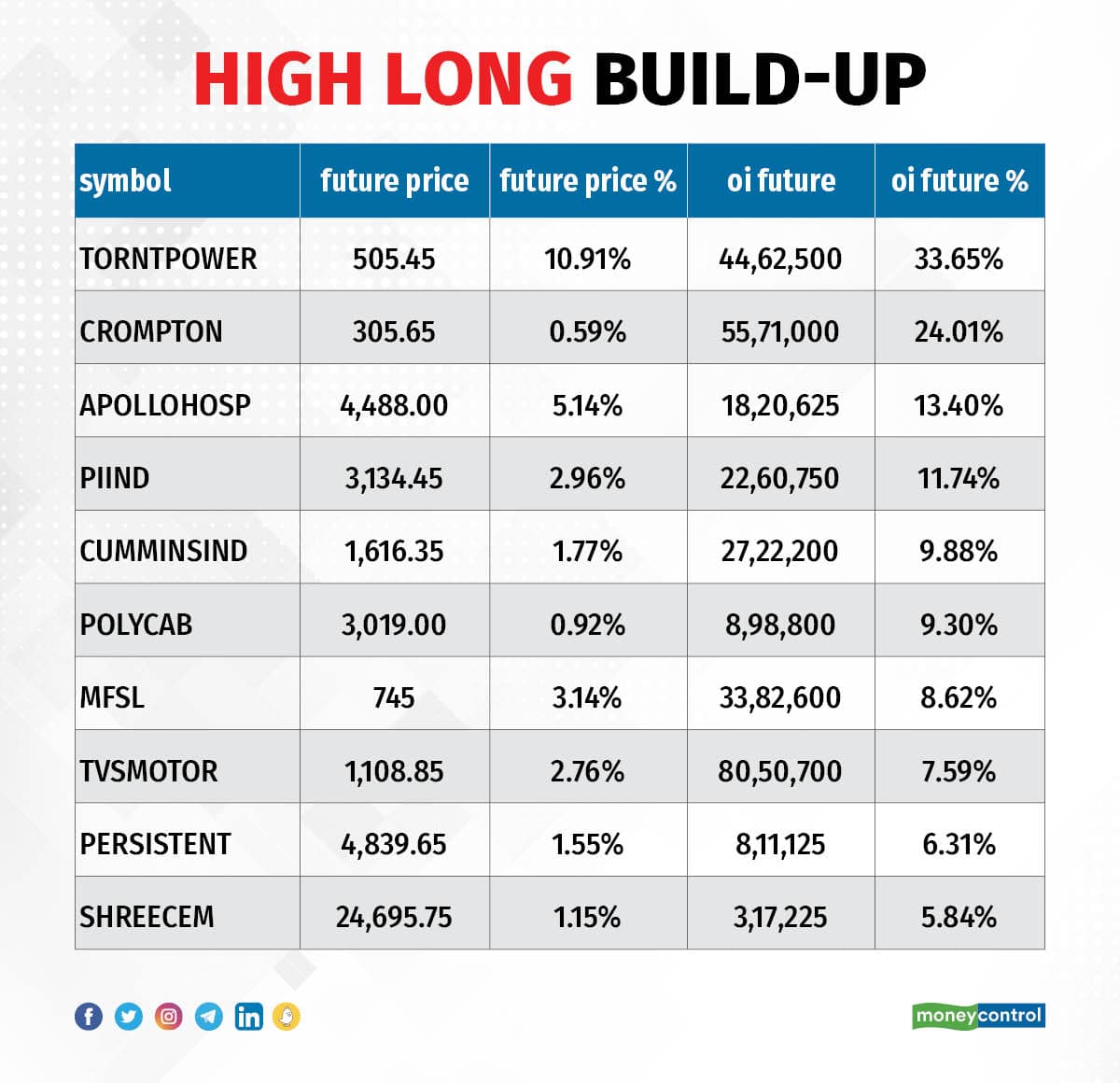

An increase in open interest (OI) and an increase in price mostly indicate a build-up of long positions. Based on the OI percentage, 83 stocks, including Torrent Power, Crompton Greaves Consumer Electricals, Apollo Hospitals Enterprise, PI Industries, and Cummins India, saw a long build-up.

A decline in OI and a decrease in price, in most cases, indicate long unwinding. Based on the OI percentage, 13 stocks including Britannia Industries, City Union Bank, Zydus Life Sciences, Glenmark Pharma, and Metropolis Healthcare, witnessed long unwinding.

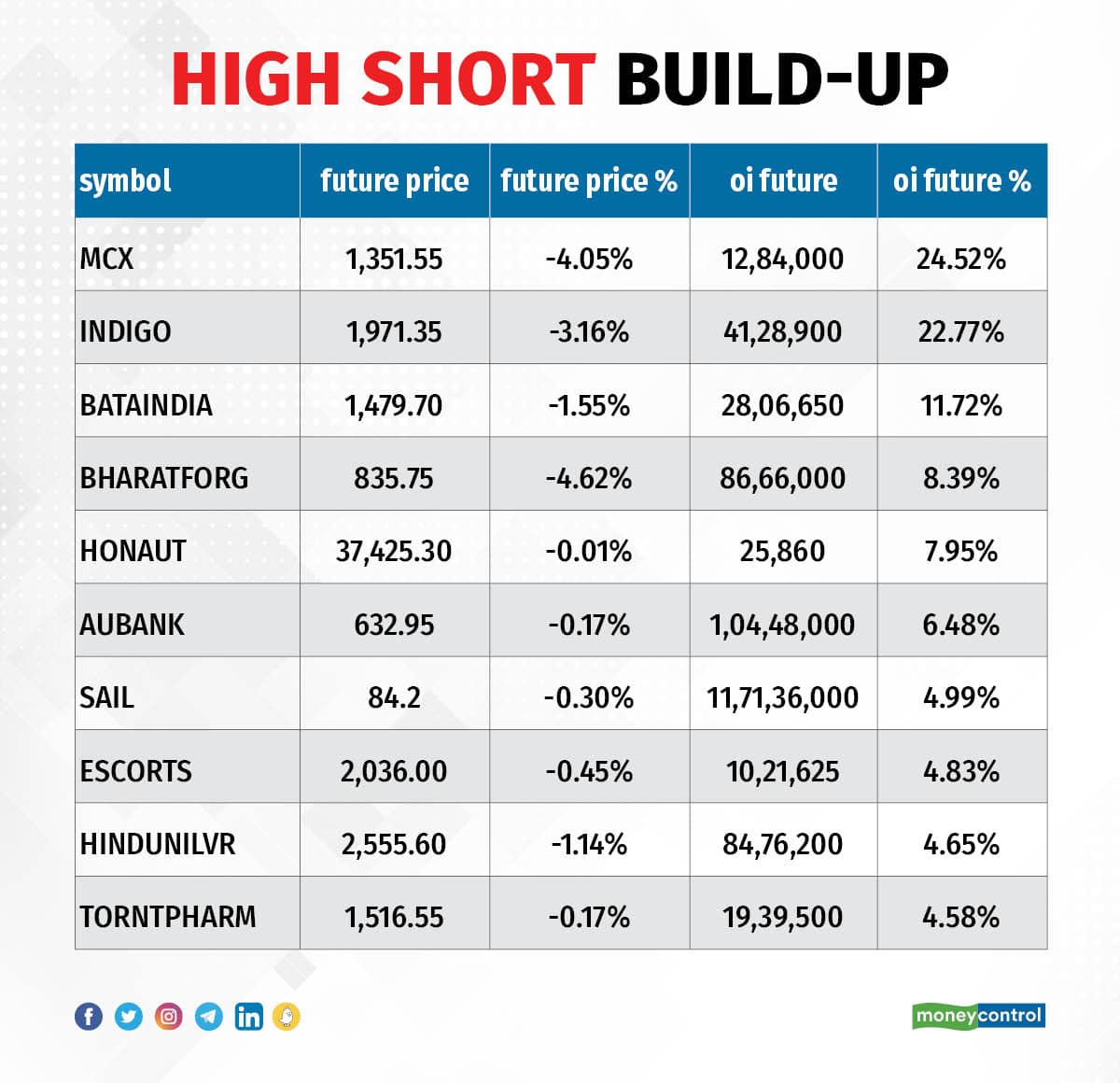

29 stocks see a short build-up

An increase in OI accompanied by a decrease in price mostly indicate a build-up of short positions. Based on the OI percentage, 29 stocks, including MCX India, InterGlobe Aviation, Bata India, Bharat Forge, and Honeywell Automation, saw a short build-up.

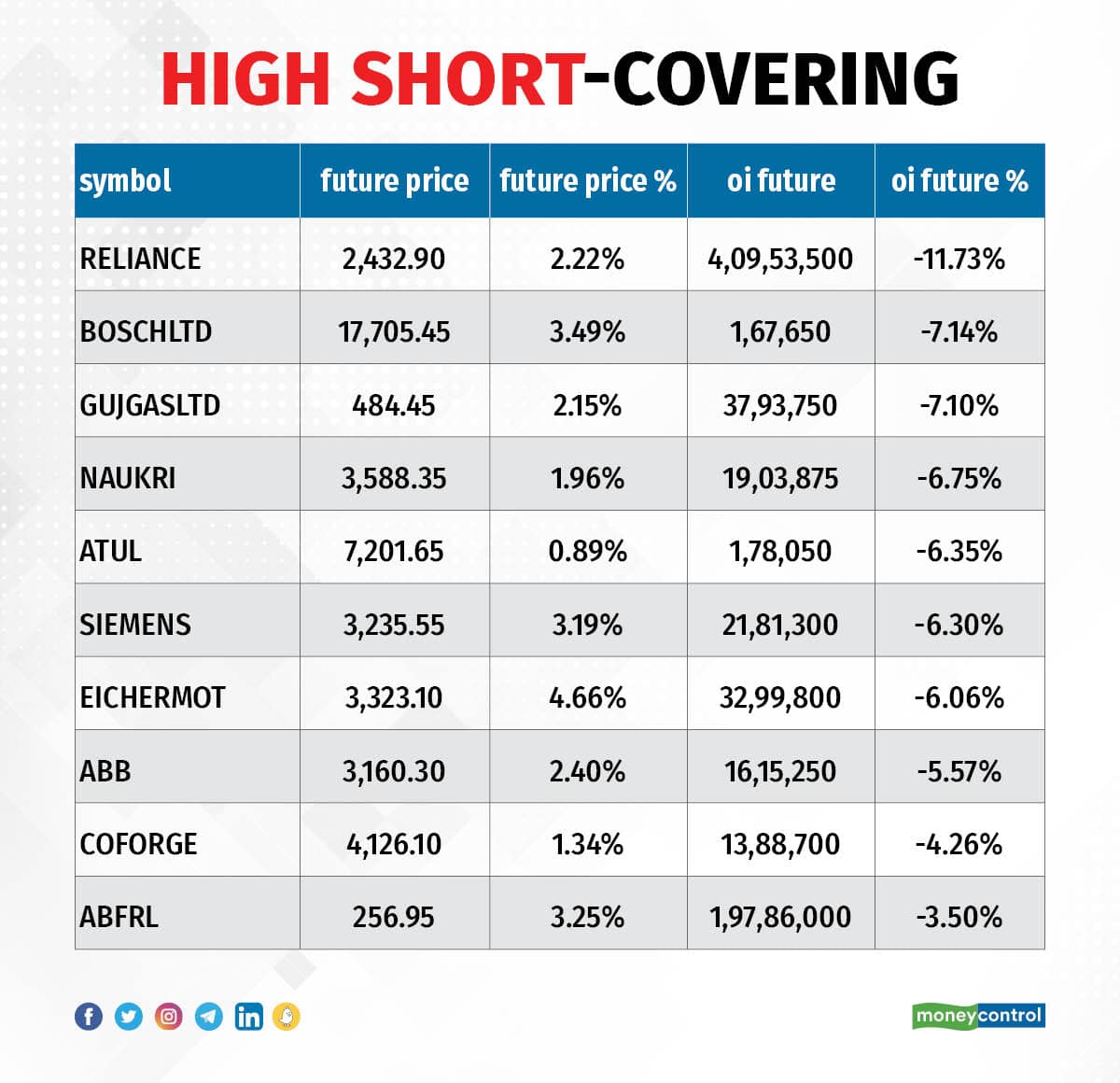

A decrease in OI along with an increase in price is an indication of short-covering. Based on the OI percentage, 68 stocks were on the short-covering list. These included Reliance Industries, Bosch, Gujarat Gas, Info Edge (India), and Atul.

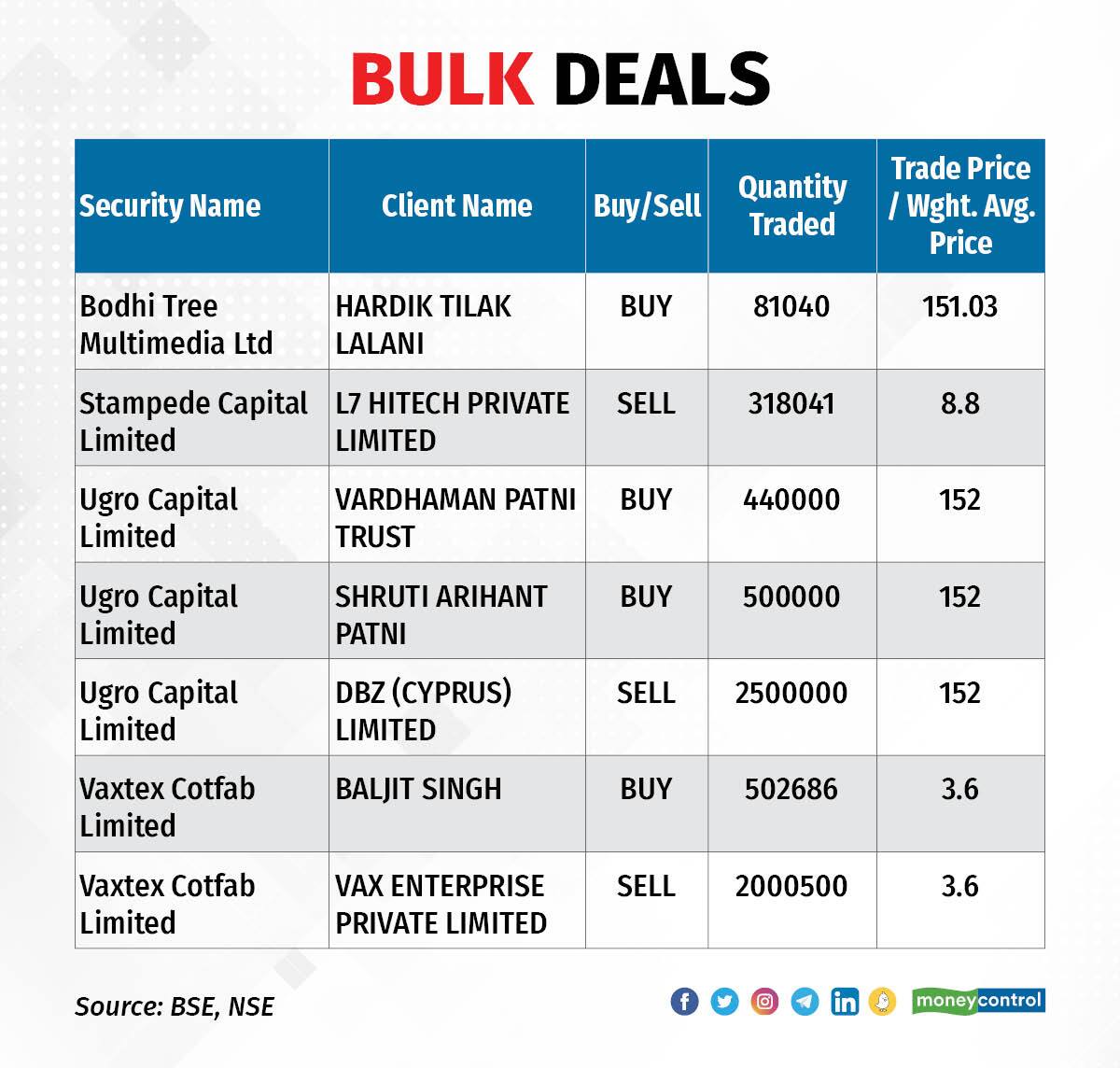

(For more bulk deals, click here)

Nestle India and Schaeffler India will be in focus ahead of quarterly earnings on February 16.

Stocks in the news

Bharat Dynamics: The state-owned defence company has entered into 10 memoranda of understanding (MoUs) with several foreign and Indian companies during Aero India 2023. These 10 companies include Thales, EDGE Group entity AL Tariq (UAE), Bultexpro (Bulgaria), and Tamil Nadu Industrial Development Corporation.

Bharat Electronics: The Navratna defence PSU has signed an MoU with Goa Shipyard to address global market opportunities for the supply of products such as autonomous boats, and other systems / solutions based on artificial intelligence for Naval platforms.

Patel Engineering: The company along with its joint venture partners has been declared as the L1 bidder for Rs 1,567 crore worth of projects in Madhya Pradesh and Maharashtra. The company's share in these new orders is Rs 1,006 crore and these orders include the construction of a pressure irrigation system in MP. With this, the order book stands at Rs 16,809 crore.

Vedanta: The company has been declared as the preferred bidder for Sijimali Bauxite Block in Odisha, under the mineral block auction conducted by the Government of Odisha. The block is a strategic fit for Vedanta given its size, location, and bauxite quality. The block has estimated reserves of 311 million tonnes of bauxite.

Shalby: The step-down subsidiary Shalby Global Technologies Pte Ltd, Singapore has received regulatory approval to market and sell knee implants, hip systems, knee, and hip instruments etc, from the Ministry of Health, Indonesia. Now, a subsidiary can import the said implants and medical devices from the USA and sell them in Indonesia. This development is fully in line with the company's strategy to grow the orthopaedic implant business and establish a footprint in the medical device market internationally.

Ramco Systems: The company has signed a digital transformation deal to automate and optimize business operations across the Philippine Airlines Group network.

Jaiprakash Associates: The Competition Commission of India has approved the acquisition of clinker, cement & power plants of Jaiprakash Associates by Dalmia Cement (Bharat). Dalmia Cement (Bharat) is a wholly owned subsidiary of Dalmia Bharat.

InterGlobe Aviation: Shobha Gangwal, the wife of IndiGo co-promoter Rakesh Gangwal, will sell 4 percent shares in the aviation company via a block deal, reports CNBC TV18 citing sources. The block deal has been launched for 1.56 crore shares. The total deal size is Rs 2,930 crore.

Fund Flow

Foreign institutional investors (FII) bought shares worth Rs 432.15 crore, while domestic institutional investors (DII) purchased shares worth Rs 516.64 crore on February 15, NSE's provisional data showed.

Stocks under F&O ban on NSE

The National Stock Exchange has retained BHEL, Punjab National Bank, Ambuja Cements and Indiabulls Housing Finance on its F&O ban list for February 16. Securities banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.